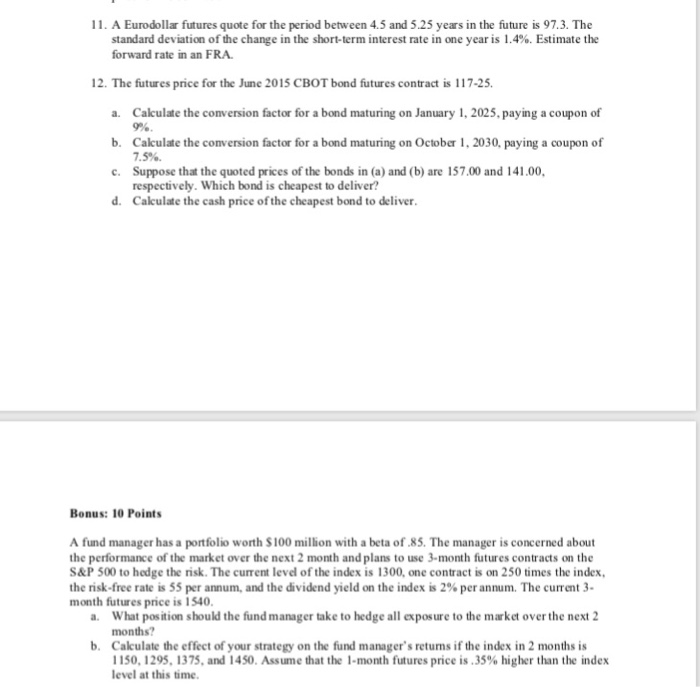

11A Eurodoll futures quote for the period between 4.5 and 5.25 ye s in the future is 97.3The standard deviation of the change in the short-term interest rate in one year is 1.4%. Estimate the forward rate in an FRA 12The futures price for the June 2015 CBOT bond futures contract is 1 17-25. a. Calculate the conversion factor for a bond maturing on January 1, 2025, paying a coupon of b. Calculate the conversion factor for a bond maturing on October 1, 2030, paying a coupon of c. Suppose that the quoted prices of the bonds in (a) and (b) are 157.00 and 141.00 d. Calculate the cash price of the cheapest bond to deliver 9%. 7.5%. respectively. Which bond is cheapest to deliver? Bonus: 10 Points A fund manager has a portfolio worth $100 million with a beta of .85The manager is concerned about the performance of the market over the next 2 month and plans to use 3-month futures contracts on the S&P 500 to hedge the risk. The current level of the index is 1300, one contract is on 250 times the index the risk-free rate is 55 per annum, and the dividend yield on the index is 2% per annum. The current 3. month futures price is 1540 What position should the fund manager take to hedge all exposure to the market over the next 2 months? Calculate the effect of your strategy on the fund manager's returns if the index in 2 months is 1150, 1295, 1375, and 1450. Assume that the 1-month futures price is .35% higher than the index level at this time. a. b. 11A Eurodoll futures quote for the period between 4.5 and 5.25 ye s in the future is 97.3The standard deviation of the change in the short-term interest rate in one year is 1.4%. Estimate the forward rate in an FRA 12The futures price for the June 2015 CBOT bond futures contract is 1 17-25. a. Calculate the conversion factor for a bond maturing on January 1, 2025, paying a coupon of b. Calculate the conversion factor for a bond maturing on October 1, 2030, paying a coupon of c. Suppose that the quoted prices of the bonds in (a) and (b) are 157.00 and 141.00 d. Calculate the cash price of the cheapest bond to deliver 9%. 7.5%. respectively. Which bond is cheapest to deliver? Bonus: 10 Points A fund manager has a portfolio worth $100 million with a beta of .85The manager is concerned about the performance of the market over the next 2 month and plans to use 3-month futures contracts on the S&P 500 to hedge the risk. The current level of the index is 1300, one contract is on 250 times the index the risk-free rate is 55 per annum, and the dividend yield on the index is 2% per annum. The current 3. month futures price is 1540 What position should the fund manager take to hedge all exposure to the market over the next 2 months? Calculate the effect of your strategy on the fund manager's returns if the index in 2 months is 1150, 1295, 1375, and 1450. Assume that the 1-month futures price is .35% higher than the index level at this time. a. b