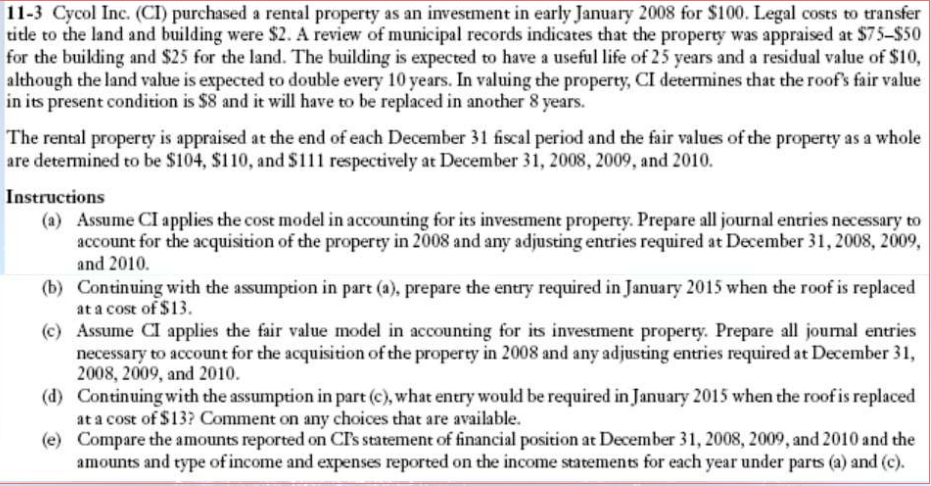

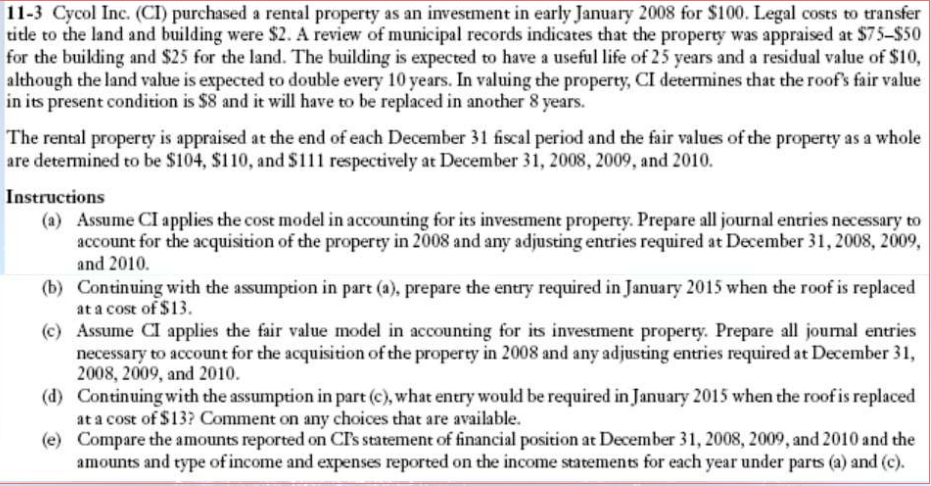

11-3 Cycol Inc. (CI) purchased a rental property as an investment in early January 2008 for S100. Legal costs to transfer title to the land and building were $2. A review of municipal records indicates that the properry was appraised at $75-$50 for the building and $25 for the land. The building is expected to have a useful life of 25 years and a residual value of $10, although the land value is expected to double every 10 years. In valuing the property, CI determines that the roofs fair value in its present condition is $8 and it will have to be replaced in another 8 years. The rental properey is appraised at the end of each December 31 fiscal period and the fair values of the property as a whole are determined to be $104, S110, and S respectively at December 31, 2008, 2009, and 2010. Instructions (a) Assume CI applies the cost model in accounting for its investment properey. Prepare all journal entries necessary to account for the acquisition of the property in 2008 and any adjusting entries required at December 31,2008, 2009, and 2010 Continuing with the assumption in part (a), prepare the entry required in January 2015 when the roof is replaced at a cost of $13. (b) (c) Assume CI applies the fair value model in accounting for its investment property. Prepare all jourmal entries necessary to account for the acquisition of the properry in 2008 and any adjusting entries required at December 31, 2008, 2009, and 2010. (d) Continuing with the assumption in part (c),what entry would be required in January 2015 when the roofis replaced (e) Compare the amounts reported on CT's statement of financial position at December 31, 2008, 2009, and 2010 and the at a cost of S13? Comment on any choices that are available. amounts and type of income and expenses reported on the income statements for each year under parts (a) and (c) 11-3 Cycol Inc. (CI) purchased a rental property as an investment in early January 2008 for S100. Legal costs to transfer title to the land and building were $2. A review of municipal records indicates that the properry was appraised at $75-$50 for the building and $25 for the land. The building is expected to have a useful life of 25 years and a residual value of $10, although the land value is expected to double every 10 years. In valuing the property, CI determines that the roofs fair value in its present condition is $8 and it will have to be replaced in another 8 years. The rental properey is appraised at the end of each December 31 fiscal period and the fair values of the property as a whole are determined to be $104, S110, and S respectively at December 31, 2008, 2009, and 2010. Instructions (a) Assume CI applies the cost model in accounting for its investment properey. Prepare all journal entries necessary to account for the acquisition of the property in 2008 and any adjusting entries required at December 31,2008, 2009, and 2010 Continuing with the assumption in part (a), prepare the entry required in January 2015 when the roof is replaced at a cost of $13. (b) (c) Assume CI applies the fair value model in accounting for its investment property. Prepare all jourmal entries necessary to account for the acquisition of the properry in 2008 and any adjusting entries required at December 31, 2008, 2009, and 2010. (d) Continuing with the assumption in part (c),what entry would be required in January 2015 when the roofis replaced (e) Compare the amounts reported on CT's statement of financial position at December 31, 2008, 2009, and 2010 and the at a cost of S13? Comment on any choices that are available. amounts and type of income and expenses reported on the income statements for each year under parts (a) and (c)