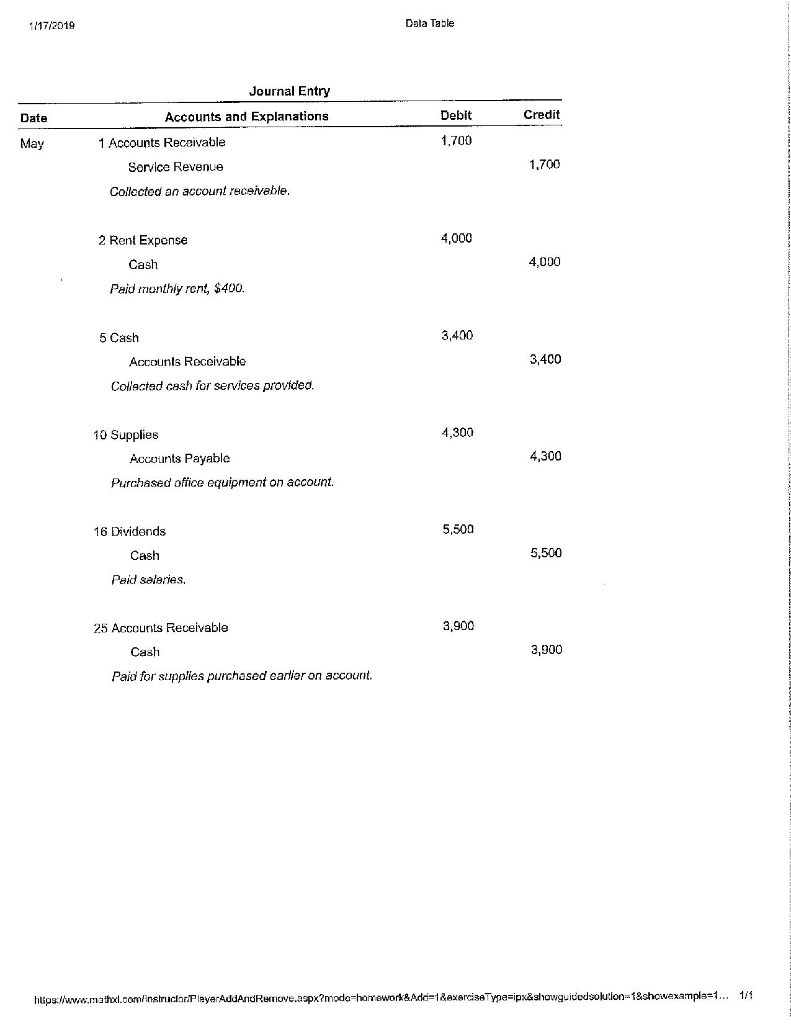

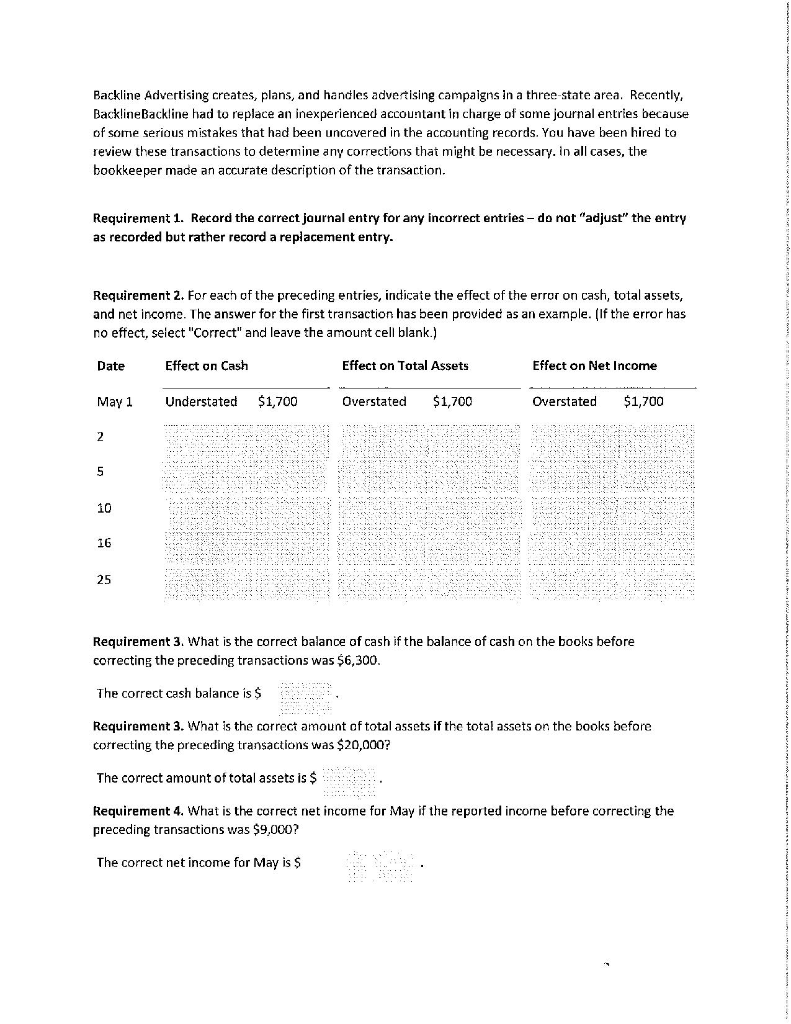

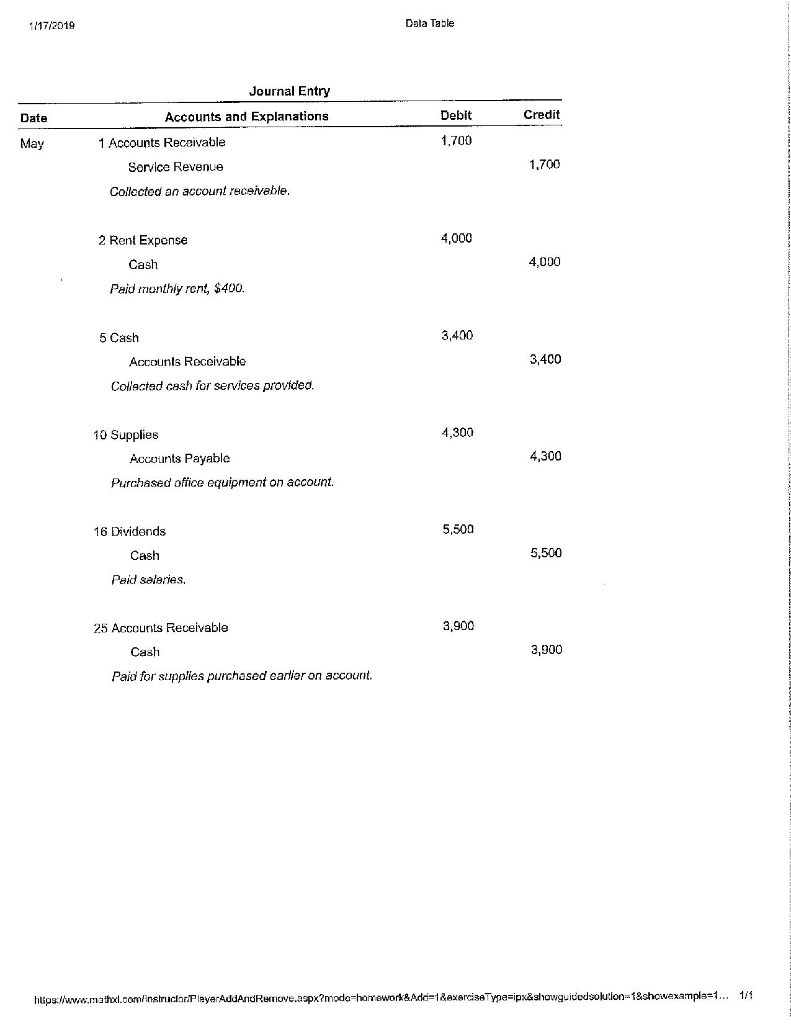

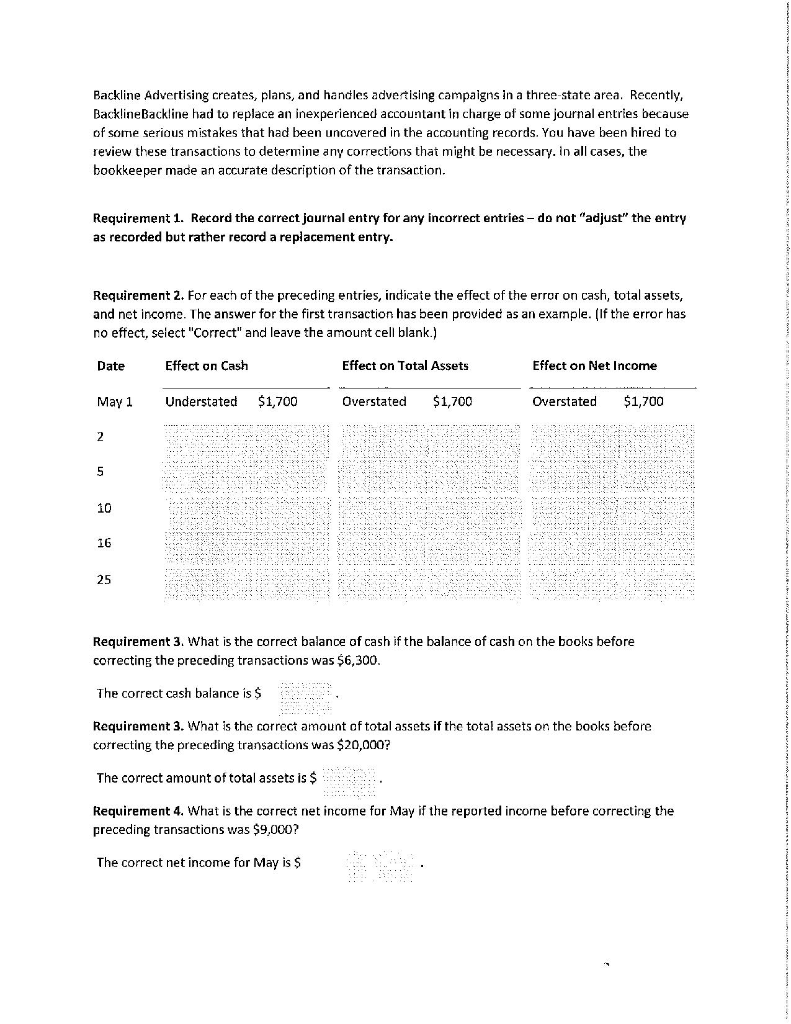

1/17/2019 Data Table Journal Entry Date Debit Credit May Accounts and Explanations 1 Accounts Receivable Service Revenue 1,700 1,700 Collected an account receivable. 2 Rent Exponse 4,000 Cash 4.000 Paid monthly rent, $400. 3,400 5 Cash Accounts Receivable Collected cash for services provided. 3,400 4,300 10 Supplies Accounts Payable Purchased office equipment on account. 4,300 16 Dividends 5,500 Cash 5,500 Paid seleries, 25 Accounts Receivable 3,900 Cash 3,900 Paid for supplies purchased cartier on account. https://www.mathxl.com/instructoriPlayerAddAndRemove.aspx?modo horrework Add18exerciseType=ipx&showguided solution=1&showexample=1... 1/1 Backline Advertising creates, plans, and handles advertising campaigns in a three-state area. Recently, Backline Backline had to replace an inexperienced accountant in charge of some journal entries because of some serious mistakes that had been uncovered in the accounting records. You have been hired to review these transactions to determine any corrections that might be necessary. in all cases, the bookkeeper made an accurate description of the transaction. Requirement 1. Record the correct journal entry for any incorrect entries - do not "adjust the entry as recorded but rather record a replacement entry. Requirement 2. For each of the preceding entries, indicate the effect of the error on cash, total assets, and net income. The answer for the first transaction has been provided as an example. (If the error has no effect, select "Correct" and leave the amount cell blank.) Date Effect on Cash Effect on Total Assets Effect on Net Income May 1 Understated $1,700 Overstated $1,700 Overstated $1,700 2 5 10 16 25 Requirement 3. What is the correct balance of cash if the balance of cash on the books before correcting the preceding transactions was $6,300. The correct cash balance is $ Requirement 3. What is the correct amount of total assets if the total assets on the books before correcting the preceding transactions was $20,000? The correct amount of total assets is $ Requirement 4. What is the correct net income for May if the reported income before correcting the preceding transactions was $9,000? The correct net income for May is $