11222333

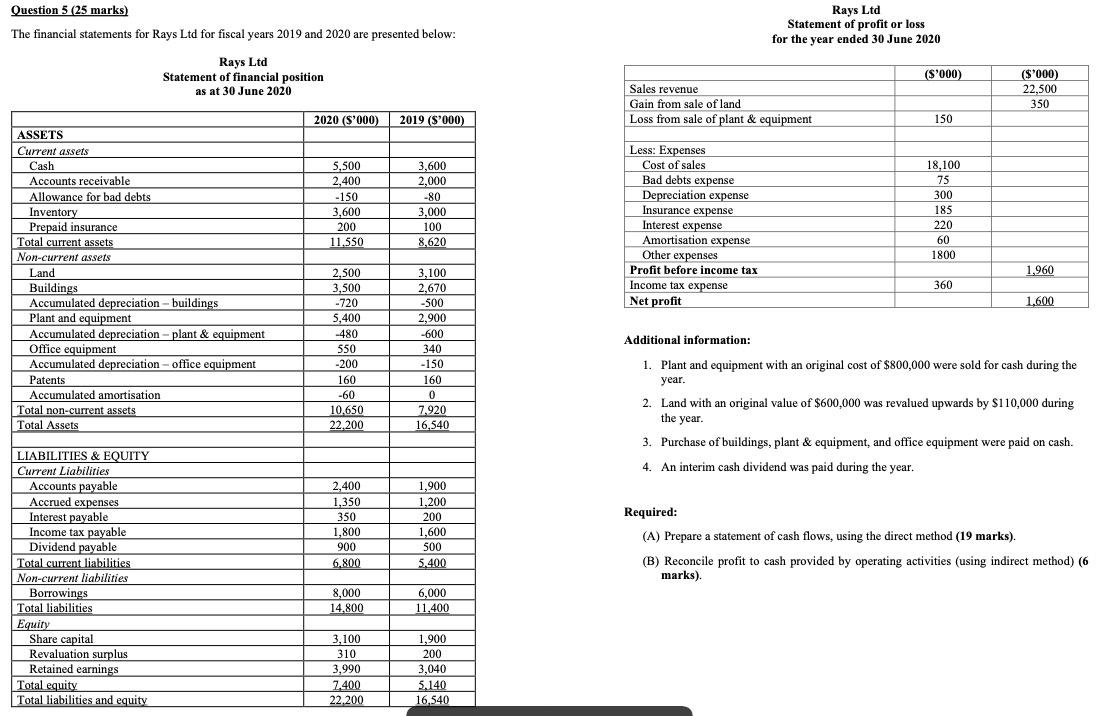

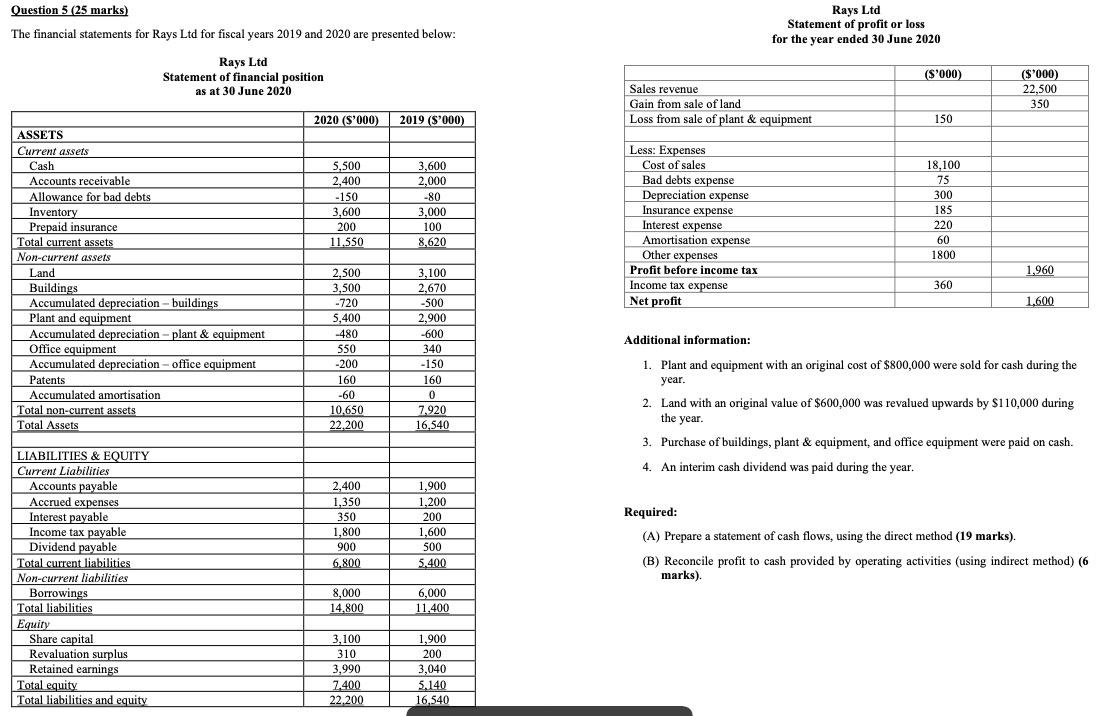

Question 5 (25 marks) Rays Ltd Statement of profit or loss for the year ended 30 June 2020 The financial statements for Rays Ltd for fiscal years 2019 and 2020 are presented below: Rays Ltd Statement of financial position as at 30 June 2020 (S'000) Sales revenue Gain from sale of land Loss from sale of plant & equipment (S'000) 22,500 350 2020 (S'000) 2019 (S'000) 150 ASSETS Current assets Cash Accounts receivable Allowance for bad debts Inventory Prepaid insurance Total current assets Non-current assets 18,100 75 300 5,500 2,400 - 150 3.600 200 11.550 3,600 2,000 -80 3,000 100 8.620 185 Less: Expenses Cost of sales Bad debts expense Depreciation expense Insurance expense Interest expense Amortisation expense Other expenses Profit before income tax Income tax expense Net profit 220 60 1800 Land 1.960 360 2,500 3,500 -720 5.400 1.600 3,100 2,670 -500 2,900 -600 340 -150 Buildings Accumulated depreciation - buildings Plant and equipment Accumulated depreciation - plant & equipment Office equipment Accumulated depreciation - office equipment Patents Accumulated amortisation Total non-current assets Total Assets Additional information: -480 550 -200 1. Plant and equipment with an original cost of $800,000 were sold for cash during the year. . 160 -60 10.650 160 0 7,920 16,540 2. Land with an original value of $600,000 was revalued upwards by $110,000 during the year. 22.200 3. Purchase of buildings, plant & equipment, and office equipment were paid on cash. 4. An interim cash dividend was paid during the year. 2,400 1,350 350 1,800 900 6.800 1,900 1,200 200 1,600 500 5.400 Required: (A) Prepare a statement of cash flows, using the direct method (19 marks). ( LIABILITIES & EQUITY Current Liabilities Accounts payable Accrued expenses Interest payable Income tax payable Dividend payable Total current liabilities Non-current liabilities Borrowings Total liabilities Equity Share capital Revaluation surplus Retained earnings Total equity Total liabilities and equity (B) Reconcile profit to cash provided by operating activities (using indirect method) 6 marks). 8,000 14.800 6,000 11,400 3,100 310 3,990 7.400 22,200 1,900 200 3,040 5.140 16,540