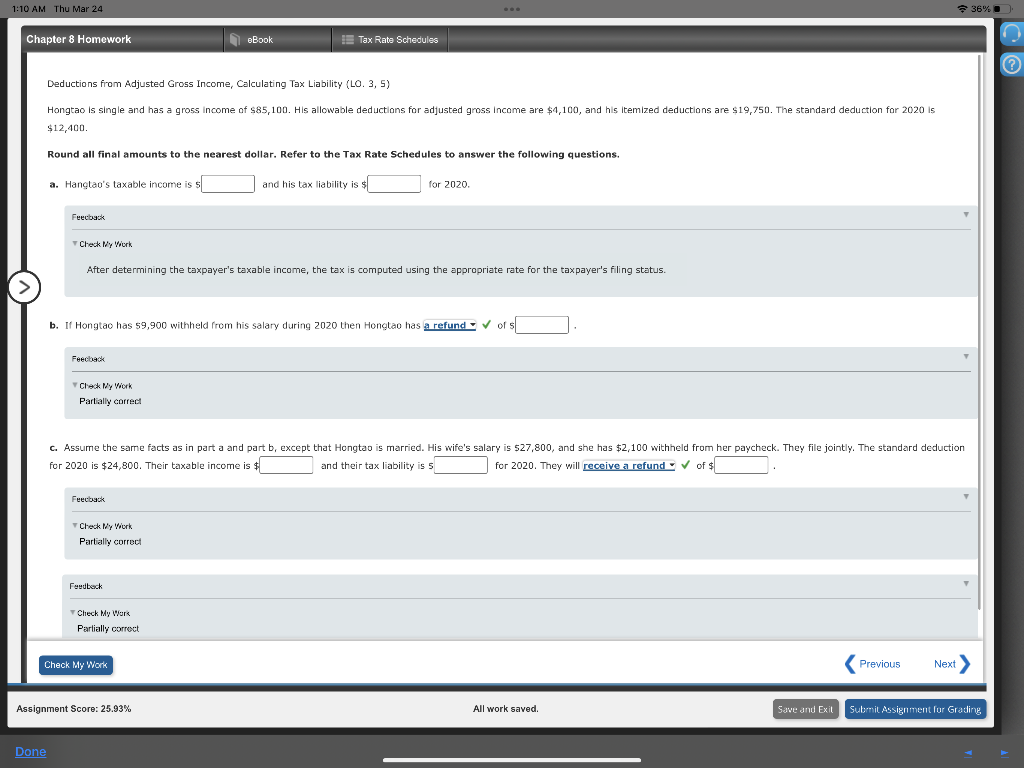

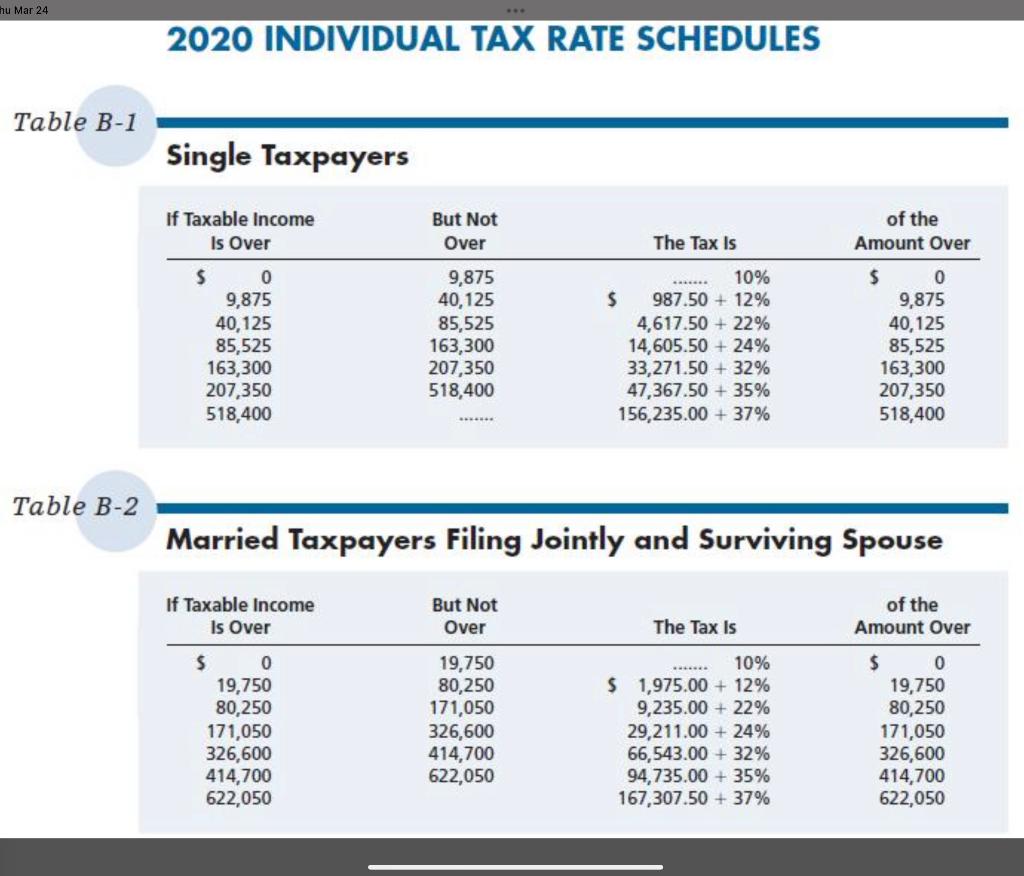

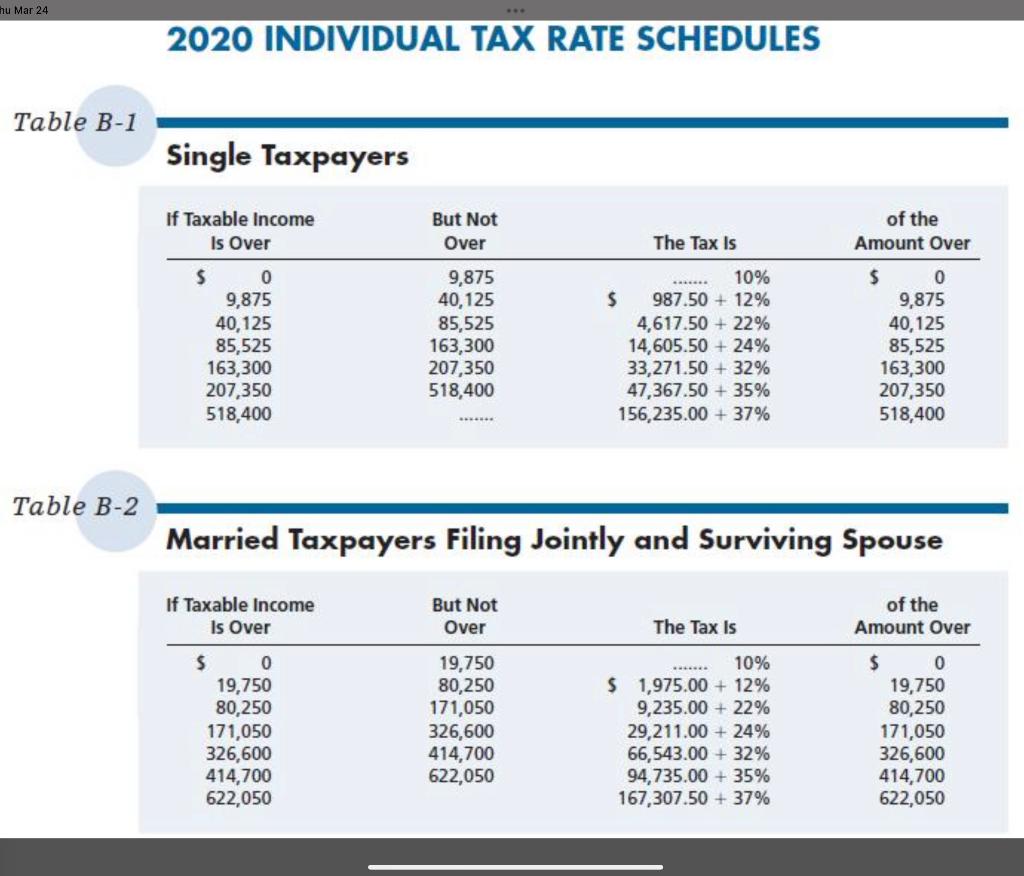

1:10 AM Thu Mar 24 36% Chapter 8 Homework eBook I Tax Rate Schedules Deductions from Adjusted Gross Income, Calculating Tax Liability (LO. 3, 5) Hongtao is single and has a gross income of $85,100. His allowable deductions for adjusted gross Income are $4,100, and his itemized deductions are $19,750. The standard deduction for 2020 is $12,400 Round all final amounts to the nearest dollar. Refer to the Tax Rate Schedules to answer the following questions a. Hangtao's taxable income is s and his tax liability is $ for 2020. Feecback Check My Work After determining the taxpayer's taxable income, the tax is computed using the appropriate rate for the taxpayer's filing status. b. If Hongtao has 59,900 withheld from his salary during 2020 then Hongtao has a refund or s Feedback Check My Work Partially correct C. Assume the same facts as in part a and part b, except that Hongtao is married. His wife's salary is $27,800, and she has $2,100 withheld from her paycheck. They file jointly. The standard deduction for 2020 is $24,800. Their taxable income is and their tax liability is 5 for 2020. They will receive a refund of $ Feecback Check My Work Partially correct Feedback Check My Wors Partially correct Check My Work Previous Next > Assignment Score: 25.93% All work saved. Save and Exit Submit Assignment for Grading Done hu Mar 24 2020 INDIVIDUAL TAX RATE SCHEDULES Table B-1 Single Taxpayers if Taxable income Is Over But Not Over of the Amount Over The Tax Is $ 0 9,875 40,125 85,525 163,300 207,350 518,400 9,875 40,125 85,525 163,300 207,350 518,400 10% $ 987.50 + 12% 4,617.50 + 22% 14,605.50 + 24% 33,271.50 + 32% 47,367.50 + 35% 156,235.00 + 37% $ 0 9,875 40,125 85,525 163,300 207,350 518,400 Table B-2 Married Taxpayers Filing Jointly and Surviving Spouse of the Amount Over The Tax Is If Taxable income Is Over $ 0 19,750 80,250 171,050 326,600 414,700 622,050 But Not Over 19,750 80,250 171,050 326,600 414,700 622,050 10% $ 1,975.00 + 12% 9,235.00 + 22% 29,211.00 +24% 66,543.00 + 32% 94,735.00 + 35% 167,307.50 + 37% $ 0 19,750 80,250 171,050 326,600 414,700 622,050