Answered step by step

Verified Expert Solution

Question

1 Approved Answer

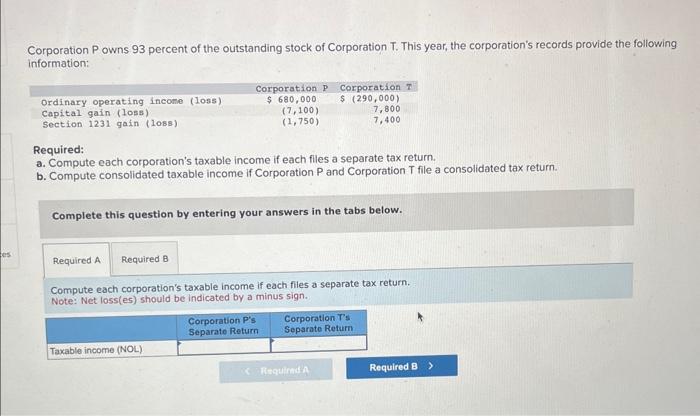

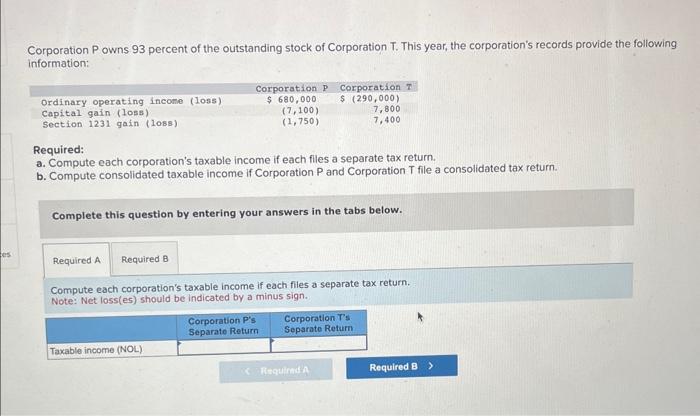

#12 & #14 Corporation P owns 93 percent of the outstanding stock of Corporation T. This year, the corporation's records provide the following information: Required:

#12 & #14

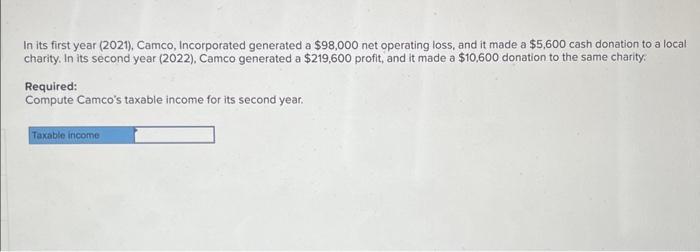

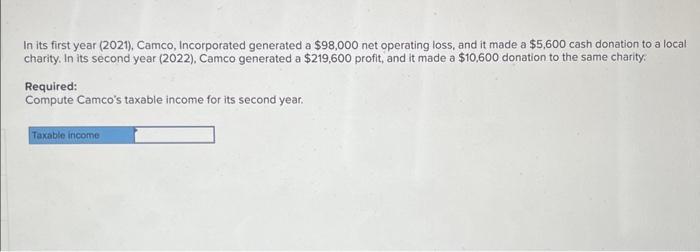

Corporation P owns 93 percent of the outstanding stock of Corporation T. This year, the corporation's records provide the following information: Required: a. Compute each corporation's taxable income if each flles a separate tax return. b. Compute consolidated taxable income if Corporation P and Corporation T file a consolidated tax return. Complete this question by entering your answers in the tabs below. Compute each corporation's taxable income if each files a separate tax return. Note: Net loss(es) should be indicated by a minus sign. In its first year (2021), Camco, Incorporated generated a $98,000 net operating loss, and it made a $5,600 cash donation to a local charity. In its second year (2022), Camco generated a $219,600 profit, and it made a $10,600 donation to the same charity: Required: Compute Camco's taxable income for its second year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started