Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11.3,11.4 and problem 11.9a g. Equity arising from investments by owners. h. The element of stockholders' equity that is increased by net income. i. Total

11.3,11.4 and problem 11.9a

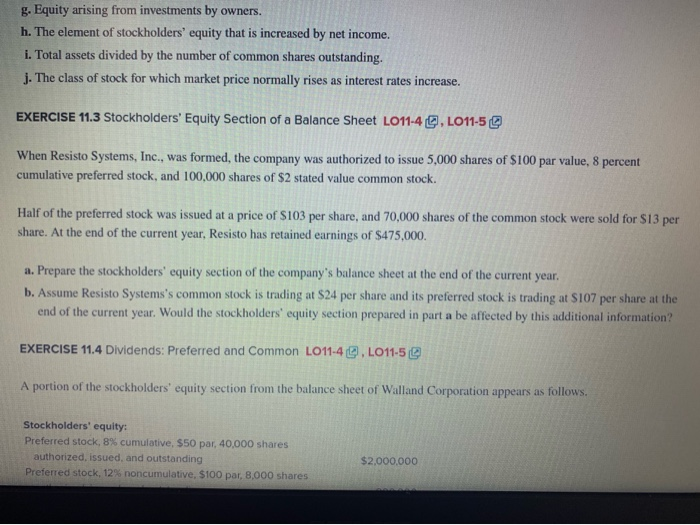

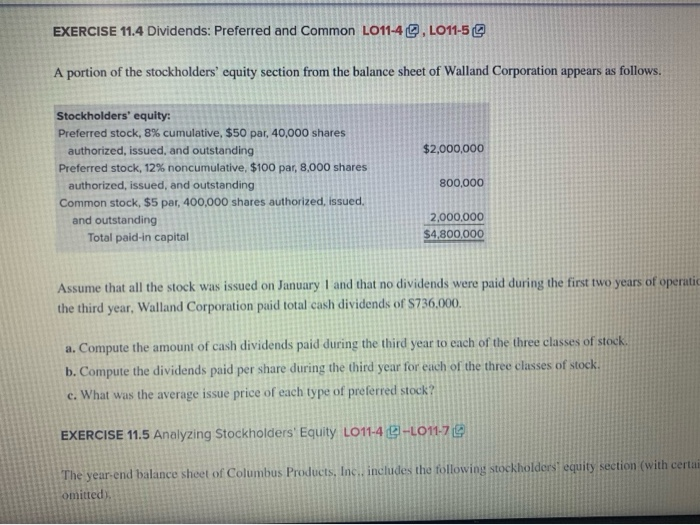

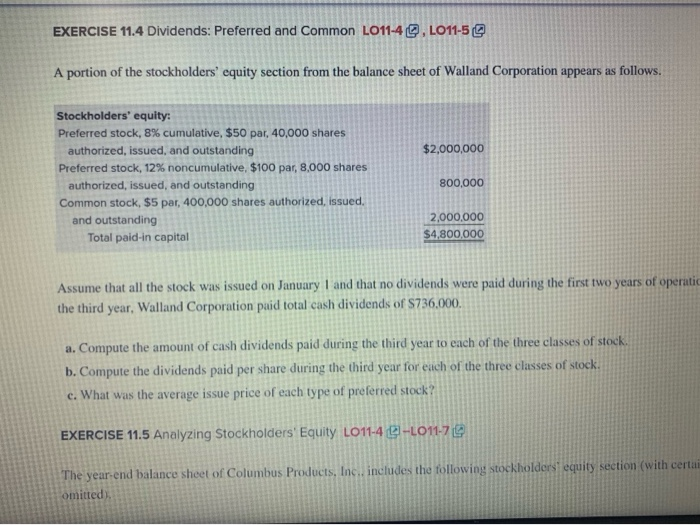

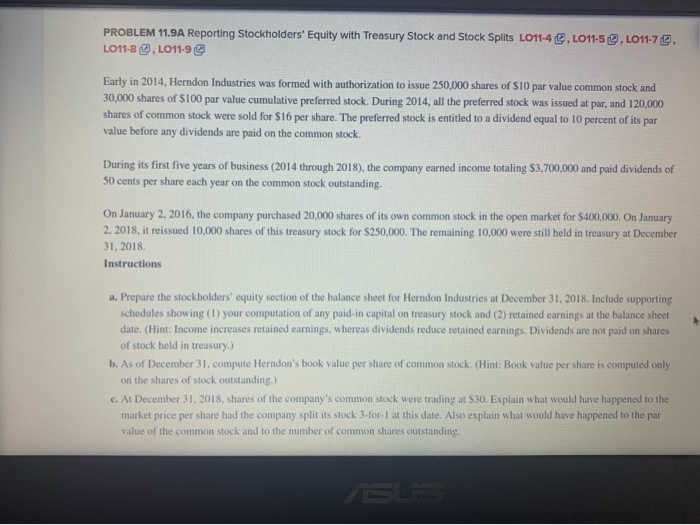

g. Equity arising from investments by owners. h. The element of stockholders' equity that is increased by net income. i. Total assets divided by the number of common shares outstanding. j. The class of stock for which market price normally rises as interest rates increase. EXERCISE 11.3 Stockholders' Equity Section of a Balance Sheet LO11-4 , LO11-5 When Resisto Systems, Inc., was formed, the company was authorized to issue 5,000 shares of $100 par value, 8 percent cumulative preferred stock, and 100,000 shares of $2 stated value common stock. Half of the preferred stock was issued at a price of S103 per share, and 70,000 shares of the common stock were sold for S13 per share. At the end of the current year, Resisto has retained earnings of $475,000 a. Prepare the stockholders' equity section of the company's balance sheet at the end of the current year. b. Assume Resisto Systems's common stock is trading at $24 per share and its preferred stock is trading at S107 per share at the end of the current year. Would the stockholders' equity section prepared in part a be affected by this additional information? EXERCISE 11.4 Dividends: Preferred and Common LO11-4. LO11-5 A portion of the stockholders' equity section from the balance sheet of Walland Corporation appears as follows. Stockholders' equity: Preferred stock, 8% cumulative, $50 par 40,000 shares authorized, issued, and outstanding Preferred stock, 12% noncumulative, $100 par, 8,000 shares $2,000,000 EXERCISE 11.4 Dividends: Preferred and Common LO11-4Q, LO11-5 A portion of the stockholders' equity section from the balance sheet of Walland Corporation appears as follows. $2,000,000 Stockholders' equity: Preferred stock, 8% cumulative, $50 par, 40,000 shares authorized, issued, and outstanding Preferred stock, 12% noncumulative, $100 par, 8,000 shares authorized, issued, and outstanding Common stock, $5 par, 400,000 shares authorized, issued and outstanding Total paid-in capital 800,000 2,000,000 $4,800,000 Assume that all the stock was issued on January 1 and that no dividends were paid during the first two years of operatic the third year, Walland Corporation paid total cash dividends of S736,000. a. Compute the amount of cash dividends paid during the third year to each of the three classes of stock. b. Compute the dividends paid per share during the third year for each of the three classes of stock. c. What was the average issue price of each type of preferred stock? EXERCISE 11.5 Analyzing Stockholders' Equity LO11-4 1-L011-7 The year-end balance sheet of Columbus Products, Inc., includes the following stockholders equity section (with certai omitted EXERCISE 11.4 Dividends: Preferred and Common LO11-4Q, LO11-59 A portion of the stockholders' equity section from the balance sheet of Walland Corporation appears as follows. $2,000,000 Stockholders' equity: Preferred stock, 8% cumulative, $50 par, 40,000 shares authorized, issued, and outstanding Preferred stock, 12% noncumulative, $100 par, 8,000 shares authorized, issued, and outstanding Common stock, $5 par, 400,000 shares authorized, issued, and outstanding Total paid-in capital 800,000 2,000,000 $4,800,000 Assume that all the stock was issued on January 1 and that no dividends were paid during the first two years of operatic the third year, Walland Corporation paid total cash dividends of S736,000. a. Compute the amount of cash dividends paid during the third year to each of the three classes of stock. b. Compute the dividends paid per share during the third year for each of the three classes of stock. e. What was the average issue price of each type of preferred stock? EXERCISE 11.5 Analyzing Stockholders' Equity L011-491-L011-79 The year-end balance sheet of Columbus Products, Inc., includes the following stockholders equity section (with certai omitted PROBLEM 11.9A Reporting Stockholders' Equity with Treasury Stock and Stock Splits L011-4. LO11-5.LO11-7@. LO11-8, L011-9 Early in 2014, Herndon Industries was formed with authorization to issue 250,000 shares of $10 par value common stock and 30,000 shares of $100 par value cumulative preferred stock. During 2014, all the preferred stock was issued at par, and 120,000 shares of common stock were sold for $16 per share. The preferred stock is entitled to a dividend equal to 10 percent of its par value before any dividends are paid on the common stock During its first five years of business (2014 through 2018), the company earned income totaling 53,700,000 and paid dividends of 50 cents per share each year on the common stock outstanding. On January 2, 2016, the company purchased 20,000 shares of its own common stock in the open market for S400,000. On January 2. 2018, it reissued 10,000 shares of this treasury stock for $250,000. The remaining 10,000 were still held in treasury at December 31, 2018 Instructions a. Prepare the stockholders' equity section of the balance sheet for Herndon Industries at December 31, 2018. Include supporting schedules showing (1) your computation of any paid.in capital on treasury stock and (2) retained earnings at the balance sheet date. (Hint: Income increases retained earnings, whereas dividends reduce retained earnings. Dividends are not paid on shares of stock held in treasury) b. As of December 31, compute Herndon's book value per share of common stock. (Hint: Book value per share is computed only on the shares of stock outstanding.) c. At December 31, 2018, shares of the company's common stock were trading at $30. Explain what would have happened to the market price per share had the company split its stock 3-for-1 at this date. Also explain what would have happened to the par value of the common stock and to the number of common shares outstanding Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started