11-14 please answer them all.

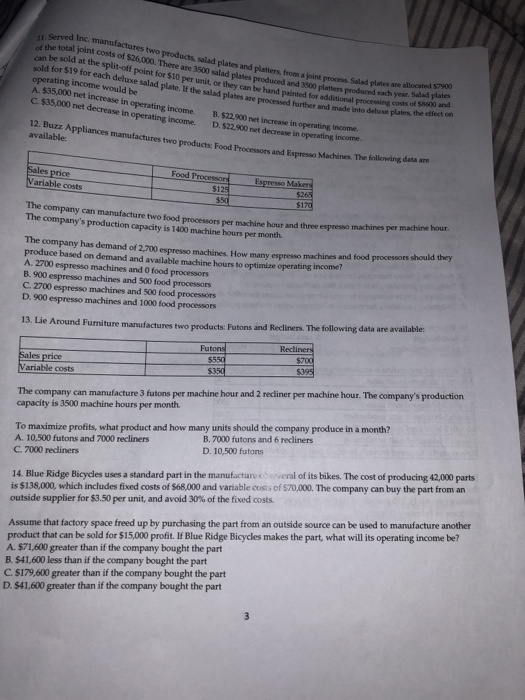

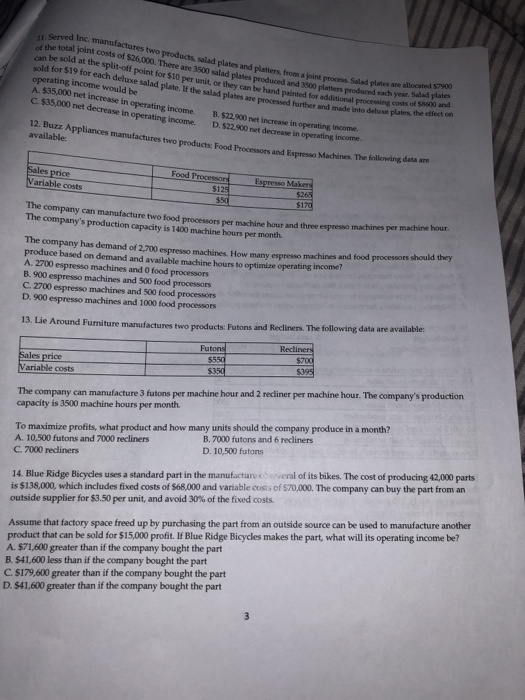

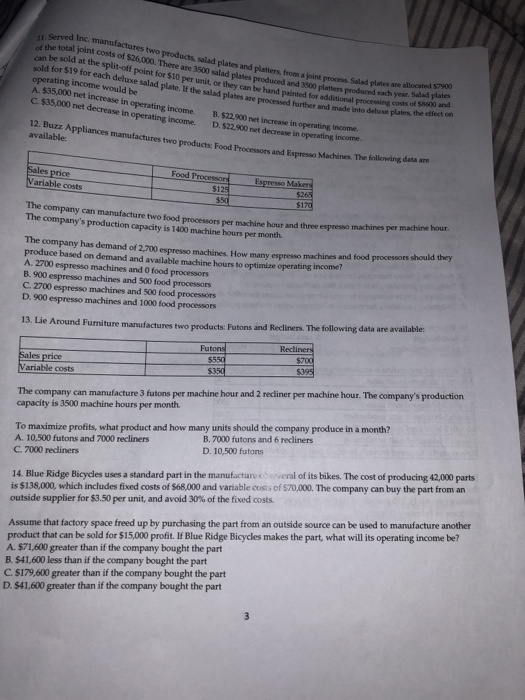

Served Inc. manufactures two products, salad plates and platters, from a joint process. be sold at the split-off point for $10 per unit, sold for $19 for each deluxe salad plate. If the salad plates are procoesed farther operating income would be A $35,000 net increase in operating income of the total joint costs of t $26,000. There are 3500 salad plates produced and 3500 platters salad plates produced and 3500 platters produced each year. Salad plate Salad plates are allocated $7900 or they can be hand painted for additional processing costs of $8600 ard and made into deluse plates, the efect on B.$22,900 net increase in operating income. in operating income. D. $22,900 net decrease in operating incone. 12. Buzz Appliances manufactures es two products: Food Processors and Espresso Machines. The following data are products Food Processo les price Variable costs S125 Espresso Mabkers The company can manufacture two food processors per machine hour and three espresso The company's production capacity is 1400 machine hours per month The company has demand of 2,700 espresso machines. How many espresso produce based on demand and available machine hours to optimize operating A-2700 espresso machines and O food processors B. 900 espresso machines and 500 food processors C 2700 espresso machines and 500 food processors D. 900 espresso machines and 1000 food processors machines and food processors should they op espresso hachines anfood proesrs 13. Lie Around Furniture manufactures two products Futons and Recliners. The following data are Fu The company can manufacture 3 futons per machine hour and 2 recdliner per machine hour. The company's production capacity is 3500 machine hours per month. To maximize profits, what product and how many units should the company produce in a month? A. 10,500 futons and 7000 recliners C. 7000 recliners B. 7000 futons and 6 recliners D. 10,500 futons 14. Blue Ridge Bicycles uses a standard part in the manufacturesveral of its bikes. The cost of producing 42,000 parts is $138,000, which includes fixed costs of $68,000 and variable cosis of $70,000. The company can buy the part from an outside supplier for $3.50 per unit, and avoid 30% of the fixed costs. Assume that factory space freed up by purchasing the part from an outside source can be used to manufacture another product that can be sold for $15,000 profit. If Blue Ridge Bicycles makes the part, what will its operating income be? A. $71,600 greater than if the company bought the part B. $41,600 less than if the company bought the part C: $179,600 greater than if the company bought the part D. $41,600 greater than if the company bought the part