11.

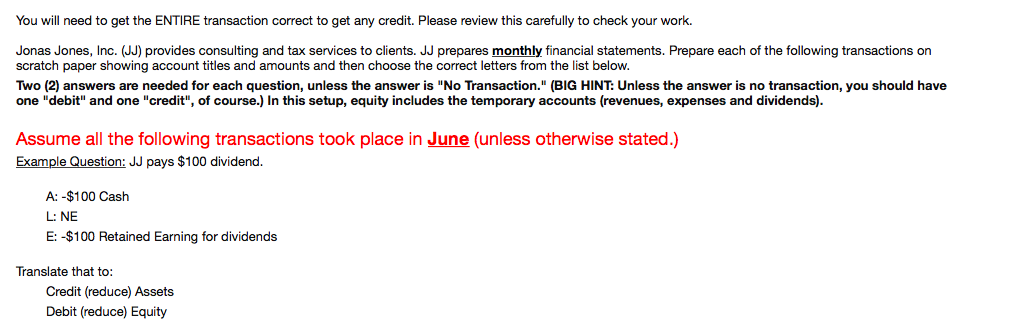

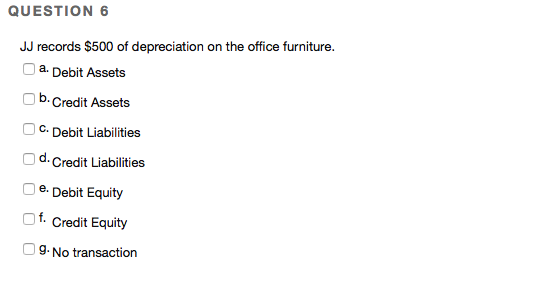

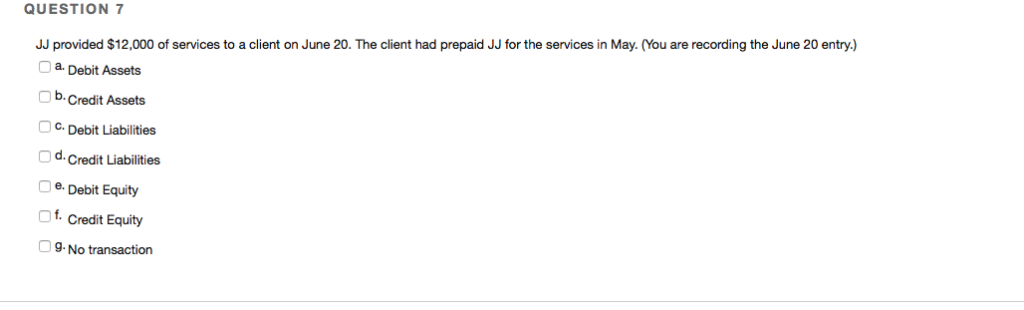

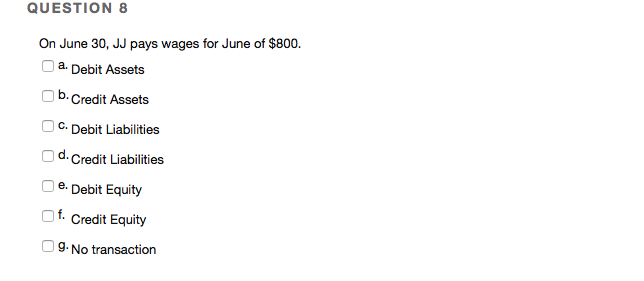

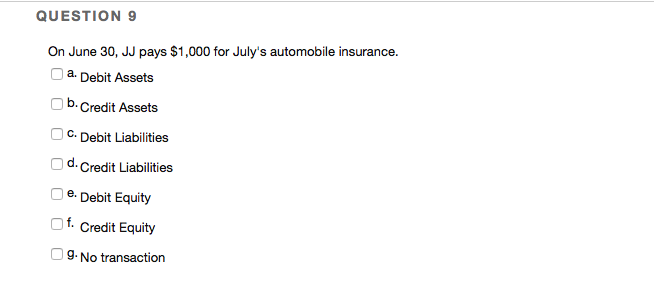

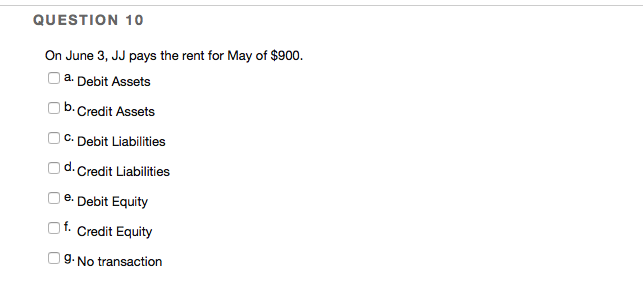

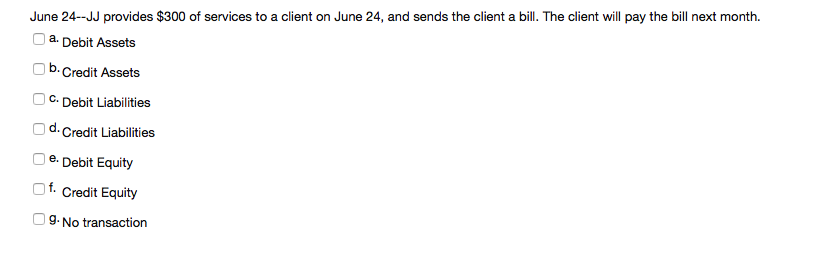

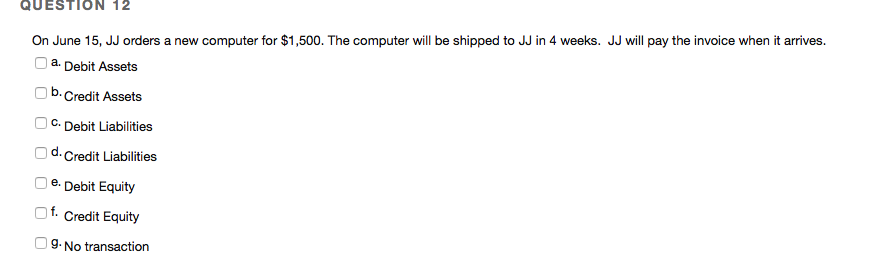

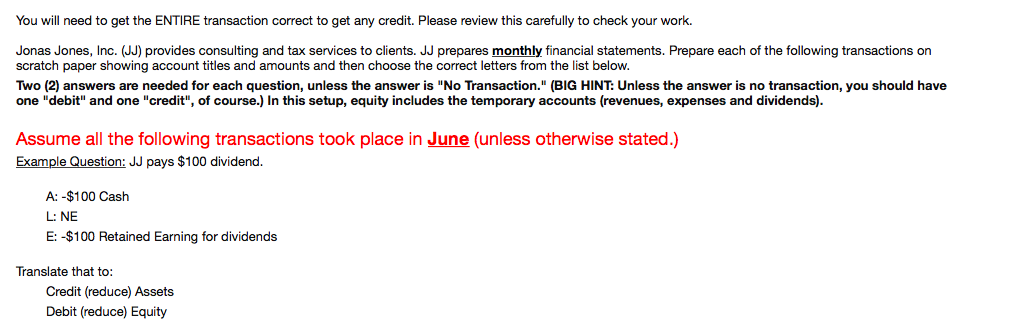

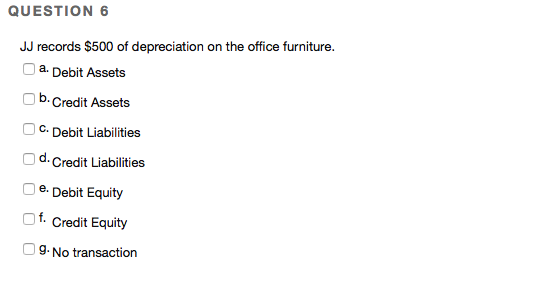

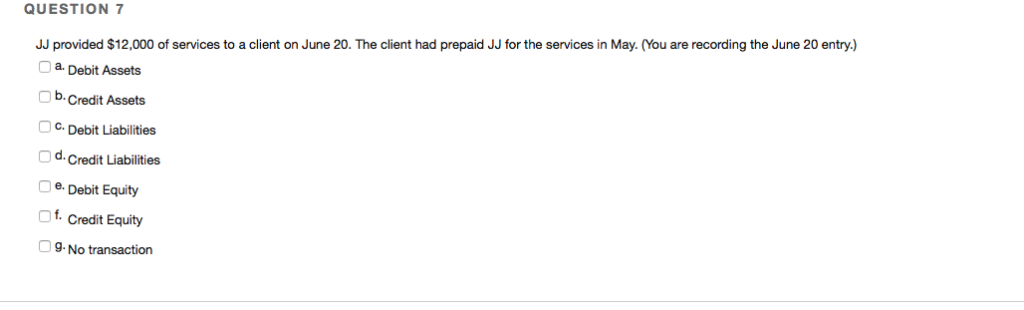

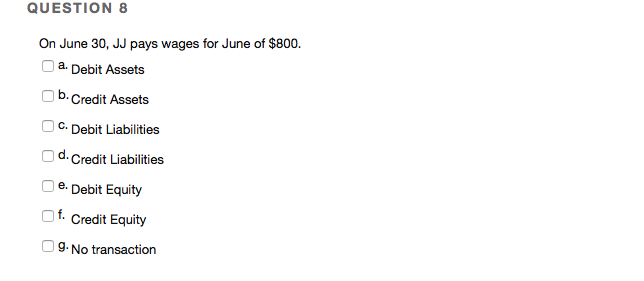

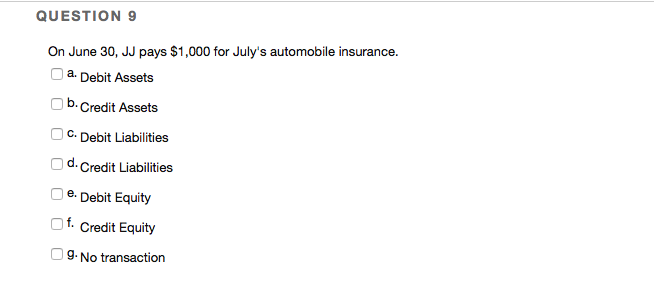

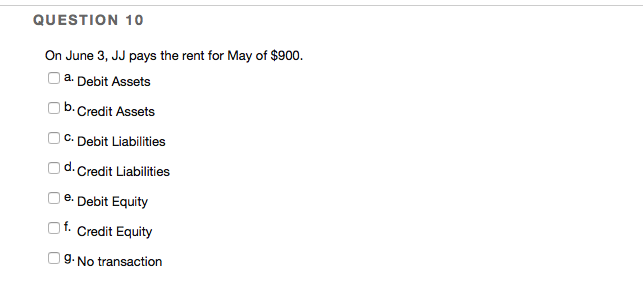

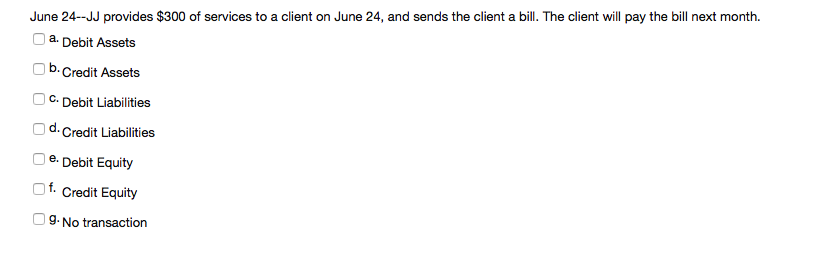

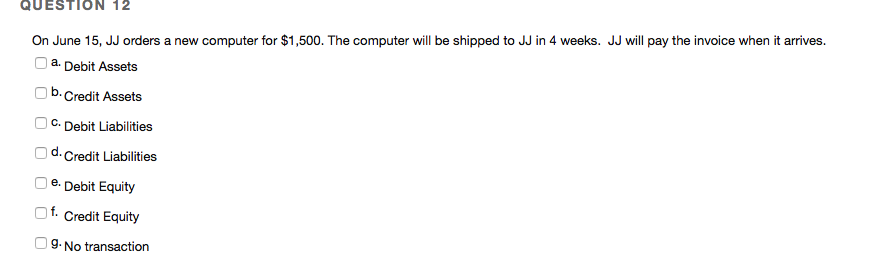

You will need to get the ENTIRE transaction correct to get any credit. Please review this carefully to check your work. Jonas Jones, Inc. (JJ) provides consulting and tax services to clients. JJ prepares monthly financial statements. Prepare each of the following transactions on scratch paper showing account titles and amounts and then choose the correct letters from the list below. Two (2) answers are needed for each question, unless the answer is "No Transaction." (BIG HINT: Unless the answer is no transaction, you should have one "debit" and one "credit", of course.) In this setup, equity includes the temporary accounts (revenues, expenses and dividends) Assume all the following transactions took place in June (unless otherwise stated.) Example Question: JJ pays $100 dividend. A: -$100 Cash L: NE E: -$100 Retained Earning for dividends Translate that to: Credit (reduce) Assets Debit (reduce) Equity QUESTION 6 JJ records $500 of depreciation on the office furniture. a. Debit Assets b.Credit Assets C. Debit Liabilities d. Credit Liabilities e. Debit Equity f. Credit Equity g. No transaction QUESTION 7 JJ provided $12,000 of services to a client on June 20. The client had prepaid JJ for the services in May. (You are recording the June 20 entry.) Debit Assets Credit Assets Debit Liabilities Credit Liabilities Debit Equity Of. Credit Equity -No transaction QUESTION 8 On June 30, JJ pays wages for June of $800. a. Debit Assets .Credit Assets C. Debit Liabilities d. Credit Liabilities e. Debit Equity f.Credit Equity g. No transaction QUESTION 9 On June 30, JJ pays $1,000 for July's automobile insurance. a. Debit Assets b. Credit Assets C. Debit Liabilities d.Credit Liabilities e. Debit Equity Of.Credit Equity g. No transaction QUESTION 10 On June 3, JJ pays the rent for May of $900. a. Debit Assets b. Credit Assets C. Debit Liabilities d. Credit Liabilities Debit Equity e. f. Credit Equity 9.No transaction June 24-JJ provides $300 of services too a client on June 24, and sends the client a bill. The client will pay the bill next month a. Debit Assets b.Credit Assets C. Debit Liabilities d. Credit Liabilities e. Debit Equity f. Credit Equity g. No transaction QUESTION 12 hew computer for $1,500. The computer will be shipped to JJ in 4 weeks. JJ will pay the invoice when it arrives. On June 15, JJ orders a a. Debit Assets b.Credit Assets C. Debit Liabilities d. Credit Liabilities e. Debit Equity O f.Credit Equity g. No transaction