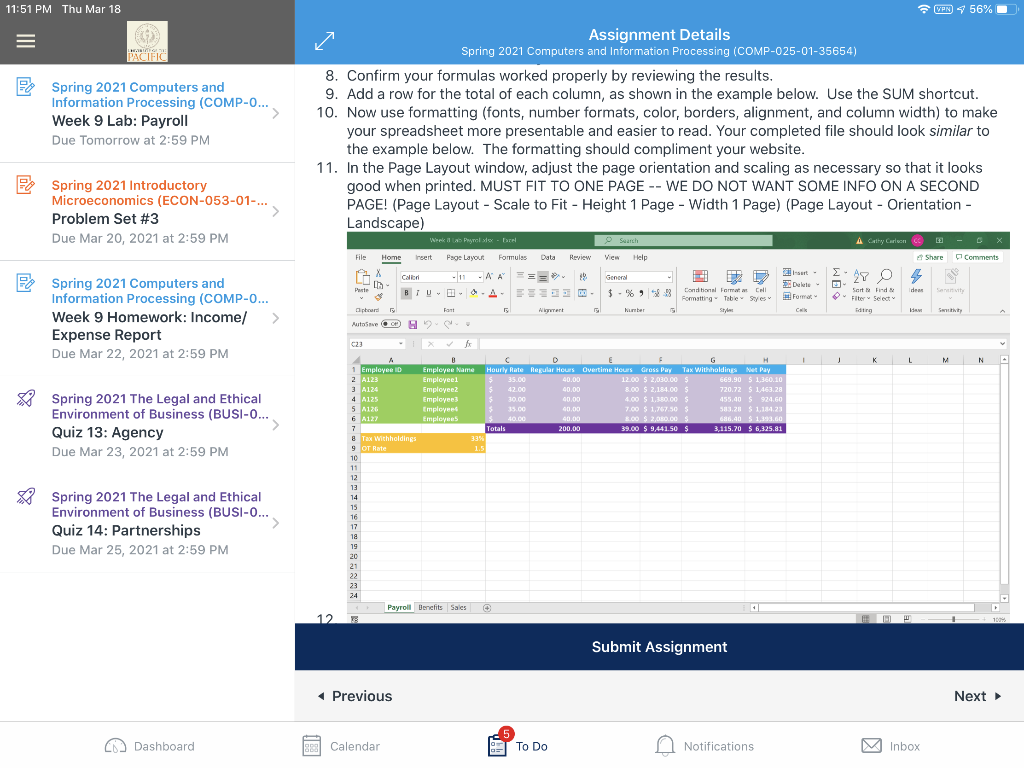

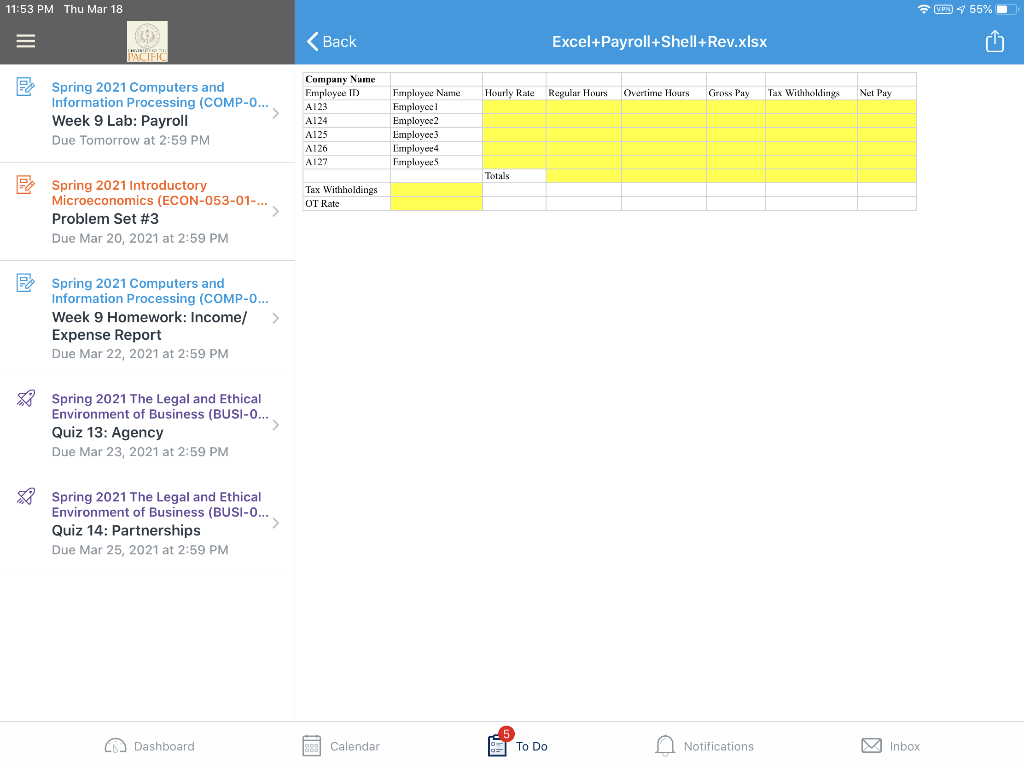

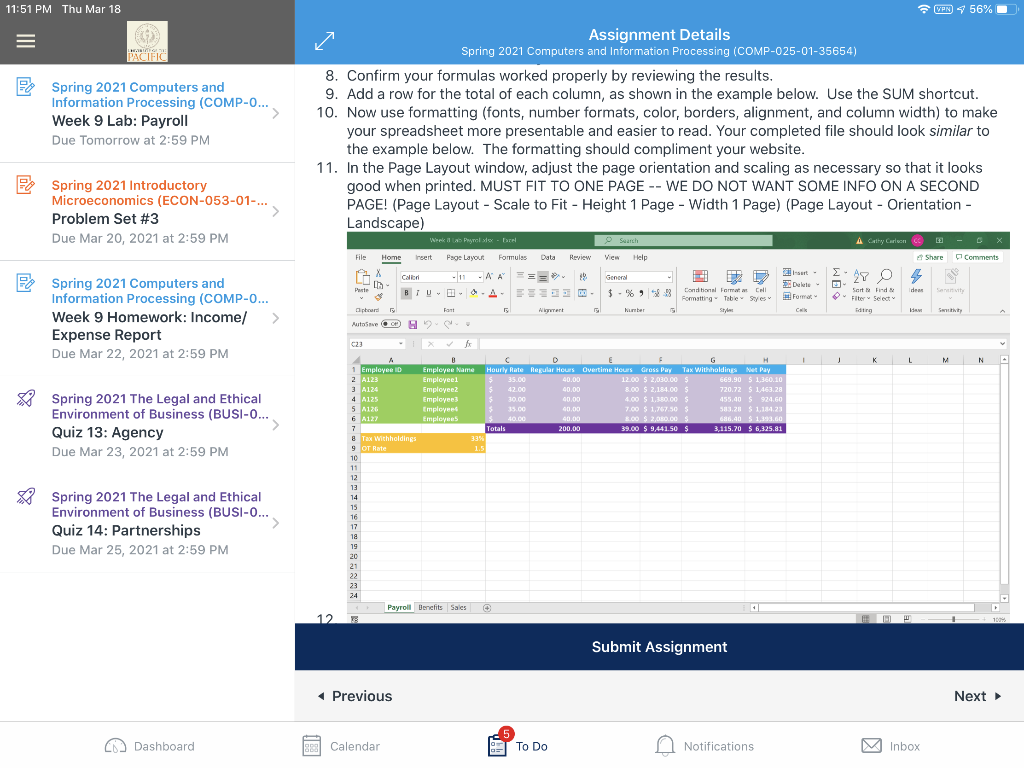

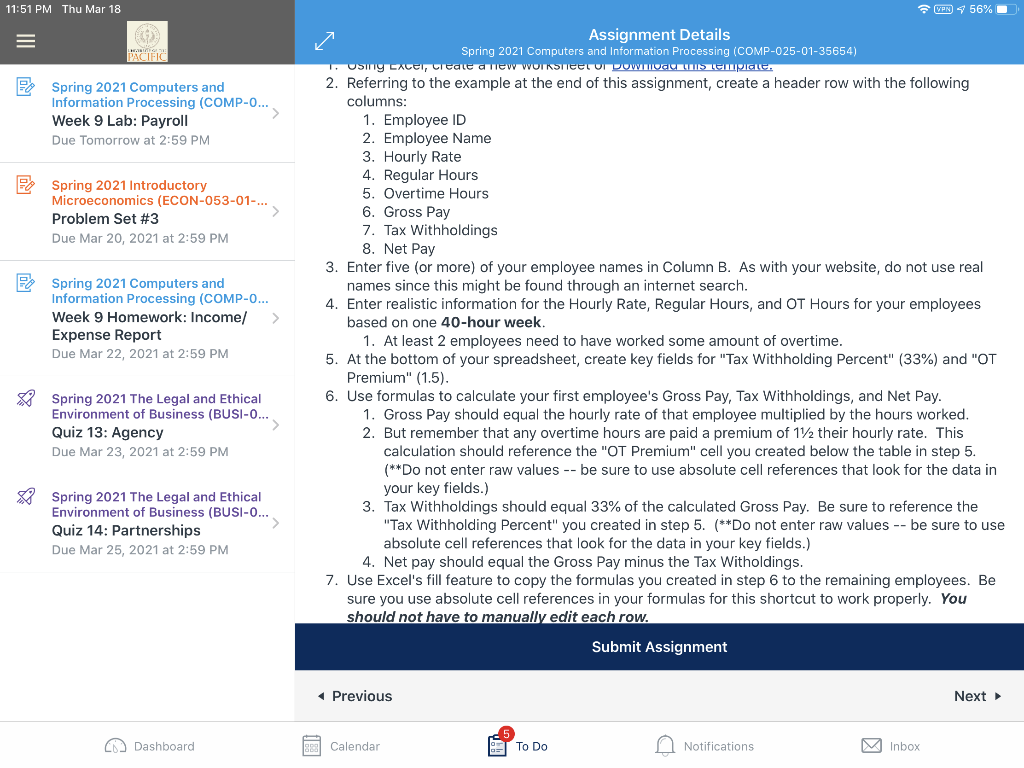

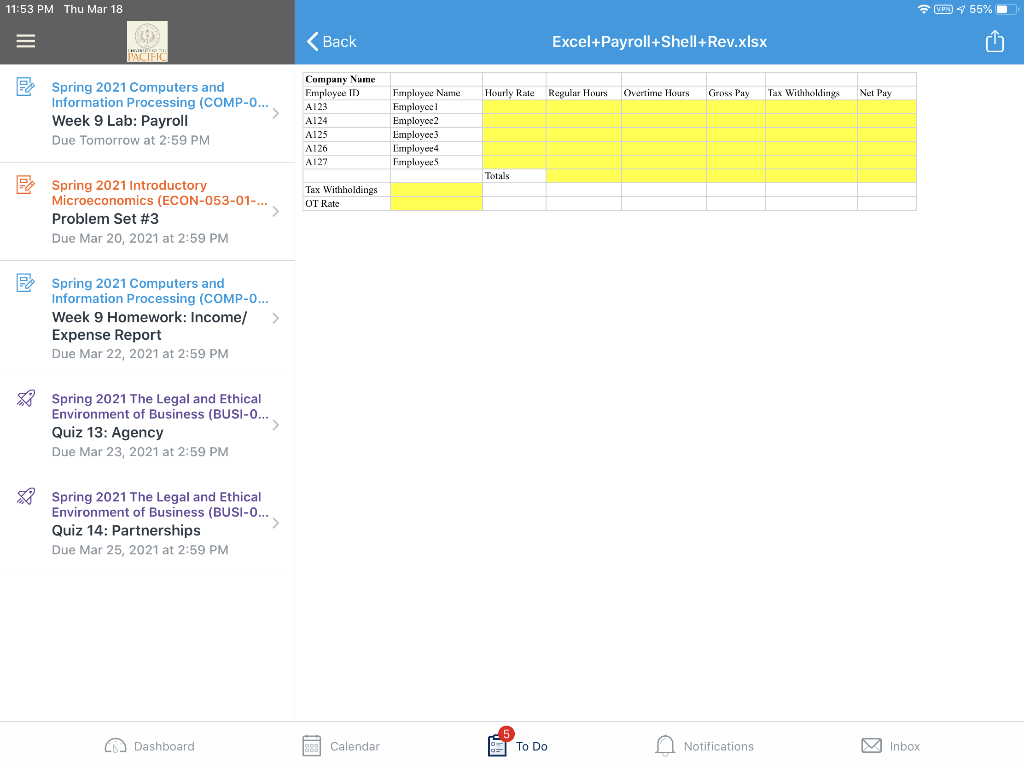

11:51 PM Thu Mar 18 = PACIFIC Spring 2021 Computers and Information Processing (COMP-O... Week 9 Lab: Payroll Due Tomorrow at 2:59 PM VPN 56% Assignment Details Spring 2021 Computers and Information Processing (COMP-025-01-35654) 8. Confirm your formulas worked properly by reviewing the results. 9. Add a row for the total of each column, as shown in the example below. Use the SUM shortcut. 10. Now use formatting (fonts, number formats, color, borders, alignment, and column width) to make your spreadsheet more presentable and easier to read. Your completed file should look similar to the example below. The formatting should compliment your website. 11. In the Page Layout window, adjust the page orientation and scaling as necessary so that it looks good when printed. MUST FIT TO ONE PAGE -- WE DO NOT WANT SOME INFO ON A SECOND PAGE! (Page Layout - Scale to Fit - Height 1 Page - Width 1 Page) (Page Layout - Orientation - Landscape) A Cathy Cartoon Share Comments -11-AA 27 O 4 Sort Senty Spring 2021 Introductory Microeconomics (ECON-053-01-... Problem Set #3 Due Mar 20, 2021 at 2:59 PM Week Pyrol - Dorel Search File Home Insert Page Layout Formulas Data Review View Help Calori == 19 Gone . LU $ .%. der 2 Conditional Format CHI Formatting Table Sys ST Delle Form Fant 15 Agent Kuhi CH ding I S Spring 2021 Computers and Information Processing (COMP-O... Week 9 Homework: Income/ > > Expense Report Due Mar 22, 2021 at 2:59 PM pboard AutoseOP) 1 L N Employee ID Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 13: Agency Due Mar 23, 2021 at 2:59 PM 023 f U G H Employee Name Hourly Rate Regular Hours Overtime Hours Gross Pay Tax Withholdings Net Pay 2 A123 Employees $ 35.00 40.00 12.00 $ 2,030.00 $ 669.90 $ 1.160.10 3 A124 Employee2 $ 42.00 40.00 8.00 $ 2.184.00 $ 720.72 S 1463.28 4 A125 Employees $ 30.00 40.00 4.00 $ 1.350.00 $ 455.40 $ 924.60 5 126 Employees 5 35.00 40.00 7.00 $ 1.767.50 $ 383.28 $ 1,181,23 6 A127 Employees $ 40.00 40.00 3.00 $ 2,000.COS 686.40 $ 1,393,60 7 Totals 200.00 39.00 $ 9.441.50 $ 3,115.70 $ 6.325.01 & Tax Withholdings 33 9 OT Rate 1.5 10 11 12 13 14 15 10 16 17 18 19 20 21 22 23 24 Payroll Benefits Sales Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 14: Partnerships Due Mar 25, 2021 at 2:59 PM 12 11 1001 Submit Assignment Expense Report Due Mar 22, 2021 at 2:59 PM VPN 56% Assignment Details Spring 2021 Computers and Information Processing (COMP-025-01-35654) USM Cacer, cieate a new worksheet or DOWLOGU LIIS Temple. 2. Referring to the example at the end of this assignment, create a header row with the following columns: 1. Employee ID 2. Employee Name 3. Hourly Rate 4. Regular Hours 5. Overtime Hours 6. Gross Pay 7. Tax Withholdings 8. Net Pay 3. Enter five (or more) of your employee names in Column B. As with your website, do not use real names since this might be found through an internet search. 4. Enter realistic information for the Hourly Rate, Regular Hours, and OT Hours for your employees based on one 40-hour week. 1. At least 2 employees need to have worked some amount of overtime. 5. At the bottom of your spreadsheet, create key fields for "Tax Withholding Percent" (33%) and "OT Premium" (1.5). 6. Use formulas to calculate your first employee's Gross Pay, Tax Withholdings, and Net Pay. 1. Gross Pay should equal the hourly rate of that employee multiplied by the hours worked. 2. But remember that any overtime hours are paid a premium of 1/2 their hourly rate. This calculation should reference the "OT Premium" cell you created below the table in step 5. (**Do not enter raw values -- be sure to use absolute cell references that look for the data in your key fields.) 3. Tax Withholdings should equal 33% of the calculated Gross Pay. Be sure to reference the "Tax Withholding Percent" you created in step 5. (**Do not enter raw values -- be sure to use absolute cell references that look for the data in your key fields.) 4. Net pay should equal the Gross Pay minus the Tax Witholdings. 7. Use Excel's fill feature to copy the formulas you created in step 6 to the remaining employees. Be sure you use absolute cell references in your formulas for this shortcut to work properly. You should not have to manually edit each row. Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 13: Agency Due Mar 23, 2021 at 2:59 PM Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 14: Partnerships Due Mar 25, 2021 at 2:59 PM Submit Assignment Expense Report Due Mar 22, 2021 at 2:59 PM Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 13: Agency Due Mar 23, 2021 at 2:59 PM Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 14: Partnerships Due Mar 25, 2021 at 2:59 PM EN Dashboard Calendar OTT To Do Notifications MInbox 11:51 PM Thu Mar 18 = PACIFIC Spring 2021 Computers and Information Processing (COMP-O... Week 9 Lab: Payroll Due Tomorrow at 2:59 PM VPN 56% Assignment Details Spring 2021 Computers and Information Processing (COMP-025-01-35654) 8. Confirm your formulas worked properly by reviewing the results. 9. Add a row for the total of each column, as shown in the example below. Use the SUM shortcut. 10. Now use formatting (fonts, number formats, color, borders, alignment, and column width) to make your spreadsheet more presentable and easier to read. Your completed file should look similar to the example below. The formatting should compliment your website. 11. In the Page Layout window, adjust the page orientation and scaling as necessary so that it looks good when printed. MUST FIT TO ONE PAGE -- WE DO NOT WANT SOME INFO ON A SECOND PAGE! (Page Layout - Scale to Fit - Height 1 Page - Width 1 Page) (Page Layout - Orientation - Landscape) A Cathy Cartoon Share Comments -11-AA 27 O 4 Sort Senty Spring 2021 Introductory Microeconomics (ECON-053-01-... Problem Set #3 Due Mar 20, 2021 at 2:59 PM Week Pyrol - Dorel Search File Home Insert Page Layout Formulas Data Review View Help Calori == 19 Gone . LU $ .%. der 2 Conditional Format CHI Formatting Table Sys ST Delle Form Fant 15 Agent Kuhi CH ding I S Spring 2021 Computers and Information Processing (COMP-O... Week 9 Homework: Income/ > > Expense Report Due Mar 22, 2021 at 2:59 PM pboard AutoseOP) 1 L N Employee ID Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 13: Agency Due Mar 23, 2021 at 2:59 PM 023 f U G H Employee Name Hourly Rate Regular Hours Overtime Hours Gross Pay Tax Withholdings Net Pay 2 A123 Employees $ 35.00 40.00 12.00 $ 2,030.00 $ 669.90 $ 1.160.10 3 A124 Employee2 $ 42.00 40.00 8.00 $ 2.184.00 $ 720.72 S 1463.28 4 A125 Employees $ 30.00 40.00 4.00 $ 1.350.00 $ 455.40 $ 924.60 5 126 Employees 5 35.00 40.00 7.00 $ 1.767.50 $ 383.28 $ 1,181,23 6 A127 Employees $ 40.00 40.00 3.00 $ 2,000.COS 686.40 $ 1,393,60 7 Totals 200.00 39.00 $ 9.441.50 $ 3,115.70 $ 6.325.01 & Tax Withholdings 33 9 OT Rate 1.5 10 11 12 13 14 15 10 16 17 18 19 20 21 22 23 24 Payroll Benefits Sales Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 14: Partnerships Due Mar 25, 2021 at 2:59 PM 12 11 1001 Submit Assignment Expense Report Due Mar 22, 2021 at 2:59 PM VPN 56% Assignment Details Spring 2021 Computers and Information Processing (COMP-025-01-35654) USM Cacer, cieate a new worksheet or DOWLOGU LIIS Temple. 2. Referring to the example at the end of this assignment, create a header row with the following columns: 1. Employee ID 2. Employee Name 3. Hourly Rate 4. Regular Hours 5. Overtime Hours 6. Gross Pay 7. Tax Withholdings 8. Net Pay 3. Enter five (or more) of your employee names in Column B. As with your website, do not use real names since this might be found through an internet search. 4. Enter realistic information for the Hourly Rate, Regular Hours, and OT Hours for your employees based on one 40-hour week. 1. At least 2 employees need to have worked some amount of overtime. 5. At the bottom of your spreadsheet, create key fields for "Tax Withholding Percent" (33%) and "OT Premium" (1.5). 6. Use formulas to calculate your first employee's Gross Pay, Tax Withholdings, and Net Pay. 1. Gross Pay should equal the hourly rate of that employee multiplied by the hours worked. 2. But remember that any overtime hours are paid a premium of 1/2 their hourly rate. This calculation should reference the "OT Premium" cell you created below the table in step 5. (**Do not enter raw values -- be sure to use absolute cell references that look for the data in your key fields.) 3. Tax Withholdings should equal 33% of the calculated Gross Pay. Be sure to reference the "Tax Withholding Percent" you created in step 5. (**Do not enter raw values -- be sure to use absolute cell references that look for the data in your key fields.) 4. Net pay should equal the Gross Pay minus the Tax Witholdings. 7. Use Excel's fill feature to copy the formulas you created in step 6 to the remaining employees. Be sure you use absolute cell references in your formulas for this shortcut to work properly. You should not have to manually edit each row. Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 13: Agency Due Mar 23, 2021 at 2:59 PM Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 14: Partnerships Due Mar 25, 2021 at 2:59 PM Submit Assignment Expense Report Due Mar 22, 2021 at 2:59 PM Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 13: Agency Due Mar 23, 2021 at 2:59 PM Spring 2021 The Legal and Ethical Environment of Business (BUSI-O... Quiz 14: Partnerships Due Mar 25, 2021 at 2:59 PM EN Dashboard Calendar OTT To Do Notifications MInbox