Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1-17 PROBLEM COM dass to ysb lenor no 290led us to Istiq Boobs to 229lbige etiq 93619 berigio gimimas ogiws Cdinem nevie van grub

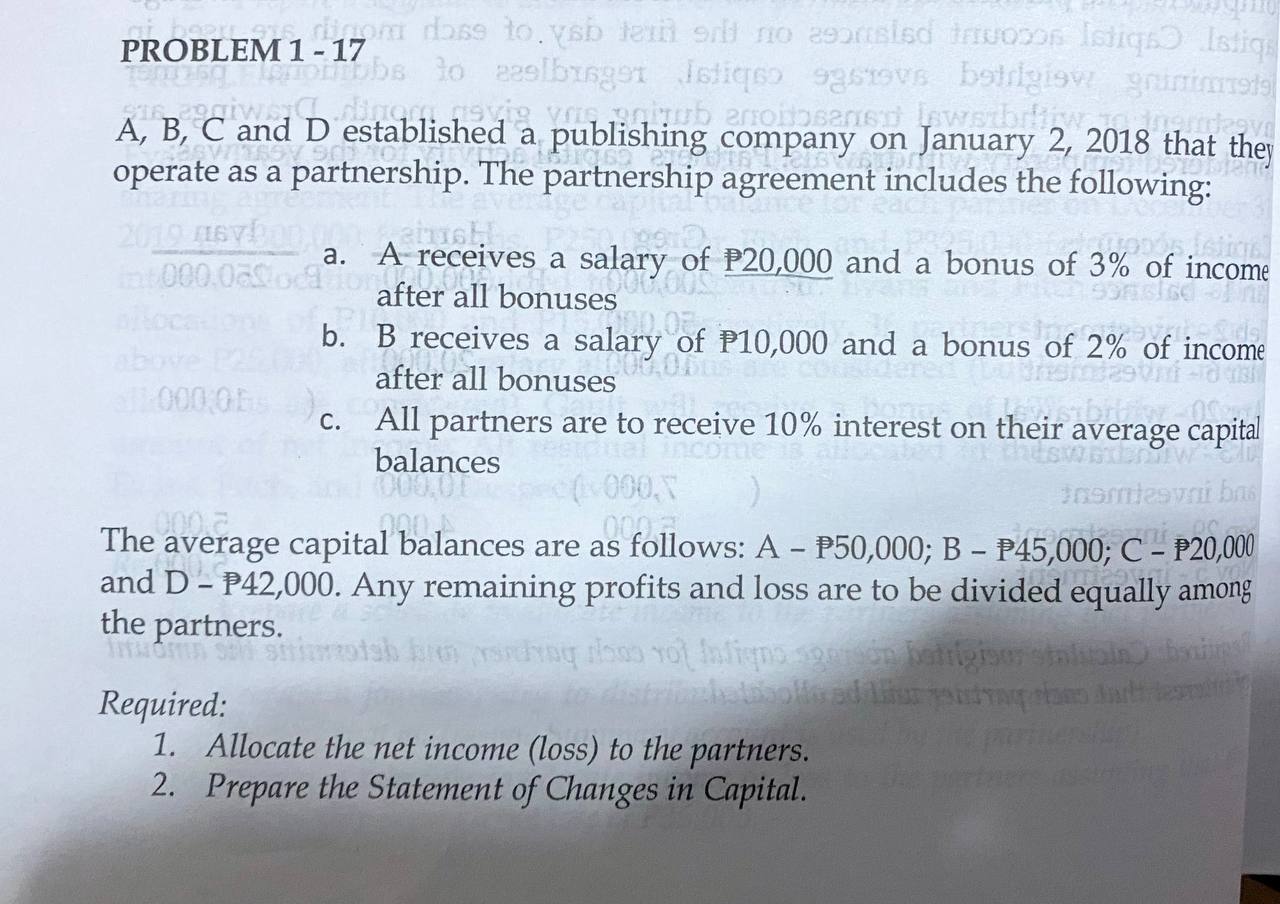

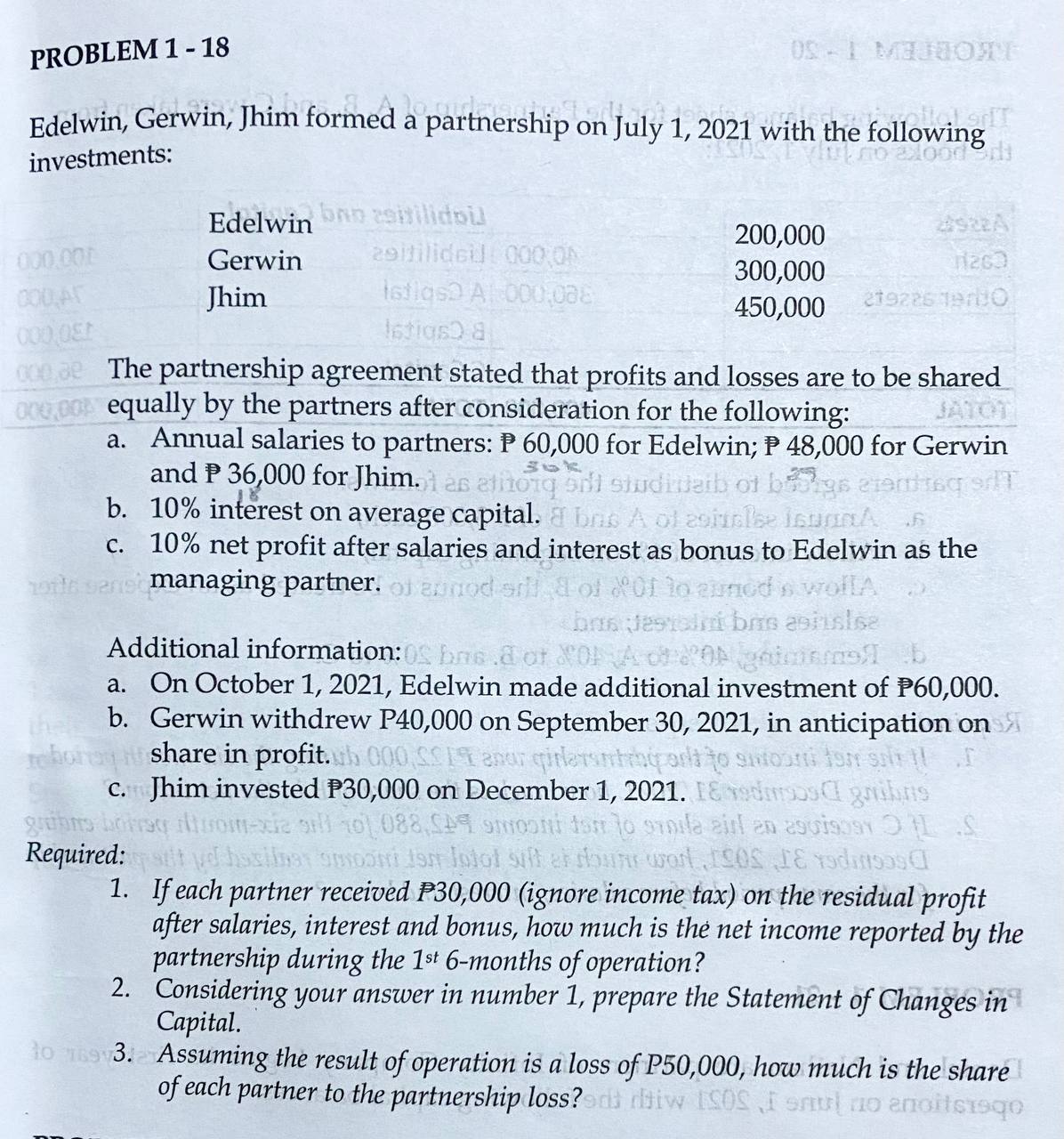

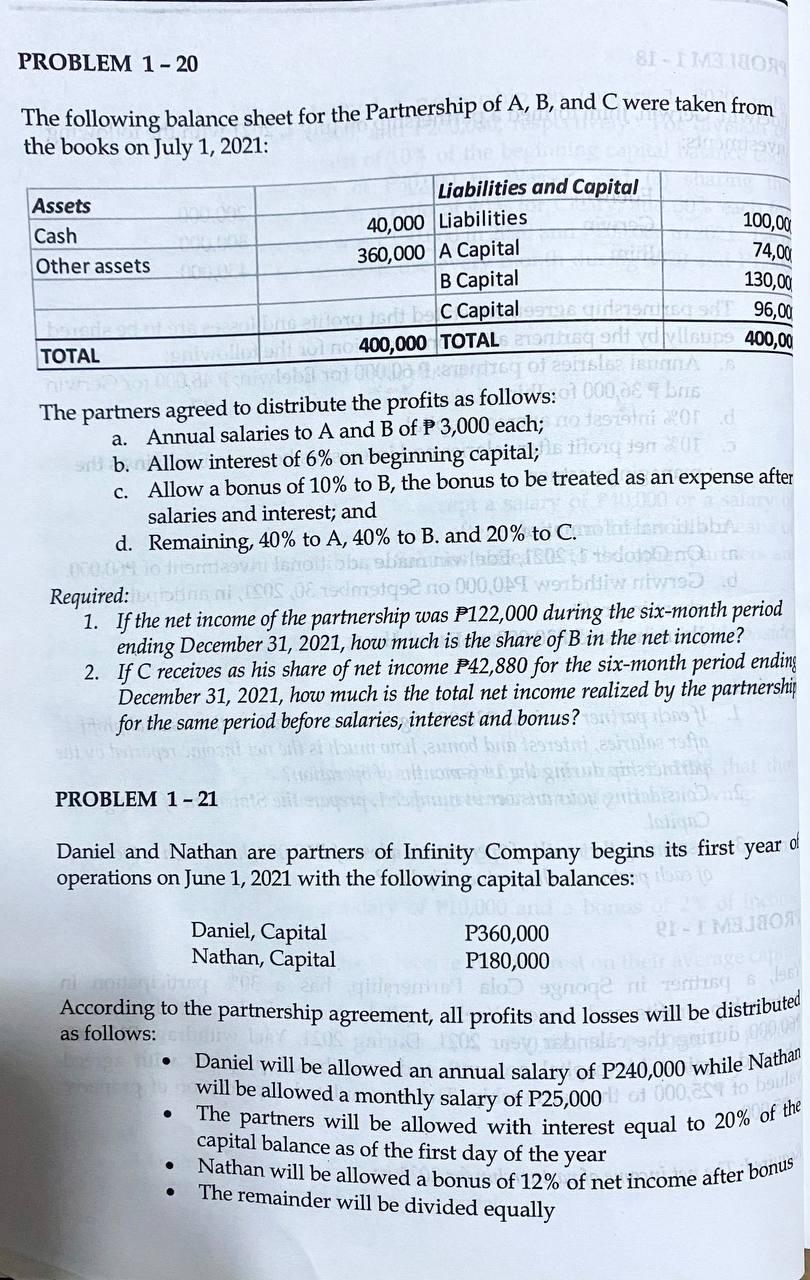

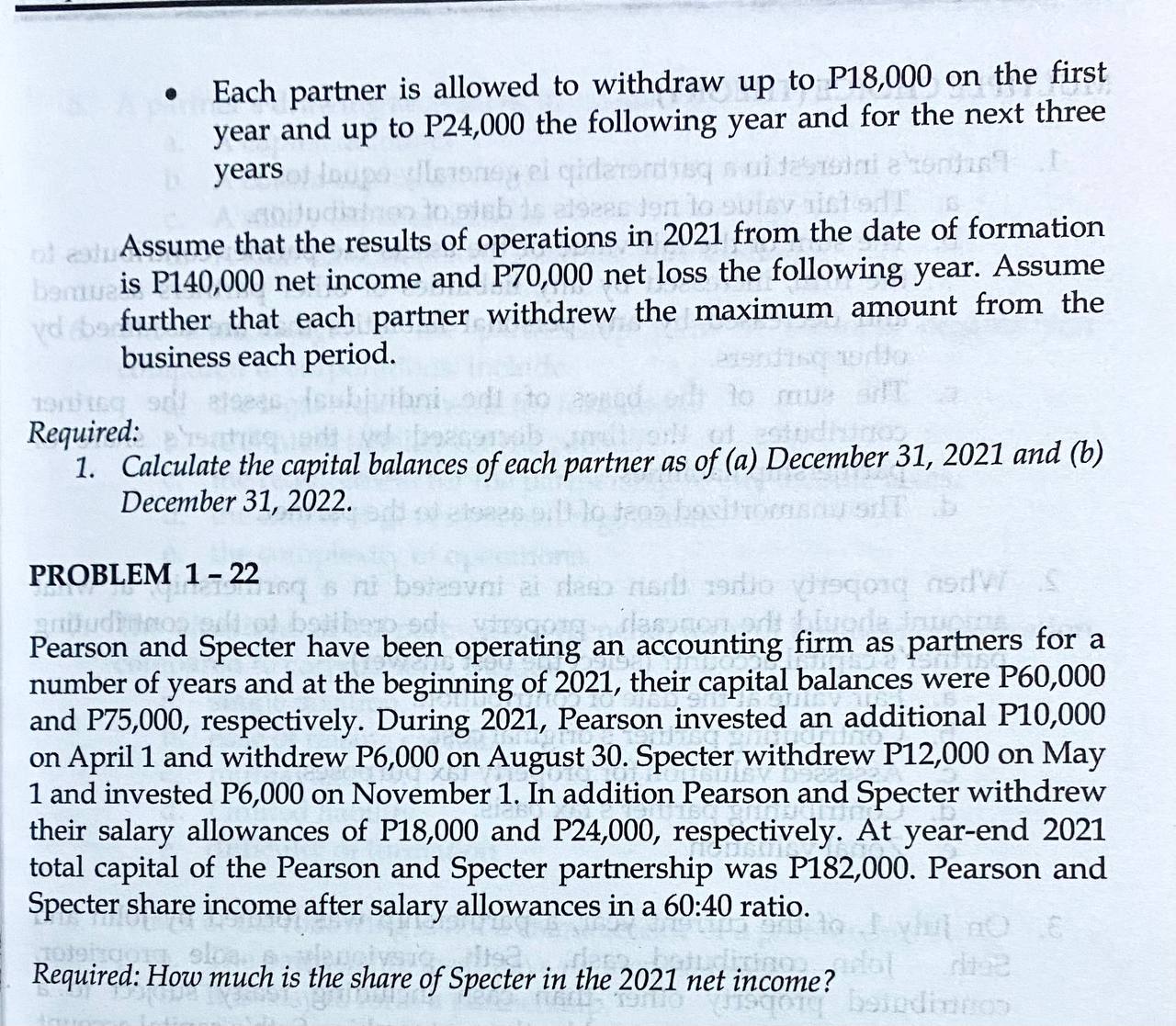

1-17 PROBLEM COM dass to ysb lenor no 290led us to Istiq Boobs to 229lbige etiq 93619 berigio gimimas ogiws Cdinem nevie van grub anonsans Lawstbiffw to naudas A, B, C and D established a publishing company on January 2, 2018 that they operate as a partnership. The partnership agreement includes the following: 2019 6b00.00 int000.03% oc a. A receives a salary of P20,000 and a bonus of 3% of income after all bonuses 100.05 b. B receives a salary of P10,000 and a bonus of 2% of income after all bonuses above all 000,0 C. 0002 10.60s All partners are to receive 10% interest on their average capital ual income theswaxbo balances (000,00 000, 000 jasmtesvni bas The average capital balances are as follows: A - P50,000; B - P45,000; C - P20, and D - P42,000. Any remaining profits and loss are to be divided equally among the partners. Required: Sabot infigno sosan battigious stalain bis distribaletasolle ad litur pada 1. Allocate the net income (loss) to the partners. 2. Prepare the Statement of Changes in Capital. PROBLEM 1-18 Edelwin, Gerwin, Jhim formed a partnership on July 1, 2021 with the following investments: alood 000.000 000 AT 000,081 Edelwin bno reitilidoi Gerwin 29itilidel 000,0 Jhim Istigs A-000,00 Istigs) a 2922A 200,000 300,000 11260 450,000 219226 19:30 000 de The partnership agreement stated that profits and losses are to be shared 000.000 equally by the partners after consideration for the following: JATOT a. Annual salaries to partners: P 60,000 for Edelwin; P 48,000 for Gerwin 36k and P 36,000 for Jhim. as athotq si studiuarb of b b. 10% interest on average capital. & bas A of 29116lb isA 6 c. 10% net profit after salaries and interest as bonus to Edelwin as the ole senst managing partner. of annod srl of oof to aunod swollA brs Jestli bus aisle Again b Additional information: 0% bred of a. On October 1, 2021, Edelwin made additional investment of P60,000. b. Gerwin withdrew P40,000 on September 30, 2021, in anticipation on reborn share in profit. 000SS1 anar qirlarshipart to storio sul !!. c. Jhim invested P30,000 on December 1, 2021. Edm the gribns Required: gribns tom-xia sill 10 088,5 smooni ton lo 9nile air! 20 290909L S vel hasilan smoomi tem lotof suff et shum worl 190 1. If each partner received P30,000 (ignore income tax) on the residual profit after salaries, interest and bonus, how much is the net income reported by the partnership during the 1st 6-months of operation? 2. Considering your answer in number 1, prepare the Statement of Changes in Capital. to 1693. Assuming the result of operation is a loss of P50,000, how much is the share of each partner to the partnership loss? tiw ISOS, sul no anoitsisq PROBLEM 1-20 81-1 M3 R The following balance sheet for the Partnership of A, B, and C were taken from the books on July 1, 2021: Liabilities and Capital Assets 40,000 Liabilities 100,00 Cash 360,000 A Capital 74,00 Other assets B Capital 130,00 TOTAL bito elong to be C Capital 10 no 400,000 TOTAL dansmite s 96,00 od vllsups 400,00 The partners agreed to distribute the profits as follows: 01 000,09 bris a. Annual salaries to A and B of P 3,000 each; o 18519ti 20 d srb. Allow interest of 6% on beginning capital;s to TO after c. Allow a bonus of 10% to B, the bonus to be treated as an expense 10000 or a salary o salaries and interest; and ta salar d. Remaining, 40% to A, 40% to B. and 20% to Cotaisnaiibbea Required:ins ni OS 0819dmstq92 no 000,00 werbriliw niwis d 1. If the net income of the partnership was P122,000 during the six-month period ending December 31, 2021, how much is the share of B in the net income? 2. If C receives as his share of net income P42,880 for the six-month period ending December 31, 2021, how much is the total net income realized by the partnership for the same period before salaries, interest and bonus? Briting that the PROBLEM 1-21 Istign Daniel and Nathan are partners of Infinity Company begins its first year of operations on June 1, 2021 with the following capital balances: Daniel, Capital Nathan, Capital W10,000 and P360,000 of incom 21-MAJ P180,000s on their average cap According to the partnership agreement, all profits and losses will be distributed as follows: Laky 05 while Nathan Daniel will be allowed an annual salary of P240,000 will be allowed a monthly salary of P25,000 1 000, to bouts The partners will be allowed with interest equal to 20% of the capital balance as of the first day of the year Nathan will be allowed a bonus of 12% of net income after bonus The remainder will be divided equally E Each partner is allowed to withdraw up to P18,000 on the first year and up to P24,000 the following year and for the next three years of loupalleroney el qiderordisq to 998b is a19ear Jon to ictedT test Assume that the results of operations in 2021 from the date of formation bemus is P140,000 net income and P70,000 net loss the following year. Assume yd be further that each partner withdrew the maximum amount from the business each period. Required: t ab lo mu ar 1. Calculate the capital balances of each partner as of (a) December 31, 2021 and (b) December 31, 2022. PROBLEM 1-22 ni betavni deso naredio record d sd virgondasunen od juoda Pearson and Specter have been operating an accounting firm as partners for a number of years and at the beginning of 2021, their capital balances were P60,000 and P75,000, respectively. During 2021, Pearson invested an additional P10,000 on April 1 and withdrew P6,000 on August 30. Specter withdrew P12,000 on May 1 and invested P6,000 on November 1. In addition Pearson and Specter withdrew their salary allowances of P18,000 and P24,000, respectively. At year-end 2021 total capital of the Pearson and Specter partnership was P182,000. Pearson and Specter share income after salary allowances in a 60:40 ratio. Required: How much is the share of Specter in the 2021 net income? bendin 254

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started