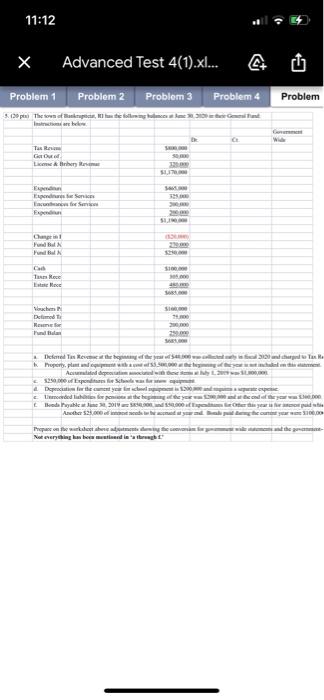

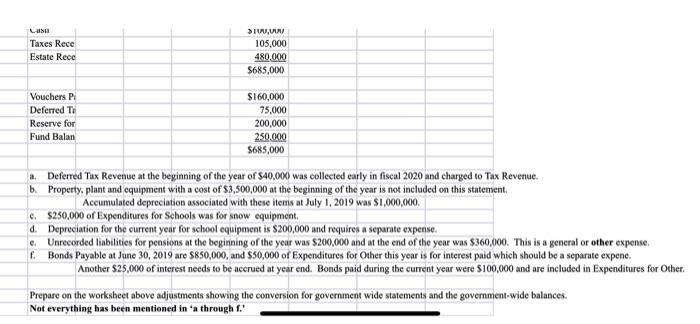

11:12 X Advanced Test 4(1).xl... Problem 1 Problem 2 Problem 3 Problem 4 5.120 pts The sound ankrupen, was storms holmsmeist Problem spendis. Son Inco Sar BN Fund C Tanne EN Wochen Demet None und Tu Me Deed Test portplant And die poniewa Depeche de les per a thada Payablete 2018 100.00 Thep on the westerse Notryching has been le brugte La Taxes Rece Estate Rece >IW, 105,000 480.000 $685,000 Vouchers P Deferred To Reserve for Fund Balan $160,000 75,000 200,000 250.000 S685,000 e. f a Deferred Tax Revenue at the beginning of the year of $40,000) was collected early in fiscal 2020 and charged to Tax Revenue. b. Property, plant and equipment with a cost of $3,500,000 at the beginning of the year is not included on this statement, Accumulated depreciation associated with these items at July 1, 2019 was $1,000,000 c. $250,000 of Expenditures for Schools was for snow equipment, 4 Depreciation for the current year for school equipment is $200,000 and requires a separate expense. Unrecorded liabilities for pensions at the beginning of the year was $200,000 and at the end of the year was $360,000. This is a general or other expense, Bonds Payable at June 30, 2019 are $850,000, and $50,000 of Expenditures for Other this year is for interest paid which should be a separate expene. Another $25,000 of interest needs to be accrued at year end. Bonds paid during the current year were $100,000 and are included in Expenditures for Other Prepare on the worksheet above adjustments showing the conversion for government wide statements and the government-wide balances. Not everything has been mentioned in 'a through 11:12 X Advanced Test 4(1).xl... Problem 1 Problem 2 Problem 3 Problem 4 5.120 pts The sound ankrupen, was storms holmsmeist Problem spendis. Son Inco Sar BN Fund C Tanne EN Wochen Demet None und Tu Me Deed Test portplant And die poniewa Depeche de les per a thada Payablete 2018 100.00 Thep on the westerse Notryching has been le brugte La Taxes Rece Estate Rece >IW, 105,000 480.000 $685,000 Vouchers P Deferred To Reserve for Fund Balan $160,000 75,000 200,000 250.000 S685,000 e. f a Deferred Tax Revenue at the beginning of the year of $40,000) was collected early in fiscal 2020 and charged to Tax Revenue. b. Property, plant and equipment with a cost of $3,500,000 at the beginning of the year is not included on this statement, Accumulated depreciation associated with these items at July 1, 2019 was $1,000,000 c. $250,000 of Expenditures for Schools was for snow equipment, 4 Depreciation for the current year for school equipment is $200,000 and requires a separate expense. Unrecorded liabilities for pensions at the beginning of the year was $200,000 and at the end of the year was $360,000. This is a general or other expense, Bonds Payable at June 30, 2019 are $850,000, and $50,000 of Expenditures for Other this year is for interest paid which should be a separate expene. Another $25,000 of interest needs to be accrued at year end. Bonds paid during the current year were $100,000 and are included in Expenditures for Other Prepare on the worksheet above adjustments showing the conversion for government wide statements and the government-wide balances. Not everything has been mentioned in 'a through