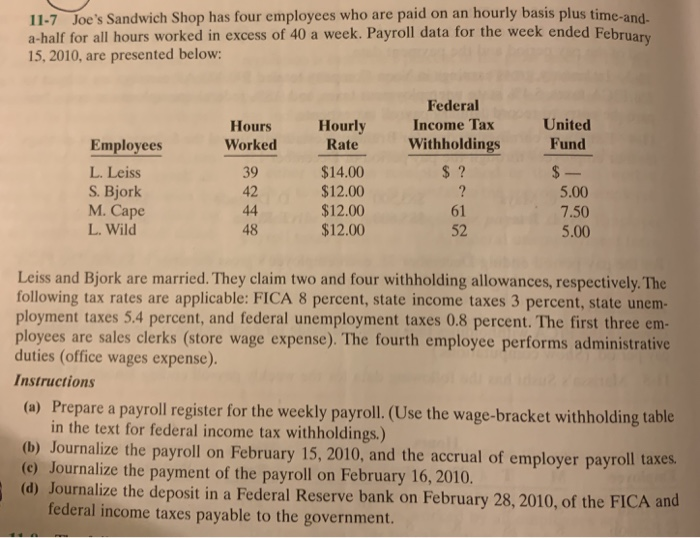

11-7 Joe's Sandwich Shop has four employees who are paid on an hourly basis plus time-and. a-half for all hours worked in excess of 40 a week. Payroll data for the week ended February 15, 2010, are presented below: Federal Hours Hourly Income Tax United Fund Worked 39 42 Withholdings S ? Rate Employees $14.00 $12.00 $12.00 $12.00 L. Leiss S. Bjork M. Cape L. Wild 5.00 7.50 5.00 61 52 48 Leiss and Bjork are married. They claim two and four withholding allowances, respectively. The following tax rates are applicable: FICA 8 percent, state income taxes 3 percent, state unem- ployment taxes 5.4 percent, and federal unemployment taxes 0.8 percent. The first three em- ployees are sales clerks (store wage expense). The fourth employee performs administrative duties (office wages expense). Instructions (a) Prepare a payroll register for the weekly payroll. (Use the wage-bracket withholding table (b) Journalize the payroll on February 15, 2010, and the accrual of employer payroll taxes. in the text for federal income tax withholdings.) e) Journalize the payment of the payroll on February 16, 2010. ournalize the deposit in a Federal Reserve bank on February 28,2010, of the FICA and federal income taxes payable to the government. 11-7 Joe's Sandwich Shop has four employees who are paid on an hourly basis plus time-and. a-half for all hours worked in excess of 40 a week. Payroll data for the week ended February 15, 2010, are presented below: Federal Hours Hourly Income Tax United Fund Worked 39 42 Withholdings S ? Rate Employees $14.00 $12.00 $12.00 $12.00 L. Leiss S. Bjork M. Cape L. Wild 5.00 7.50 5.00 61 52 48 Leiss and Bjork are married. They claim two and four withholding allowances, respectively. The following tax rates are applicable: FICA 8 percent, state income taxes 3 percent, state unem- ployment taxes 5.4 percent, and federal unemployment taxes 0.8 percent. The first three em- ployees are sales clerks (store wage expense). The fourth employee performs administrative duties (office wages expense). Instructions (a) Prepare a payroll register for the weekly payroll. (Use the wage-bracket withholding table (b) Journalize the payroll on February 15, 2010, and the accrual of employer payroll taxes. in the text for federal income tax withholdings.) e) Journalize the payment of the payroll on February 16, 2010. ournalize the deposit in a Federal Reserve bank on February 28,2010, of the FICA and federal income taxes payable to the government