Question

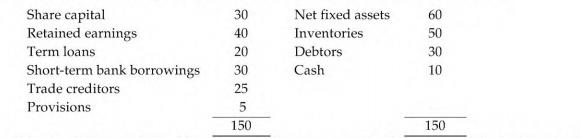

The balance sheet of Elgin Corporation as of 31st December 20X0 is shown below: Sales for 20X0 were 160, while net profit after taxes was

The balance sheet of Elgin Corporation as of 31st December 20X0 is shown below:

Sales for 20X0 were 160, while net profit after taxes was 10. Elgin paid dividend of 5 to equity shareholders.

(a) If sales increase by 50 percent (80) during 20X1, what will be Elgin's external funds requirement? Assume that the profit margin ratio and dividend payout ratio would remain unchanged.

(b) Prepare Elgin's projected balance sheet as of 31st December 20X1. Assume that the external fund requirement will be raised equally from term loans and fresh issues on equity capital.

(c) Calculate the following ratios for 20X0 and 20X1: current ratio, debt to total assets ratio, and return on equity.

(d) Assume, now, that the sales growth of 80 occurs evenly over a period of 4 years (20 per year) rather than in just one year,

(i) Calculate the total external fund requirement over the four-year period,

(ii) Construct a pro forma balance sheet as of December 31, 20X4.

Share capital Retained earnings Term loans Short-term bank borrowings Trade creditors Provisions 30 40 20 30 25 5 150 Net fixed assets Inventories Debtors Cash 60 50 30 10 150

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

aExternal funds requirement Increase in Working Capital Funds for Dividend Payout Increase in Working Capital Increase in Sales x Current Ratio Increa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started