Answered step by step

Verified Expert Solution

Question

1 Approved Answer

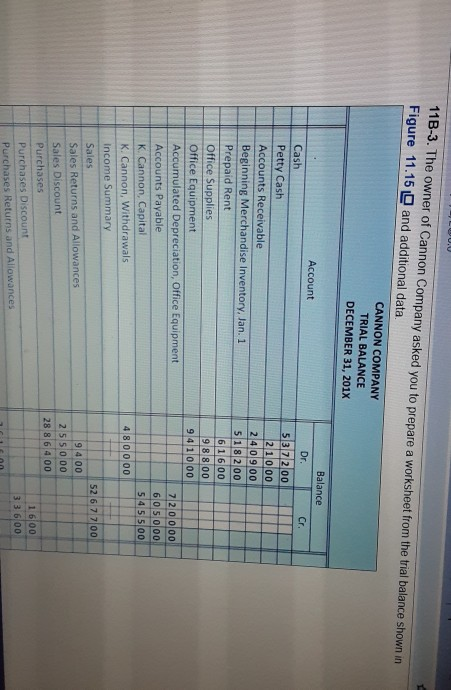

11B-3. The owner of Cannon Company asked you to prepare a worksheet from the trial balance shown in Figure 11.15 and additional data CANNON COMPANY

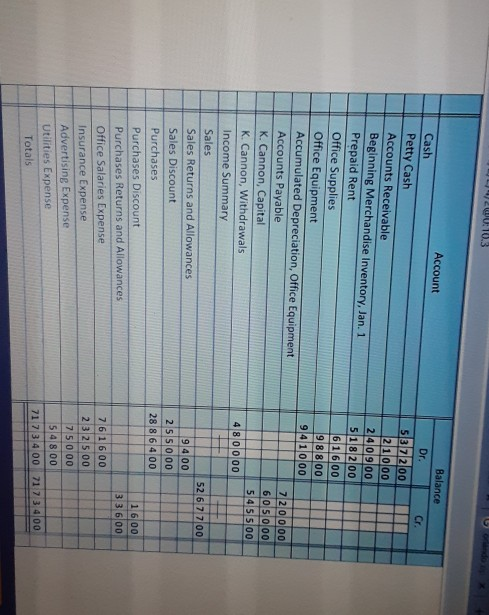

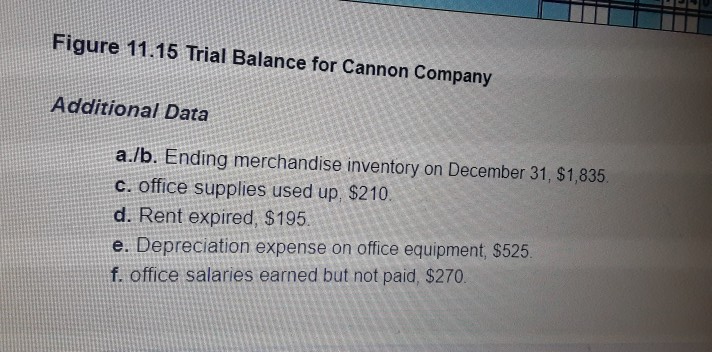

11B-3. The owner of Cannon Company asked you to prepare a worksheet from the trial balance shown in Figure 11.15 and additional data CANNON COMPANY TRIAL BALANCE DECEMBER 31, 2017 Balance Account Dr. I cr. Cash Petty Cash 5 3 7 2 00 2 1 000 Accounts Receivable 2 40900 Beginning Merchandise Inventory, Jan. 1 5 1 8200 Prepaid Rent 616 00 Office Supplies 9 8 800 Office Equipment 9 4 1 000 Accumulated Depreciation, Office Equipment 7 20 000 Accounts Payable 605 000 K. Cannon, Capital 545 500 K. Cannon, Withdrawals 480000 Income Summary Sales 52 6 7 700 Sales Returns and Allowances 2 55 000 Sales Discount 28 8 6 400 Purchases 1 600 Purchases Discount Purchases Returns and Allowances 9400 3 3 600 0:10.3 Account Cash Balance Dr. 5372.00 Cr. 2 1 000 240 9.00 18200 61600 98 800 7 20 000 60 50 00 545 500 48 00 00 Petty Cash Accounts Receivable Beginning Merchandise Inventory, Jan. 1 Prepaid Rent Office Supplies Office Equipment Accumulated Depreciation, Office Equipment Accounts Payable K. Cannon, Capital K. Cannon, Withdrawals Income Summary Sales Sales Returns and Allowances Sales Discount Purchases Purchases Discount Purchases Returns and Allowances Office Salaries Expense Insurance Expense Advertising Expense Utilities Expense Totals 52 6.7 7.00 94.00 2 5 5 000 28 8 6 4 00 1600 3 3 600 7 6 16 00 232500 75 000 54800 71 734 00 71 734 00 Figure 11.15 Trial Balance for Cannon Company Additional Data a./b. Ending merchandise inventory on December 31, $1,835. C. office supplies used up, $210. d. Rent expired, $195. e. Depreciation expense on office equipment, $525. f. office salaries earned but not paid $270

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started