Answered step by step

Verified Expert Solution

Question

1 Approved Answer

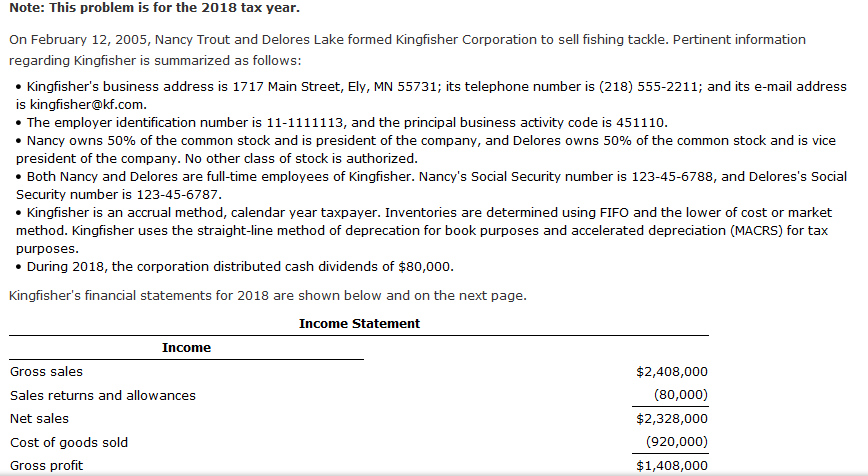

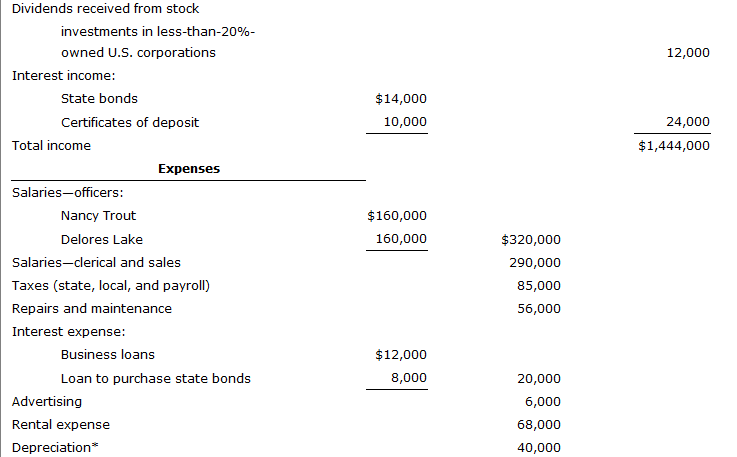

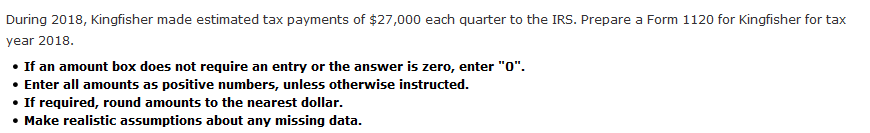

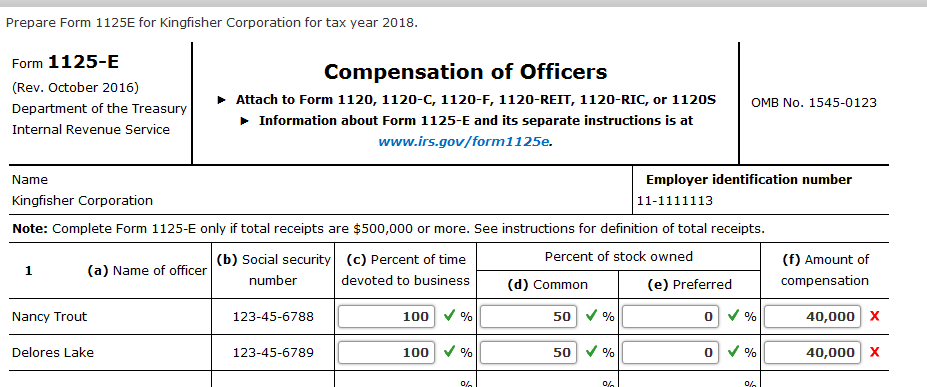

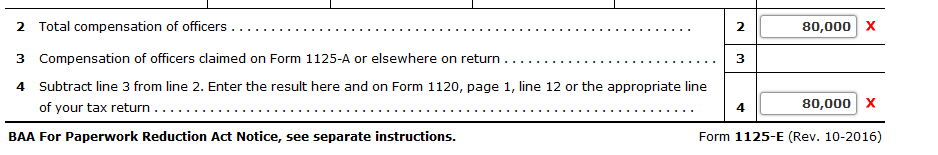

1125E and federal statement 12,000 $14,000 10,000 24,000 $1,444,000 Dividends received from stock investments in less-than-20%- owned U.S. corporations Interest income: State bonds Certificates of

1125E and federal statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started