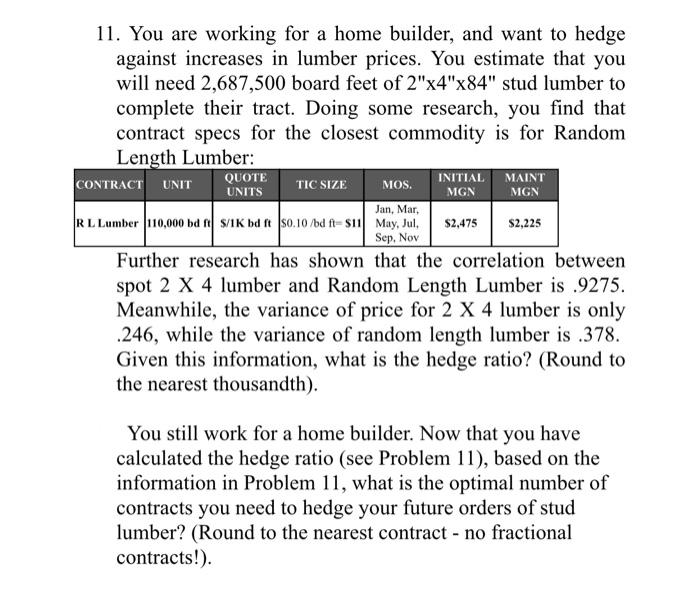

11. You are working for a home builder, and want to hedge against increases in lumber prices. You estimate that you will need 2,687,500 board feet of 2"x4"x84" stud lumber to complete their tract. Doing some research, you find that contract specs for the closest commodity is for Random Length Lumber: CONTRACT UNIT QUOTE UNITS TIC SIZE MOS. INITIAL MAINT MGN MGN Jan, Mar, RL Lumber 10,000 bd S/IK bdt 0.10/bd fl-s11 May, Jul, $2,475 Sep. Nov Further research has shown that the correlation between spot 2 X 4 lumber and Random Length Lumber is 9275. Meanwhile, the variance of price for 2 X 4 lumber is only .246, while the variance of random length lumber is .378. Given this information, what is the hedge ratio? (Round to the nearest thousandth). S2,225 You still work for a home builder. Now that you have calculated the hedge ratio (see Problem 11), based on the information in Problem 11, what is the optimal number of contracts you need to hedge your future orders of stud lumber? (Round to the nearest contract - no fractional contracts!). 11. You are working for a home builder, and want to hedge against increases in lumber prices. You estimate that you will need 2,687,500 board feet of 2"x4"x84" stud lumber to complete their tract. Doing some research, you find that contract specs for the closest commodity is for Random Length Lumber: CONTRACT UNIT QUOTE UNITS TIC SIZE MOS. INITIAL MAINT MGN MGN Jan, Mar, RL Lumber 10,000 bd S/IK bdt 0.10/bd fl-s11 May, Jul, $2,475 Sep. Nov Further research has shown that the correlation between spot 2 X 4 lumber and Random Length Lumber is 9275. Meanwhile, the variance of price for 2 X 4 lumber is only .246, while the variance of random length lumber is .378. Given this information, what is the hedge ratio? (Round to the nearest thousandth). S2,225 You still work for a home builder. Now that you have calculated the hedge ratio (see Problem 11), based on the information in Problem 11, what is the optimal number of contracts you need to hedge your future orders of stud lumber? (Round to the nearest contract - no fractional contracts!)