11/9

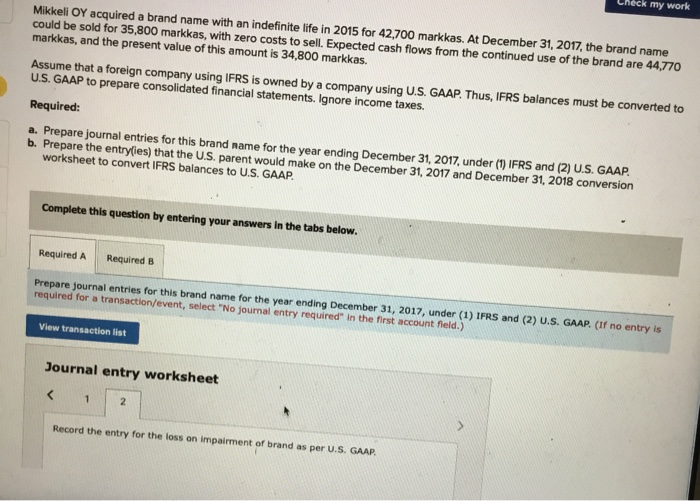

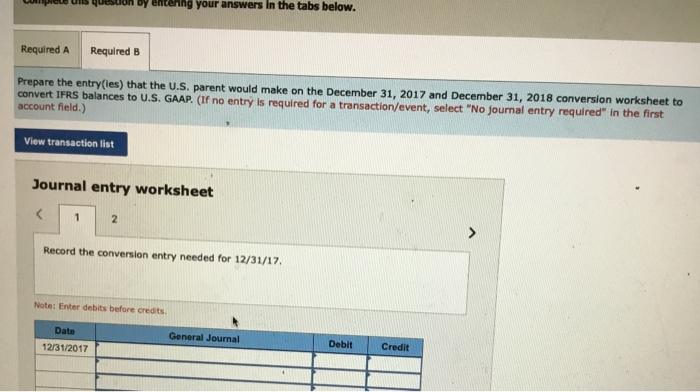

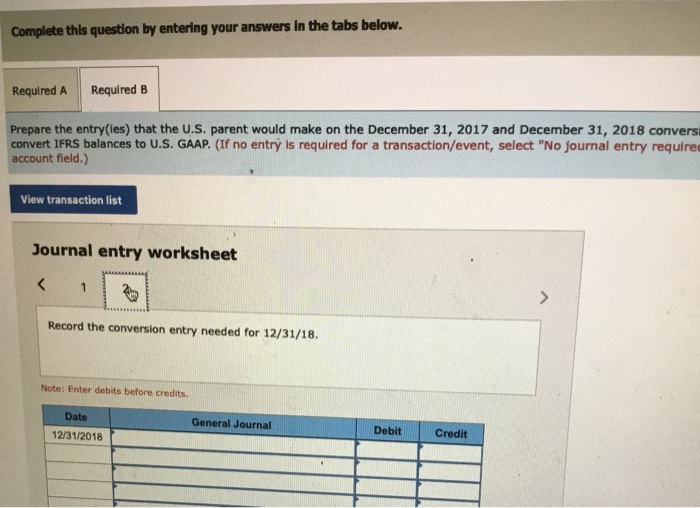

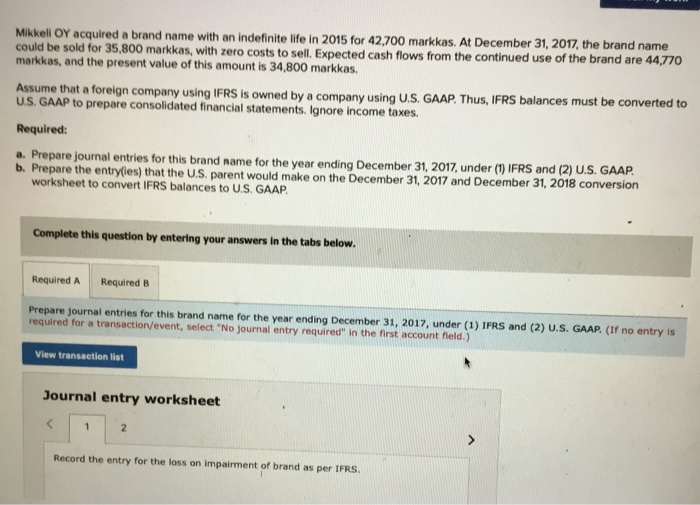

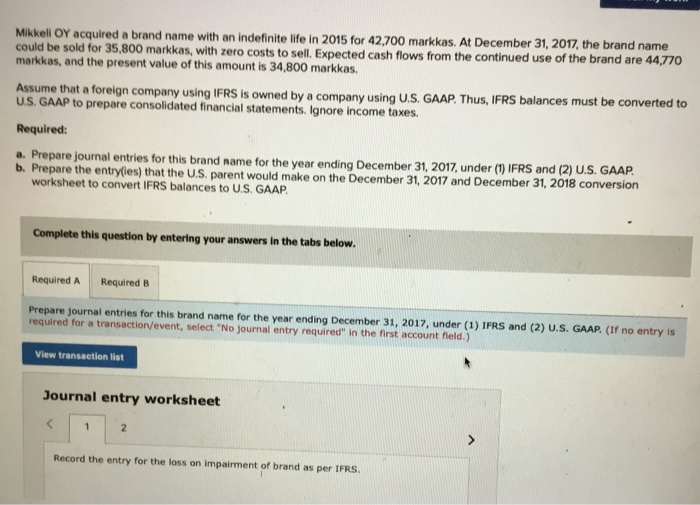

Mikkeli Oy acquired a brand name with an indefinite life in 2015 for 42,700 markkas. At December 31, 2017, the brand name could be sold for 35,800 markkas, with zero costs to sell. Expected cash flows from the continued use of the brand are 44,770 markkas, and the present value of this amount is 34,800 markkas. Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: a. Prepare journal entries for this brand name for the year ending December 31, 2017, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017 and December 31, 2018 conversion worksheet to convert IFRS balances to U.S. GAAP. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries for this brand name for the year ending December 31, 2017, under (1) IFRS and (2) U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 Record the entry for the loss on impairment of brand as per IFRS. ck my work Mikkeli Oy acquired a brand name with an indefinite life in 2015 for 42,700 markkas. At December 31, 2017, the brand name could be sold for 35,800 markkas, with zero costs to sell. Expected cash flows from the continued use of the brand are 44,770 markkas, and the present value of this amount is 34,800 markkas. Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: a. Prepare journal entries for this brand name for the year ending December 31, 2017, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entryies) that the U.S. parent would make on the December 31, 2017 and December 31, 2018 conversion worksheet to convert IFRS balances to U.S. GAAP. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries for this brand name for the year ending December 31, 2017, under (1) IFRS and (2) U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 Record the entry for the loss on impairment of brand as per U.S. GAAP. ces entening your answers in the tabs below. Required A Required B Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017 and December 31, 2018 conversion worksheet to convert IFRS balances to U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the conversion entry needed for 12/31/17 Note: Enter debits before credits Date General Journal 12/31/2017 Debit Credit Complete this question by entering your answers in the tabs below. Required A Required B Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017 and December 31, 2018 convers convert IFRS balances to U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry requires account field.) View transaction list Journal entry worksheet

11/9

11/9