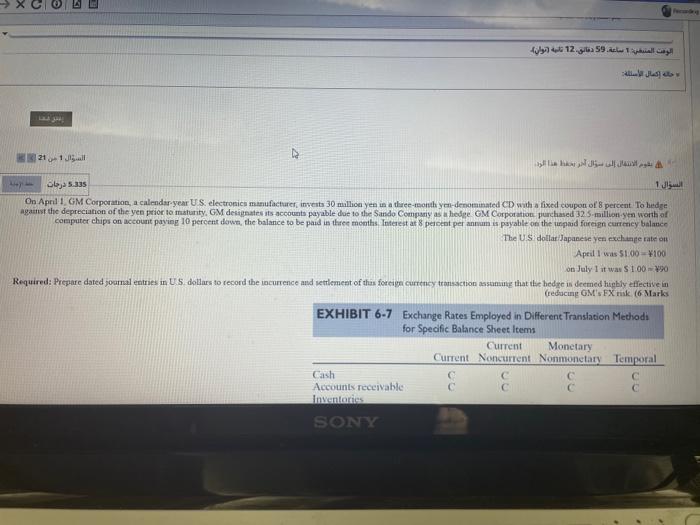

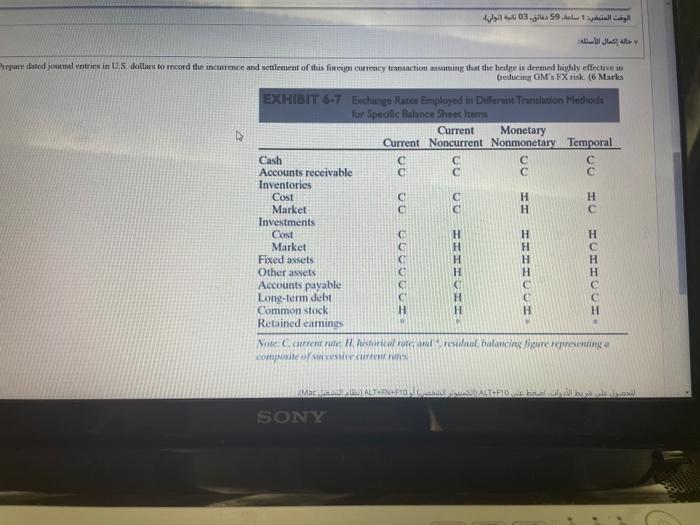

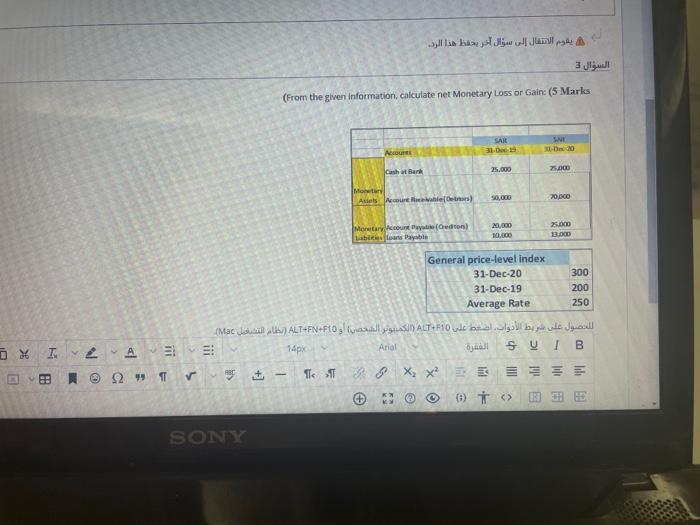

12 1 21 1 5.335 On April, GM Corporation, a calendar year US electronics manufacturer, invests 30 million yen in three months y denominated CD with a fixed coupon of percent To hedge against the depreciation of the yen prior to maturity. GM desiates its accounts payable due to the Sando Company as hede GM Corporation purchased 25 millionym worth of computer chips on account paying 10 percent down the balance to be paid in three months. Interest at 8 percent per annum is payable on the paid foreign currency balance The US dollar Japanese yen exchange rate on April I was 5100 = 100 on July 1 it was S 100 90 Required: Prepare dated journal entries in US dollars to record the currence and settlement of this foreign currency transaction assuming that the hedge is deemed highly effective in (reducing GM's FX ruk. (6 Marks EXHIBIT 6-7 Exchange Rates Employed in Different Translation Methodi for Specific Balance Sheet Items Current Monetary Current Noncurrent Nonmonetary Temporal Cash C Accounts receivable Inventories SONY & . 03 ( & repare dated journal entren in U.S. deillars to record the incurrence and settlement of this foreign currency transaction assiting that the hedge is deemed hthly effective in (reducing GM's FX risk. (6 Maria EXHIBIT 6-7 Exchange Rates Employed in Different Translation Mediode for Specific Balance Sheet Items Current Monetary Current Noncurrent Nonmonetary Temporal Cash Accounts receivable & E Inventories Cost H 8. Market H Investments Cost Market Fixed assets Other assets Accounts payable Long-term debt Common stock H H Retained earnings MC Ciren historical residual balancing gure patinga composite of current rules 10- 3 SONY : 1 . 19 2 21 535 2 Belgium has a classical system of taxation Calculate the Net incomes of the company and shareholders and the total taxes that would be paid by a company headquartered in Brush that eas 2,500,000 Euro () and distributes 45 percent of its earnings as a dividend to its shareholders. Assume that the company's shareholders are in the 50 percent tout bracket and (that the company's income tax rate is 35 percent (5 Mark 0 IL * T. ) ATF10 ALT + 84 + F10 Ma / = = = = = = * * 1 !!! 14px B es ES ES ) 19 5 2 SONY 3 (From the given information, calculate net Monetary Loss or Gain: (5 Marks SAR WE De 20 More Cash Bank Mony Aalal Malant has sahla [ Clini) ) 50,00 2 Morstars Moon Day at an ( neral ton) 20,000 11 ( 3.00 300 General price-level index 31-De-20 31-Dec-19 Average Rate 200 250 . ALT + F10 ATFM + F10 ( Mac) = = A Arial B 1 * T 124 E 2 0 0 1 * > [+ * (5) f( SONY 12 1 21 1 5.335 On April, GM Corporation, a calendar year US electronics manufacturer, invests 30 million yen in three months y denominated CD with a fixed coupon of percent To hedge against the depreciation of the yen prior to maturity. GM desiates its accounts payable due to the Sando Company as hede GM Corporation purchased 25 millionym worth of computer chips on account paying 10 percent down the balance to be paid in three months. Interest at 8 percent per annum is payable on the paid foreign currency balance The US dollar Japanese yen exchange rate on April I was 5100 = 100 on July 1 it was S 100 90 Required: Prepare dated journal entries in US dollars to record the currence and settlement of this foreign currency transaction assuming that the hedge is deemed highly effective in (reducing GM's FX ruk. (6 Marks EXHIBIT 6-7 Exchange Rates Employed in Different Translation Methodi for Specific Balance Sheet Items Current Monetary Current Noncurrent Nonmonetary Temporal Cash C Accounts receivable Inventories SONY & . 03 ( & repare dated journal entren in U.S. deillars to record the incurrence and settlement of this foreign currency transaction assiting that the hedge is deemed hthly effective in (reducing GM's FX risk. (6 Maria EXHIBIT 6-7 Exchange Rates Employed in Different Translation Mediode for Specific Balance Sheet Items Current Monetary Current Noncurrent Nonmonetary Temporal Cash Accounts receivable & E Inventories Cost H 8. Market H Investments Cost Market Fixed assets Other assets Accounts payable Long-term debt Common stock H H Retained earnings MC Ciren historical residual balancing gure patinga composite of current rules 10- 3 SONY : 1 . 19 2 21 535 2 Belgium has a classical system of taxation Calculate the Net incomes of the company and shareholders and the total taxes that would be paid by a company headquartered in Brush that eas 2,500,000 Euro () and distributes 45 percent of its earnings as a dividend to its shareholders. Assume that the company's shareholders are in the 50 percent tout bracket and (that the company's income tax rate is 35 percent (5 Mark 0 IL * T. ) ATF10 ALT + 84 + F10 Ma / = = = = = = * * 1 !!! 14px B es ES ES ) 19 5 2 SONY 3 (From the given information, calculate net Monetary Loss or Gain: (5 Marks SAR WE De 20 More Cash Bank Mony Aalal Malant has sahla [ Clini) ) 50,00 2 Morstars Moon Day at an ( neral ton) 20,000 11 ( 3.00 300 General price-level index 31-De-20 31-Dec-19 Average Rate 200 250 . ALT + F10 ATFM + F10 ( Mac) = = A Arial B 1 * T 124 E 2 0 0 1 * > [+ * (5) f( SONY