Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11.1- *PLEASE ANSWER ALL 5 QUESTIONS * 5 multiple choice questions: 1. 2. 3. 4. 5. Personal liability is a significant disadvantage of the partnership

11.1- *PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions:

1.

2.

3.

4.

5.

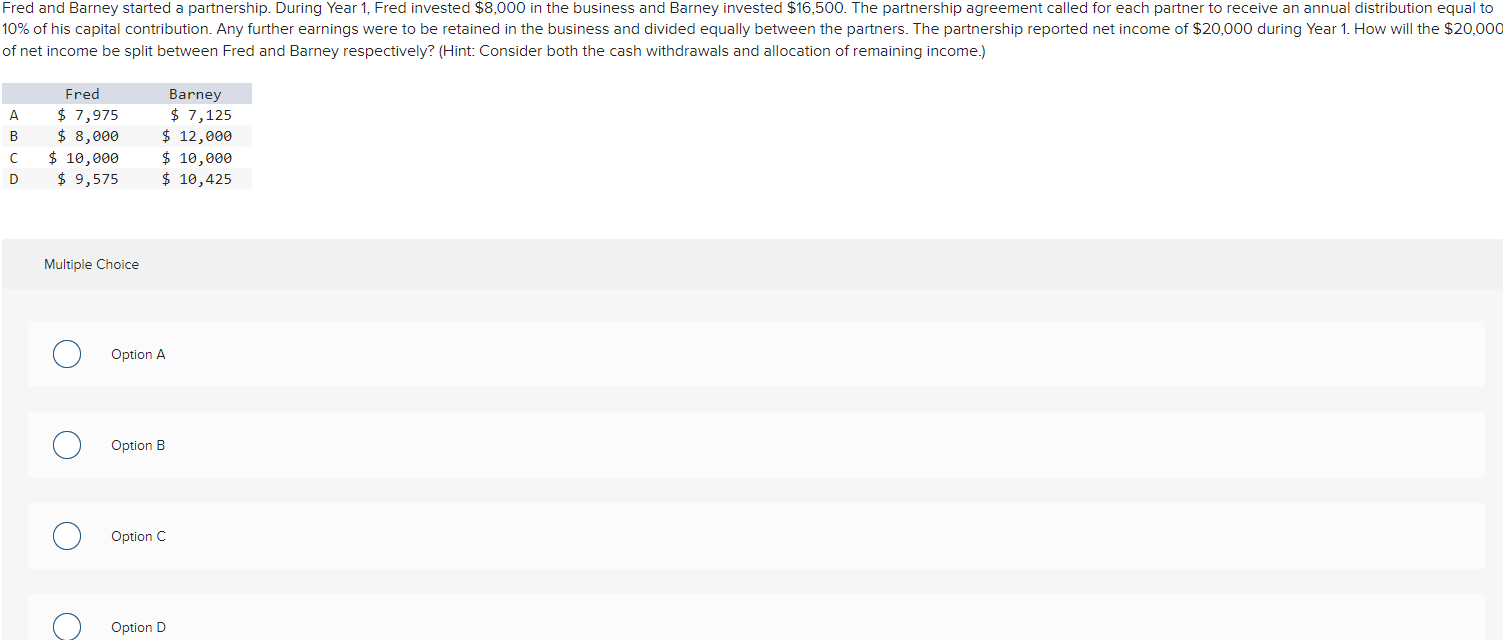

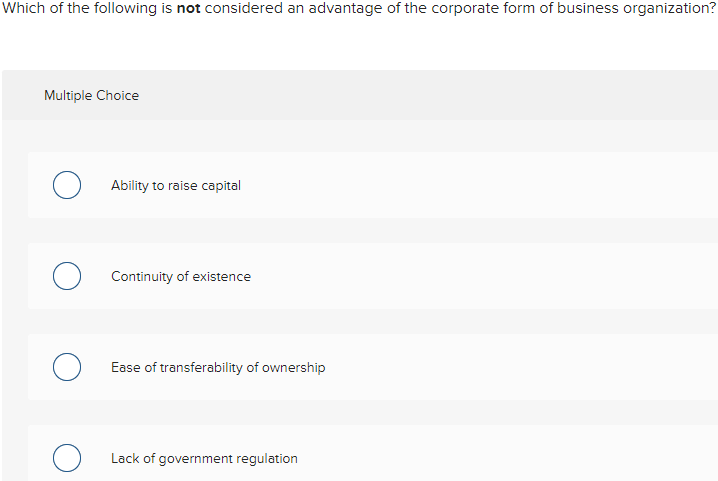

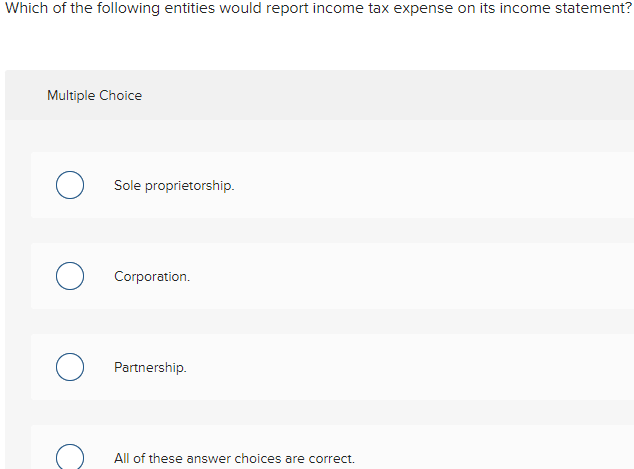

Personal liability is a significant disadvantage of the partnership form of business organization True or False A separate capital account is maintained for each partner in a partnership. True or False Ihich of the following entities would report income tax expense on its income statement? Multiple Choice Sole proprietorship. Corporation. Partnership. All of these answer choices are correct. f net income be split between Fred and Barney respectively? (Hint: Consider both the cash withdrawals and allocation of remaining income.) Multiple Choice Option A Option B Option C Option D /hich of the following is not considered an advantage of the corporate form of business organization? Multiple Choice Ability to raise capital Continuity of existence Ease of transferability of ownership Lack of government regulation

Personal liability is a significant disadvantage of the partnership form of business organization True or False A separate capital account is maintained for each partner in a partnership. True or False Ihich of the following entities would report income tax expense on its income statement? Multiple Choice Sole proprietorship. Corporation. Partnership. All of these answer choices are correct. f net income be split between Fred and Barney respectively? (Hint: Consider both the cash withdrawals and allocation of remaining income.) Multiple Choice Option A Option B Option C Option D /hich of the following is not considered an advantage of the corporate form of business organization? Multiple Choice Ability to raise capital Continuity of existence Ease of transferability of ownership Lack of government regulation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started