Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11.15 certainty equiv a cash flow with a negative beta exceds e 11.9. Explain intuitively why the certaintye -flow-8-expected value Exercises 11.10-11.14 make use of

11.15

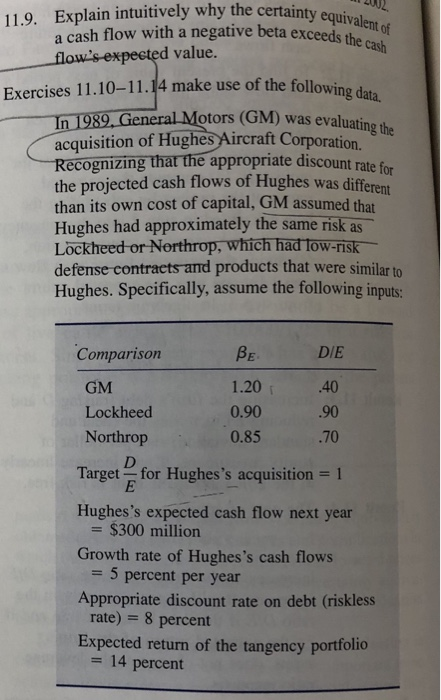

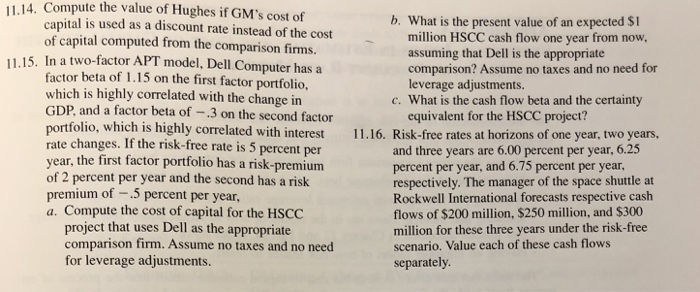

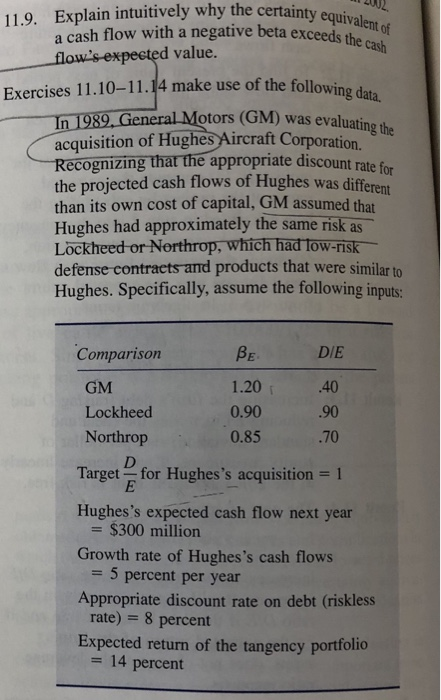

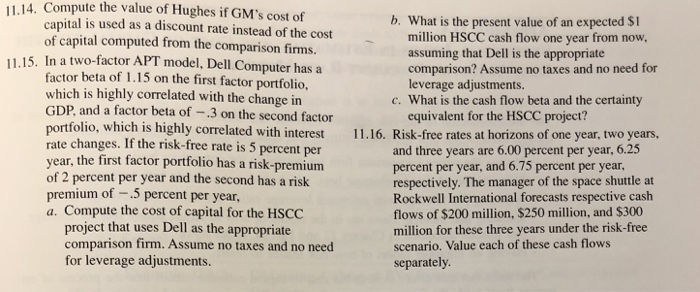

certainty equiv a cash flow with a negative beta exceds e 11.9. Explain intuitively why the certaintye -flow-8-expected value Exercises 11.10-11.14 make use of the followino Geeral Motors (GM) was evaluating the acquisition of Hughes Aircraft Corporation. zing that the appropriate discount rate for ecogni the projected cash flows of Hughes was different than its own cost of capital, GM Hughes had approximately the same risk as Lockheed or Northrop, which had Tow-Tisk defense contracts and products that were similar to Hughes. Specifically, assume the following inputs assumed that BE 1.20 0.90 0.85 DIE .40 .90 .70 Comparison GM Lockheed Northrop Target for Hughes's acquisition -1 Hughes's expected cash flow next year = $300 million - 5 percent per year rate) 8 percent = 14 percent Growth rate of Hughes's cash flows Appropriate discount rate on debt (riskless Expected return of the tangency portfolio 114. Compute the value of Hughes if GM's cost of capital is used as a discount rate instead of the cost of capital computed from the comparison firms. b. What is the present value of an expected $1 million HSCC cash flow one year from now 11.15. In a two-factor APT model, Dell Computer has a assuming that Dell is the appropriate comparison? Assume no taxes and no need for factor beta of 1.15 on the first factor portfolio, which is highly correlated with the change in GDP, and a factor beta of-.3 on the second factor portfolio, which is highly correlated with interest 11.16. Risk-free rates at horizons of one year, two years, rate changes. If the risk-free rate is 5 percent per year, the first factor portfolio has a risk-premium of 2 percent per year and the second has a risk premium of-5 percent per year, a. Compute the cost of capital for the HSCC leverage adjustments. c. What is the cash flow beta and the certainty equivalent for the HSCC project? and three years are 6.00 percent per year, 6.25 percent per year, and 6.75 percent per year respectively. The manager of the space shuttle at Rockwell International forecasts respective cash flows of $200 million, $250 million, and $300 million for these three years under the risk-free scenario. Value each of these cash flows separately project that uses Dell as the appropriate comparison firm. Assume no taxes and no need for leverage adjustments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started