Question: could any one help me with the four questiones? the four of them not only the second one !!!! Superior Manufacturing Company In February 2005,

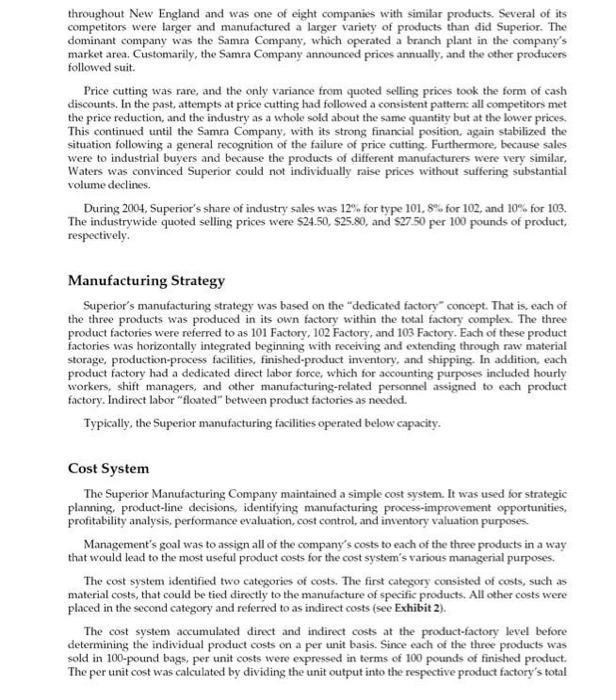

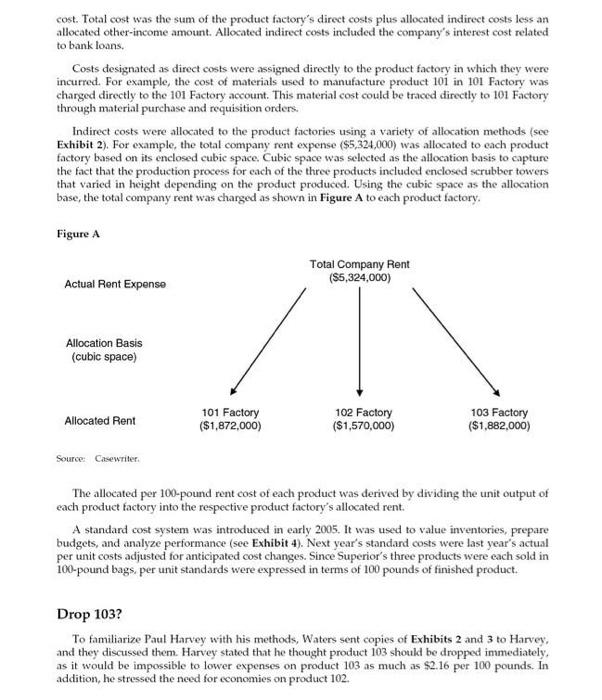

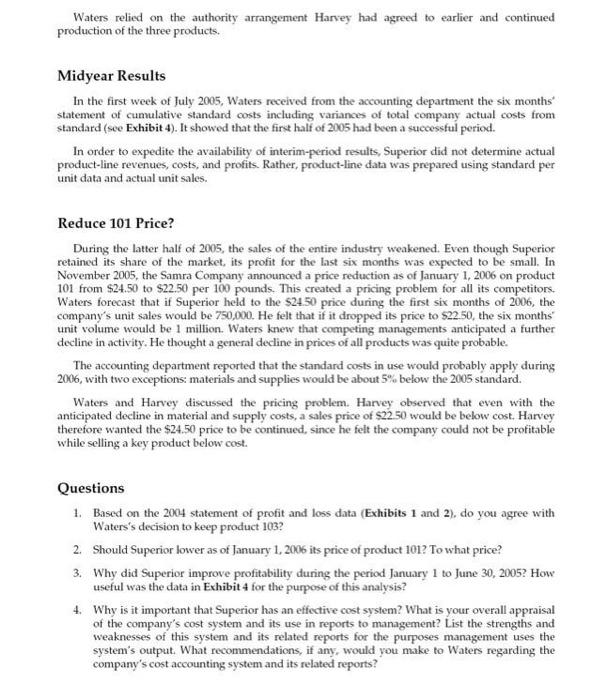

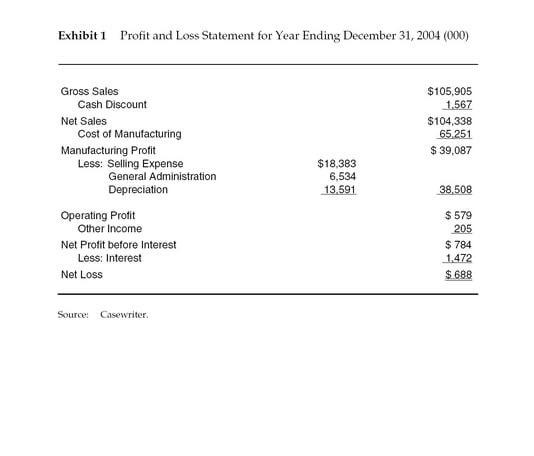

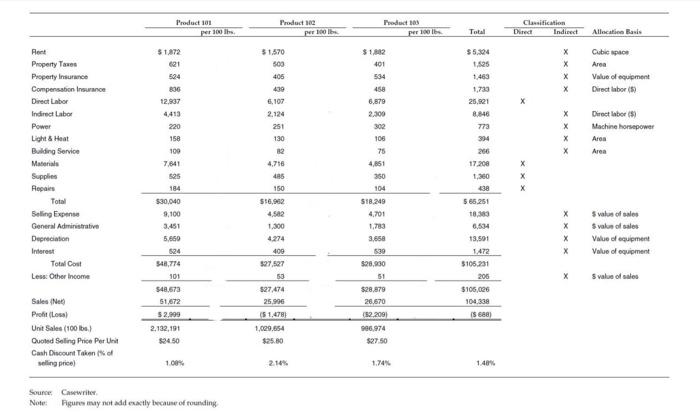

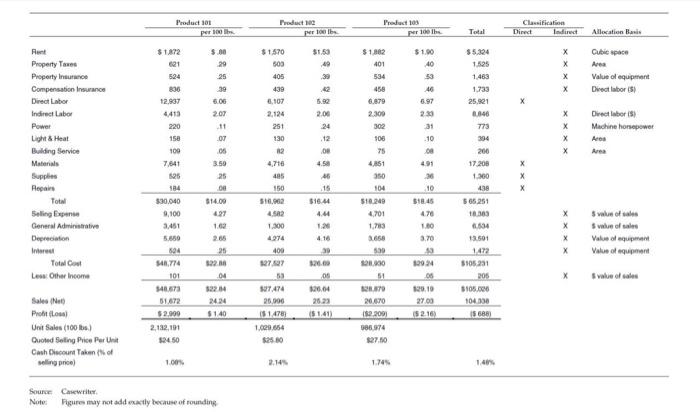

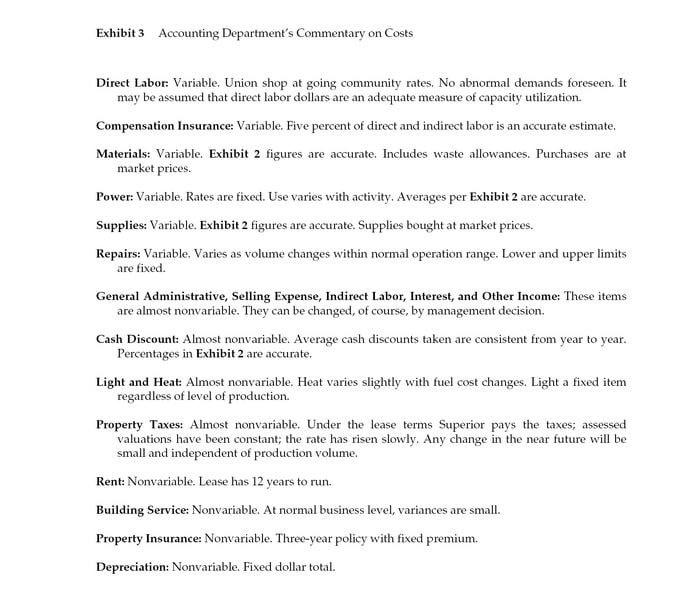

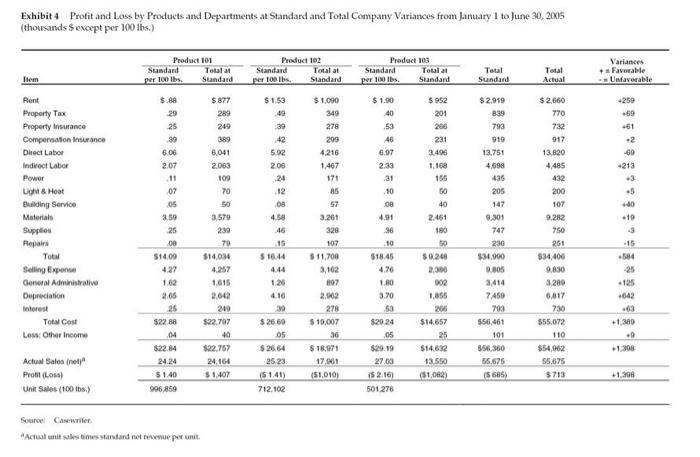

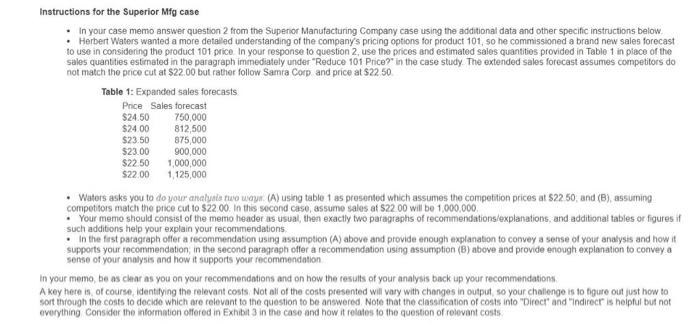

Superior Manufacturing Company In February 2005, Herbert Waters was appointed general manager of the Superior Manufacturing Company by Paul Harvey, president. Waters, 56, had wide executive experience in manufacturing products similar to those of Superior. The appointment of Waters resulted from management problems arising from the death of Richard Harvey, founder and, until his death in early 2004, president of Superior. Paul Harvey had only four years' experience with the company, and in early 2005 was 34 years old. His father had hoped to train him over a 10-year period, but his untimely death had cut this seasoning period short. The younger Harvey became president when his father died and had exercised full control until he hired Waters. New Management Paul Harvey knew that during 2004 he had made several poor decisions and noted that morale of the organization had suffered, apparently through lack of confidence in him. When he received the income statement for 2004 (see Exhibit 1) showing a net loss of $688,000 during a good business year. he knew he needed help. He attracted Waters from a competitor by offering a stock option incentive in addition to salary, knowing that Waters wanted to acquire a financial competence for his retirement. The two men came to a clear understanding that Waters, as general manager, had full authority to execute any changes he desired. In addition, Waters would explain the reasons for his decisions to Harvey and thereby train him for successful leadership upon Waters's retirement Upon taking office in February 2005, Waters decided against immediate major changes. Rather, he chose to analyze 2004 operations and to wait to see results for the first half of 2005. He instructed the accounting department to provide detailed expenses and earnings statements by products and departments for 2004 (see Exhibit 2). In addition, he requested an explanation of the nature of the company's costs including their expected future behavior (see Exhibit 3). Company and Industry The Superior Manufacturing Company made only three industrial products: 101, 102, and 103. They were sold by the company's sales force for use in the processes of other manufacturers. All of the sales force on a salary basis, sold the three products but in varying proportions. Superior sold throughout New England and was one of eight companies with similar products. Several of its competitors were larger and manufactured a larger variety of products than did Superior. The dominant company was the Samra Company, which operated a branch plant in the company's market area. Customarily, the Samra Company announced prices annually, and the other producers followed suit. l'rice cutting was rare, and the only variance from quoted selling prices took the form of cash discounts. In the past, attempts at price cutting had followed a consistent pattern: all competitors met the price reduction, and the industry as a whole sold about the same quantity but at the lower prices This continued until the Samra Company, with its strong financial position again stabilized the situation following a general recognition of the failure of price cutting. Furthermore, because sales were to industrial buyers and because the products of different manufacturers were very similar, Waters was convinced Superior could not individually raise prices without suffering substantial volume declines. During 2004, Superior's share of industry sales was 12% for type 101,8% for 102, and 10% for 103. The industrywide quoted selling prices were $24.50, $25.80, and $27.50 per 100 pounds of product, respectively. Manufacturing Strategy Superior's manufacturing strategy was based on the "dedicated factory concept. That is, each of the three products was produced in its own factory within the total factory complex. The three product factories were referred to as 101 Factory, 102 Factory, and 103 Factory. Each of these product factories was horizontally integrated beginning with receiving and extending through raw material storage, production process facilities, finished product inventory, and shipping. In addition, each product factory had a dedicated direct labor force, which for accounting purposes included hourly workers, shift managers, and other manufacturing-related personnel assigned to each product factory. Indirect labor "floated" between product factories as needed. Typically, the Superior manufacturing facilities operated below capacity. Cost System The Superior Manufacturing Company maintained a simple cost system. It was used for strategic planning, product-line decisions, identifying manufacturing process-improvement opportunities, profitability analysis, performance evaluation, cost control, and inventory valuation purposes Management's goal was to assign all of the company's costs to each of the three products in a way that would lead to the most useful product costs for the cost system's various managerial purposes. The cost system identified two categories of costs. The first category consisted of costs, such as material costs, that could be tied directly to the manufacture of specific products. All other costs were placed in the second category and referred to as indirect costs (see Exhibit 2). The cost system accumulated direct and indirect costs at the product-factory level before determining the individual product costs on a per unit basis. Since each of the three products was sold in 100-pound bags, per unit costs were expressed in terms of 100 pounds of finished product. The per unit cost was calculated by dividing the unit output into the respective product factory's total cost. Total cost was the sum of the product factory's direct costs plus allocated indirect costs less an allocated other-income amount. Allocated indirect costs included the company's interest cost related to bank loans. Costs designated as direct costs were assigned directly to the product factory in which they were incurred. For example, the cost of materials used to manufacture product 101 in 101 Factory was charged directly to the 101 Factory account. This material cost could be traced directly to 101 Factory through material purchase and requisition orders. Indirect costs were allocated to the product factories using a variety of allocation methods (see Exhibit 2). For example, the total company rent expense ($5,324,000) was allocated to cach product factory based on its enclosed cubic space Cubic space was selected as the allocation basis to capture the fact that the production process for each of the three products included enclosed scrubber towers that varied in height depending on the product produced. Using the cubic space as the allocation base, the total company rent was charged as shown in Figure A to each product factory. Figure A Total Company Rent ($5,324,000) Actual Rent Expense Allocation Basis (cubic space) Allocated Rent 101 Factory ($1,872,000) 102 Factory ($1,570,000) 103 Factory ($1,882,000) Source: Crewriter The allocated per 100-pound rent cost of each product was derived by dividing the unit output of each product factory into the respective product factory's allocated rent. A standard cost system was introduced in early 2005. It was used to value inventories, prepare budgets, and analyze performance (see Exhibit 4). Next year's standard costs were last year's actual per unit costs adjusted for anticipated cost changes. Since Superior's three products were cach sold in 100-pound bags per unit standards were expressed in terms of 100 pounds of finished product. Drop 103? To familiarize Paul Harvey with his methods, Waters sent copies of Exhibits 2 and 3 to Harvey. and they discussed them. Harvey stated that he thought product 103 should be dropped immediately. as it would be impossible to lower expenses on product 103 as much as $2.16 per 100 pounds. In addition, he stressed the need for economies on product 102. Waters relied on the authority arrangement Harvey had agreed to earlier and continued production of the three products. Midyear Results In the first week of July 2005, Waters received from the accounting department the six months statement of cumulative standard costs including variances of total company actual costs from standard (see Exhibit 4). It showed that the first half of 2005 had been a successful period. In order to expedite the availability of interim-period results, Superior did not determine actual product-line revenues, costs, and profits. Rather, product-line data was prepared using standard per unit data and actual unit sales. Reduce 101 Price? During the latter half of 2005, the sales of the entire industry weakened. Even though Superior retained its share of the market, its profit for the last six months was expected to be small. In November 2005, the Samra Company announced a price reduction as of January 1, 2006 on product 101 from $24.50 to $22.50 per 100 pounds. This created a pricing problem for all its competitors. Waters forecast that if Superior held to the $24.50 price during the first six months of 2006, the company's unit sales would be 750,000. He felt that if it dropped its price to $22.50, the six months unit volume would be 1 million. Waters knew that competing managements anticipated a further decline in activity. He thought a general decline in prices of all products was quite probable. The accounting department reported that the standard costs in use would probably apply during 2006, with two exceptions: materials and supplies would be about 5% below the 2005 standard. Waters and Harvey discussed the pricing problem. Harvey observed that even with the anticipated decline in material and supply costs, a sales price of $22.50 would be below cost. Harvey therefore wanted the $24.50 price to be continued, since he felt the company could not be profitable while selling a key product below cost. Questions 1. Based on the 2004 statement of profit and loss data (Exhibits 1 and 2). do you agree with Waters's decision to keep product 103? 2. Should Superior lower as of January 1, 2006 its price of product 1012 To what price? 3. Why did Superior improve profitability during the period January 1 to June 30, 2005? How useful was the data in Exhibit 4 for the purpose of this analysis? 4. Why is it important that Superior has an effective cost system? What is your overall appraisal of the company's cost system and its use in reports to management? List the strengths and weaknesses of this system and its related reports for the purposes management uses the system's output. What recommendations, if any, would you make to Waters regarding the company's cost accounting system and its related reports? Exhibit 1 Profit and Loss Statement for Year Ending December 31, 2004 (000) $105,905 1.567 $104,338 65 251 $ 39,087 Gross Sales Cash Discount Net Sales Cost of Manufacturing Manufacturing Profit Less: Selling Expense General Administration Depreciation Operating Profit Other Income Net Profit before Interest Less: Interest Net Loss $18,383 6,534 13.591 38,508 $ 579 205 $ 784 1.472 $ 688 Source: Casewriter Product 101 Products Products Classification Direct Indirect pers Total Allocation Basis 51.872 X X x Cubicace Area Value of woment Direct labor X 524 806 12.937 4,413 220 158 100 7641 $1,570 500 405 430 6,107 2.124 251 130 B2 4,716 485 150 5:6,962 4.582 1.300 4.274 Property Town Property Insurance Compensation Insurance Direct Labor Indirect Labor Power Light & Heat Building Service Materiale Supplies Repairs Total Seling Expense General Administrative Depreciation Interest Total Cost Less Other Income $1,812 401 534 458 6,879 2.300 302 106 75 4,651 350 104 X Direct labor x Machine horsepower X Ares X Area $5,304 1.525 1.463 1.730 25,821 8.840 773 394 256 17.20 1,300 1:38 5 65.251 18,383 6,634 19.501 1.472 5105,231 206 $106,026 104.338 Issa X X 184 $30,040 8,100 3.451 X x $18.249 4.701 1,783 3,658 539 328,930 $value of les $value of sales Value of equipment Value of equipment 5.650 x 400 $27.527 53 51 x S value of le 541,774 101 548,673 51.672 5 2.999 2,132,191 $24.50 527,474 25,906 $28.079 26,670 (52.2001 151.478 1.029.654 Profit (Lose Unit Sale (100 lbs) Quoted Selling PricePerUnit Cash Discount Taken of selling price 906.974 $27.50 $25.80 1.00% 2.1 140% Source Cawwriter Note: Figures may not add exactly because of tounding Product 101 Product 12 Productos 100h Classification Direct Indirect 100 The Total Allocation Band $1.872 $1.50 49 Cubie space $ 1.162 401 $5.324 1.525 621 24 $.00 20 25 39 X X X x 42 1.733 Value of equipment Direct labor (5) X Rent Property Towes Property Insurance Compensation Insurance Direct Labor Indirect Labor Powert Light & Heat Building Service Materials $1.570 503 405 439 6.107 2,124 251 130 12 4,716 836 12.837 4413 220 150 100 7.641 2.00 2.07 11 07 6.879 2.300 302 100 75 4861 $1.00 40 53 46 6.97 235 -31 -10 00 491 26 10 25.821 1846 773 394 200 17.20 1.300 X Direct laboris X Machine horsepower X Ares 12 4.50 125 X X 3.50 25 . $14.00 497 1.62 330.000 9,100 3.451 X Hepairs Total Seling General Administrative Depreciation In Total Cost Les Other Income 150 51.62 452 1.300 4274 400 4.70 1.00 104 $10.240 4.701 1.22 31658 500 15 $16:44 4.44 120 416 30 520.00 05 120.04 2623 3.70 value of a value of sales Value o quant Value of equipment 505251 18.30 0504 13.501 1.472 5105231 205 $105.000 104000 25 1228 X 04 51 524 $48.774 101 140.673 51.672 $2.000 2,132,101 52450 X 27474 25.000 129.24 05 12.10 27.03 152.16 2424 $1.40 2.70 20.670 18.2.2001 986.74 27.10 Sale Net Proto Unit Sales (100 lbs) Quoted Sofing PricePerUnit Cash Ciscount Taken of eing price) 1.600.654 $25.00 1.005 1.745 Source Casewriter Note Figures may not addetly because of rounding Exhibit 3 Accounting Department's Commentary on Costs Direct Labor: Variable. Union shop at going community rates. No abnormal demands foreseen. It may be assumed that direct labor dollars are an adequate measure of capacity utilization. Compensation Insurance: Variable. Five percent of direct and indirect labor is an accurate estimate Materials: Variable. Exhibit 2 figures are accurate. Includes waste allowances. Purchases are at market prices. Power: Variable. Rates are fixed. Use varies with activity. Averages per Exhibit 2 are accurate. Supplies: Variable. Exhibit 2 figures are accurate. Supplies bought at market prices. Repairs: Variable. Varies as volume changes within normal operation range. Lower and upper limits are fixed. General Administrative, Selling Expense, Indirect Labor, Interest, and Other Income: These items are almost nonvariable. They can be changed, of course, by management decision. Cash Discount: Almost nonvariable. Average cash discounts taken are consistent from year to year. Percentages in Exhibit 2 are accurate, Light and Heat: Almost nonvariable. Heat varies slightly with fuel cost changes. Light a fixed item regardless of level of production Property Taxes: Almost nonvariable. Under the lease terms Superior pays the taxes; assessed valuations have been constant, the rate has risen slowly. Any change in the near future will be small and independent of production volume. Rent: Nonvariable. Lease has 12 years to run. Building Service: Nonvariable. At normal business level, variances are small. Property Insurance: Nonvariable. Three-year policy with fixed premium. Depreciation: Nonvariable. Fixed dollar total. Exhibit 4 Protit and Loss by Products and Departments at Standard and Total Company Variances from January 1 to June 30, 2015 (thousands Sexcept per 100 lbs.) Product 101 Standard Total per 100 lbs Standard Product 102 Standard Total at Standard Product 103 Standard Touala per 100 lbs. Standard Total Standard Item Variances + Favorable Unfavorable Total Actual $ 1.53 49 39 $952 201 $.88 29 25 39 6.06 2.07 $ 877 280 249 389 6.041 2063 100 70 259 .69 -61 +2 -60 213 Rent Property Tax Property Insurance Compensation Intrance Direct Labor Indirect Labor Power Light & Heat Building Service Materials Supplies Repair Total Selling Expense General Administrative Depreciation Interest Total Cost Les Other Income $2.919 839 793 910 13.751 4.698 435 205 $ 1.090 340 278 209 4,216 1,467 171 85 57 3.261 328 107 $11.708 3,162 5.92 200 24 12 08 4.58 .46 15 $ 16:44 231 3.490 1.168 155 50 40 2.461 180 25 -40 -10 $ 1.90 40 53 46 6.97 2.33 31 10 08 4.91 36 10 $18.45 4.76 1.80 3.70 53 $20 24 05 $29.19 27.03 152.16) 501 276 $9.29 3.579 230 70 $14,034 4.257 1.615 2,642 240 $22.797 40 -15 -584 -25 $ 2,660 770 732 917 13.820 4485 432 200 107 9.282 750 251 $34.400 9.830 3.200 6,617 730 $55.072 110 $54,062 55.675 3713 07 05 3.50 25 09 $14.00 4.27 1.62 2.65 25 $22.88 04 $22.84 24.24 $1.40 996,850 097 125 1.26 4.10 vo $ 2660 05 $20.64 25.23 (51.41) 712.102 2.062 278 $ 10,007 36 $ 18,071 17.961 (51,010) 9.301 747 230 $34.900 0.005 1414 7450 703 $56,461 101 356,360 55.675 15685) 002 1.855 200 $14.657 25 $14.632 13.550 (51 012) .642 .63 +1,390 . 1308 Actual Sales (net Pront LO) Unit Sales (100) $22.757 24.164 $ 1.407 1398 Source Casewriter Actual unit times standardet e per unit Instructions for the Superior Mig case In your case memo answer question 2 from the Superior Manufacturing Company case using the additional data and other specific instructions below Herbert Waters wanted a more detailed understanding of the company's pricing options for product 101, so he commissioned a brand new sales forecast to use in considering the product 101 price in your response to question 2 use the prices and estimated sales quantities provided in Tablo 1 in place of the sales quantities estimated in the paragraph immediately under "Reduce 101 Price in the case study. The extended sales forecast assumes competitors do not match the price cut at $22.00 but rather follow Samra Corp and price at 22 50 Table 1: Expanded sales forecasts Price Sales forecast $24.50 750,000 $2400 812,500 $23.50 875,000 $23.00 900,000 $2250 1,000,000 $22.00 1125,000 Waters asks you to do your analysis two way. (A) using table 1 as presented which assumes the competition prices at S22 50, and (B)assuming competitors match the price cut to $22.00. In this second case, assume sales af 522.00 will be 1,000,000 . Your memo should consist of the memo header as usual, then exactly two paragraphs of recommendations/explanations, and additional tables or figures if such additions help your explain your recommendations In the first paragraph offer a recommendation using assumption (A) above and provide enough explanation to convey a sense of your analysis and how it supports your recommendation in the second paragraph offer a recommendation using assumption (B) above and provide enough explanation to conveya sense of your analysis and how it supports your recommendation in your memo, be as cher as you on your recommendations and on how the results of your analysis back up your recommendations A key here is, of course, identifying the relevant costs. Not all of the costs presented will vary with changes in output so your challenge is to figure out just how to sort through the costs to decide which are relevant to the question to be answered. Note that the classification of costs into "Direct" and "Indirect is helpful but not everything Consider the information offered in Exhibit 3 in the case and how it relates to the question of relevant costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts