Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1:15: Instructions 1. What are the Advantages and Disadvantages of Partnerships? explain 2. What is the difference between a limited partnership and a limited liability

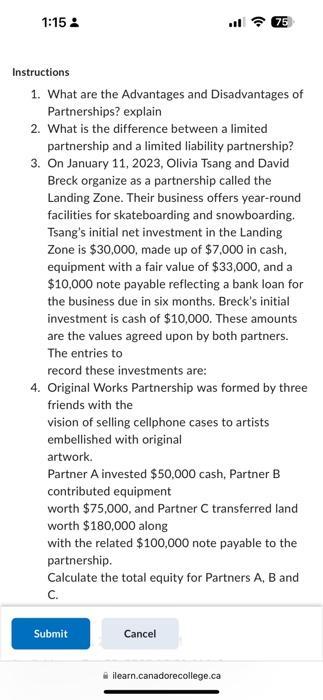

1:15: Instructions 1. What are the Advantages and Disadvantages of Partnerships? explain 2. What is the difference between a limited partnership and a limited liability partnership? 3. On January 11, 2023, Olivia Tsang and David Breck organize as a partnership called the Landing Zone. Their business offers year-round facilities for skateboarding and snowboarding. Tsang's initial net investment in the Landing Zone is $30,000, made up of $7,000 in cash, equipment with a fair value of $33,000, and a $10,000 note payable reflecting a bank loan for the business due in six months. Breck's initial investment is cash of $10,000. These amounts are the values agreed upon by both partners. The entries to record these investments are: 4. Original Works Partnership was formed by three friends with the vision of selling cellphone cases to artists embellished with original 75 artwork. Partner A invested $50,000 cash, Partner B contributed equipment worth $75,000, and Partner C transferred land worth $180,000 along with the related $100,000 note payable to the partnership. Calculate the total equity for Partners A, B and C. Submit Cancel ilearn.canadorecollege.ca

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started