Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. 13. 14. 15. 16. 17. A company estimates that it will need $74,000 in 10 years to replace a computer. If it establishes

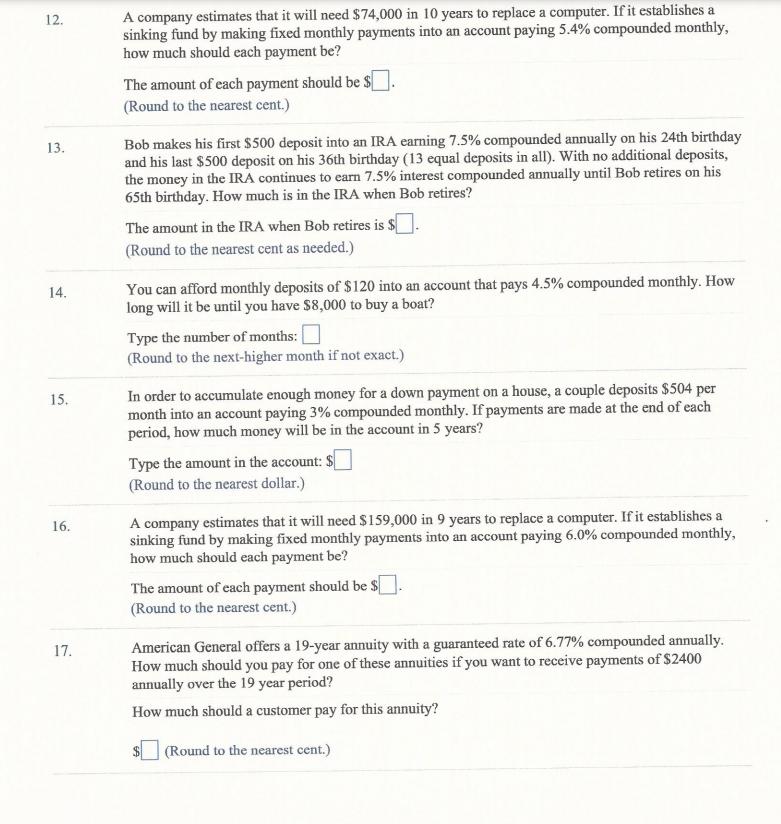

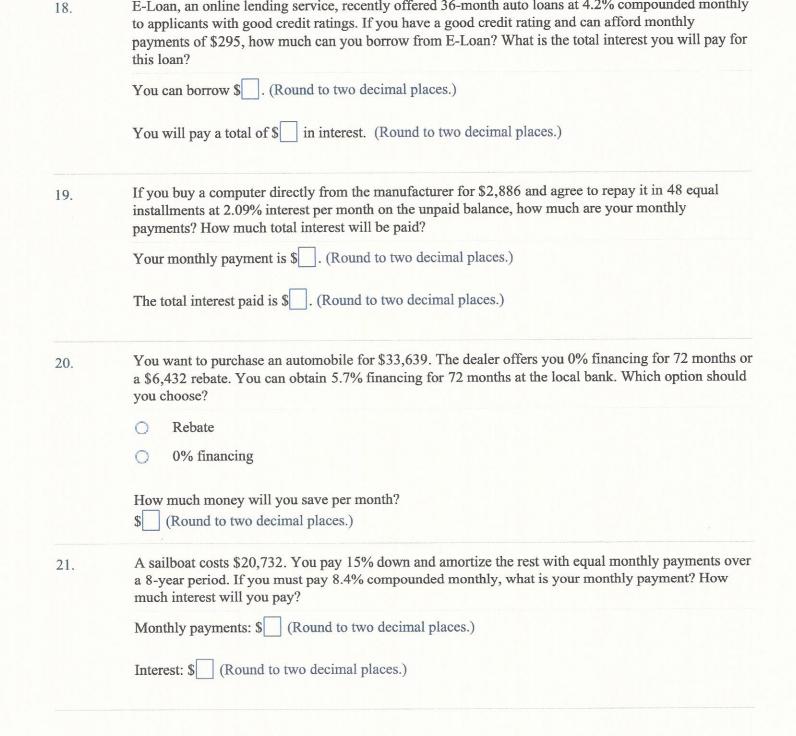

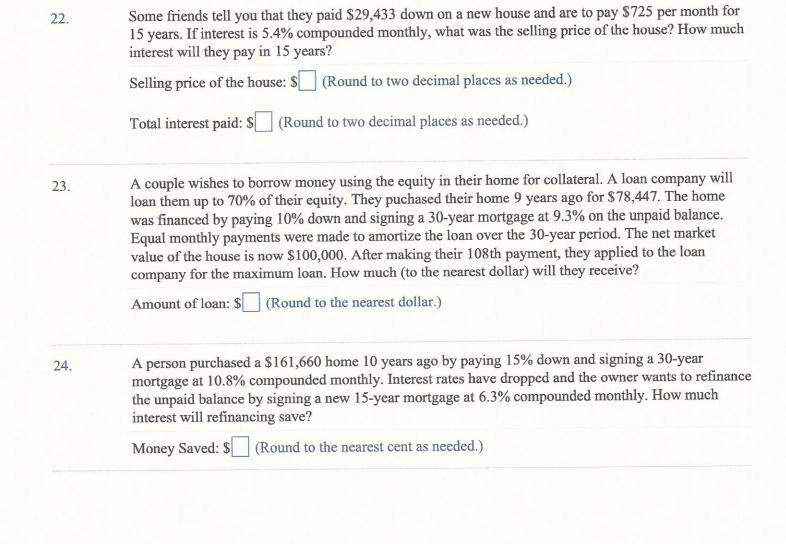

12. 13. 14. 15. 16. 17. A company estimates that it will need $74,000 in 10 years to replace a computer. If it establishes a sinking fund by making fixed monthly payments into an account paying 5.4% compounded monthly, how much should each payment be? The amount of each payment should be $ (Round to the nearest cent.) Bob makes his first $500 deposit into an IRA earning 7.5% compounded annually on his 24th birthday and his last $500 deposit on his 36th birthday (13 equal deposits in all). With no additional deposits, the money in the IRA continues to earn 7.5% interest compounded annually until Bob retires on his 65th birthday. How much is in the IRA when Bob retires? The amount in the IRA when Bob retires is $ (Round to the nearest cent as needed.) You can afford monthly deposits of $120 into an account that pays 4.5% compounded monthly. How long will it be until you have $8,000 to buy a boat? Type the number of months: (Round to the next-higher month if not exact.) In order to accumulate enough money for a down payment on a house, a couple deposits $504 per month into an account paying 3% compounded monthly. If payments are made at the end of each period, how much money will be in the account in 5 years? Type the amount in the account: (Round to the nearest dollar.) A company estimates that it will need $159,000 in 9 years to replace a computer. If it establishes a sinking fund by making fixed monthly payments into an account paying 6.0% compounded monthly, how much should each payment be? The amount of each payment should be $ (Round to the nearest cent.) American General offers a 19-year annuity with a guaranteed rate of 6.77% compounded annually. How much should you pay for one of these annuities if you want to receive payments of $2400 annually over the 19 year period? How much should a customer pay for this annuity? (Round to the nearest cent.) 18. 19. 20. 21. E-Loan, an online lending service, recently offered 36-month auto loans at 4.2% compounded monthly to applicants with good credit ratings. If you have a good credit rating and can afford monthly payments of $295, how much can you borrow from E-Loan? What is the total interest you will pay for this loan? You can borrow $. (Round to two decimal places.) You will pay a total of $ in interest. (Round to two decimal places.) If you buy a computer directly from the manufacturer for $2,886 and agree to repay it in 48 equal installments at 2.09% interest per month on the unpaid balance, how much are your monthly payments? How much total interest will be paid? Your monthly payment is $. (Round to two decimal places.) The total interest paid is $. (Round to two decimal places.) You want to purchase an automobile for $33,639. The dealer offers you 0% financing for 72 months or a $6,432 rebate. You can obtain 5.7% financing for 72 months at the local bank. Which option should you choose? O Rebate 0% financing How much money will you save per month? $(Round to two decimal places.) A sailboat costs $20,732. You pay 15% down and amortize the rest with equal monthly payments over a 8-year period. If you must pay 8.4% compounded monthly, what is your monthly payment? How much interest will you pay? Monthly payments: $ (Round to two decimal places.) Interest: S (Round to two decimal places.) 22. 23. 24. Some friends tell you that they paid $29,433 down on a new house and are to pay $725 per month for 15 years. If interest is 5.4% compounded monthly, what was the selling price of the house? How much interest will they pay in 15 years? Selling price of the house: $ Total interest paid: S (Round to two decimal places as needed.) (Round to two decimal places as needed.) A couple wishes to borrow money using the equity in their home for collateral. A loan company will loan them up to 70% of their equity. They puchased their home 9 years ago for $78,447. The home was financed by paying 10% down and signing a 30-year mortgage at 9.3% on the unpaid balance. Equal monthly payments were made to amortize the loan over the 30-year period. The net market value of the house is now $100,000. After making their 108th payment, they applied to the loan company for the maximum loan. How much (to the nearest dollar) will they receive? Amount of loan: $ (Round to the nearest dollar.) A person purchased a $161,660 home 10 years ago by paying 15% down and signing a 30-year mortgage at 10.8% compounded monthly. Interest rates have dropped and the owner wants to refinance the unpaid balance by signing a new 15-year mortgage at 6.3% compounded monthly. How much interest will refinancing save? Money Saved: $ (Round to the nearest cent as needed.)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lovestion 12 Compound Monthly Is Amount Principle 1 Rate me 74000 100045 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started