Answered step by step

Verified Expert Solution

Question

1 Approved Answer

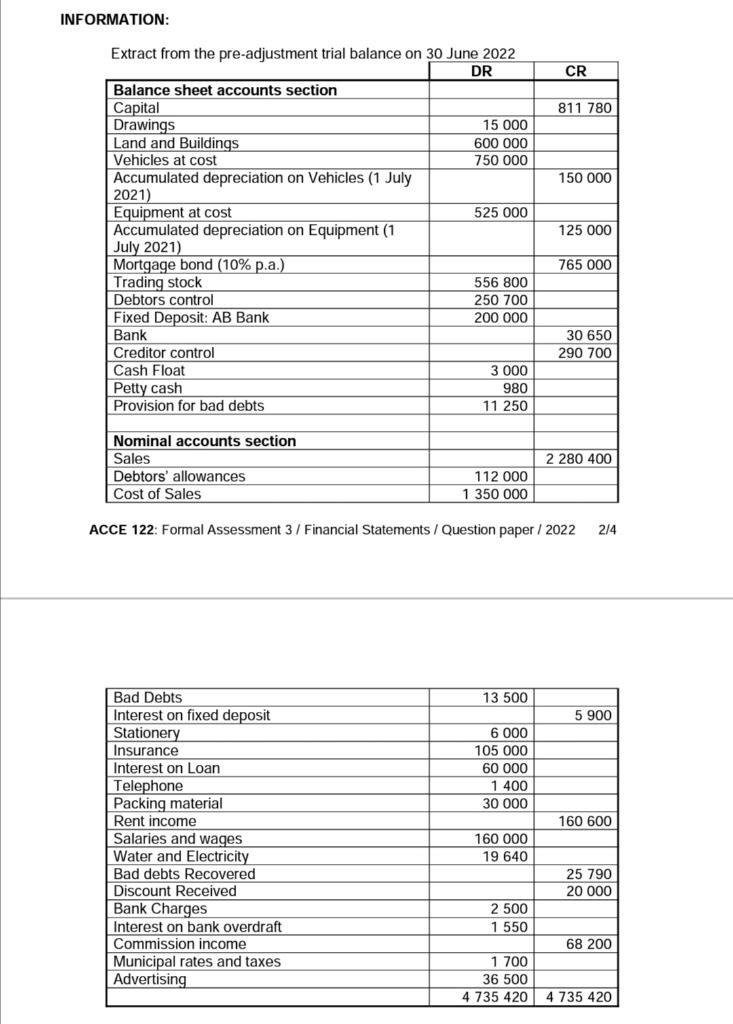

1.1.3 Prepare ONLY the ASSET SECTION of the Statement of Financial Position at the end of the financial year on 30 June 2022 (20) NFORMATION:

1.1.3 Prepare ONLY the ASSET SECTION of the Statement of Financial Position at the end of the financial year on 30 June 2022 (20)

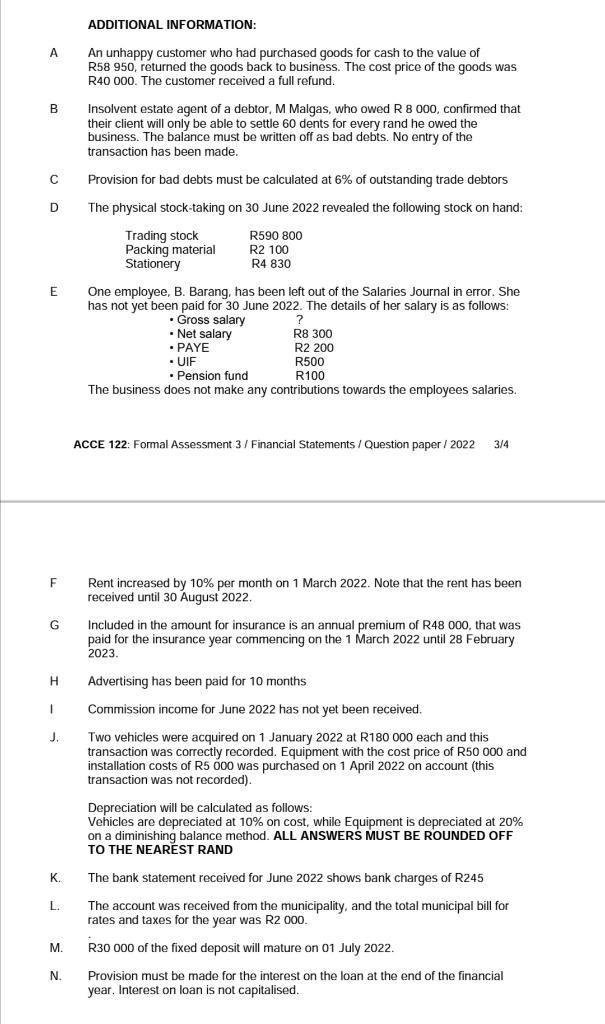

NFORMATION: Extract from the pre-adjustment trial balance on 30 June 2022 ACCE 122: Formal Assessment 3 / Financial Statements / Question paper / 2022 ADDITIONAL INFORMATION: A An unhappy customer who had purchased goods for cash to the value of R58 950, returned the goods back to business. The cost price of the goods was R40 000. The customer received a full refund. B Insolvent estate agent of a debtor, M Malgas, who owed R 8000 , confirmed that their client will only be able to settle 60 dents for every rand he owed the business. The balance must be written off as bad debts. No entry of the transaction has been made. C Provision for bad debts must be calculated at 6% of outstanding trade debtors D The physical stock-taking on 30 June 2022 revealed the following stock on hand: E One employee, B. Barang, has been left out of the Salaries Journal in error. She has not yet been paid for 30 June 2022 . The details of her salary is as follows: - Gross salary - Net salary - PAYE - UIF R R500 - Pension fund R100 The business does not make any contributions towards the employees salaries. ACCE 122: Formal Assessment 3/ Financial Statements / Question paper / 20223/4 F Rent increased by 10% per month on 1 March 2022 . Note that the rent has been received until 30 August 2022. G Included in the amount for insurance is an annual premium of R48 000 , that was paid for the insurance year commencing on the 1 March 2022 until 28 February 2023. H Advertising has been paid for 10 months I Commission income for June 2022 has not yet been received. J. Two vehicles were acquired on 1 January 2022 at R180 000 each and this transaction was correctly recorded. Equipment with the cost price of R50 000 and installation costs of R5 000 was purchased on 1 April 2022 on account (this transaction was not recorded). Depreciation will be calculated as follows: Vehicles are depreciated at 10% on cost, while Equipment is depreciated at 20% on a diminishing balance method. ALL ANSWERS MUST BE ROUNDED OFF TO THE NEAREST RAND K. The bank statement received for June 2022 shows bank charges of R245 L. The account was received from the municipality, and the total municipal bill for rates and taxes for the year was R2 000 . M. R30 000 of the fixed deposit will mature on 01 July 2022. N. Provision must be made for the interest on the loan at the end of the financial year. Interest on loan is not capitalised. NFORMATION: Extract from the pre-adjustment trial balance on 30 June 2022 ACCE 122: Formal Assessment 3 / Financial Statements / Question paper / 2022 ADDITIONAL INFORMATION: A An unhappy customer who had purchased goods for cash to the value of R58 950, returned the goods back to business. The cost price of the goods was R40 000. The customer received a full refund. B Insolvent estate agent of a debtor, M Malgas, who owed R 8000 , confirmed that their client will only be able to settle 60 dents for every rand he owed the business. The balance must be written off as bad debts. No entry of the transaction has been made. C Provision for bad debts must be calculated at 6% of outstanding trade debtors D The physical stock-taking on 30 June 2022 revealed the following stock on hand: E One employee, B. Barang, has been left out of the Salaries Journal in error. She has not yet been paid for 30 June 2022 . The details of her salary is as follows: - Gross salary - Net salary - PAYE - UIF R R500 - Pension fund R100 The business does not make any contributions towards the employees salaries. ACCE 122: Formal Assessment 3/ Financial Statements / Question paper / 20223/4 F Rent increased by 10% per month on 1 March 2022 . Note that the rent has been received until 30 August 2022. G Included in the amount for insurance is an annual premium of R48 000 , that was paid for the insurance year commencing on the 1 March 2022 until 28 February 2023. H Advertising has been paid for 10 months I Commission income for June 2022 has not yet been received. J. Two vehicles were acquired on 1 January 2022 at R180 000 each and this transaction was correctly recorded. Equipment with the cost price of R50 000 and installation costs of R5 000 was purchased on 1 April 2022 on account (this transaction was not recorded). Depreciation will be calculated as follows: Vehicles are depreciated at 10% on cost, while Equipment is depreciated at 20% on a diminishing balance method. ALL ANSWERS MUST BE ROUNDED OFF TO THE NEAREST RAND K. The bank statement received for June 2022 shows bank charges of R245 L. The account was received from the municipality, and the total municipal bill for rates and taxes for the year was R2 000 . M. R30 000 of the fixed deposit will mature on 01 July 2022. N. Provision must be made for the interest on the loan at the end of the financial year. Interest on loan is not capitalised

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started