Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12 5 points eBook 103 Hint Ask Exercise 8-19A (Static) Computing and recording depletion expense LO 8-9 Colorado Mining paid $600,000 to acquire a mine

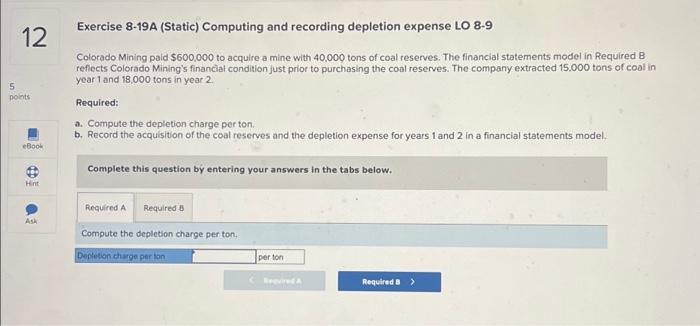

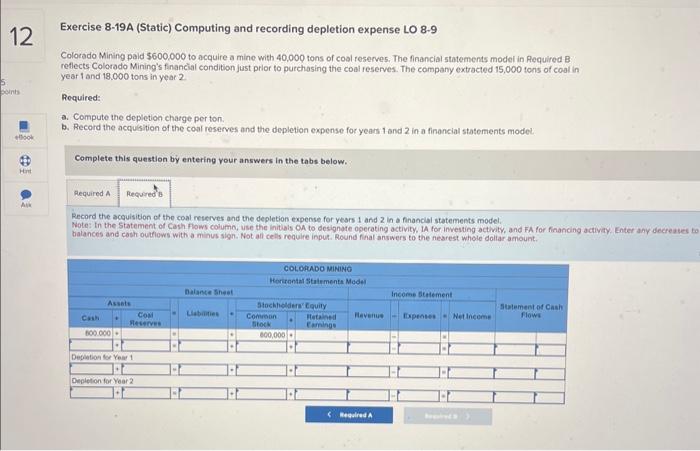

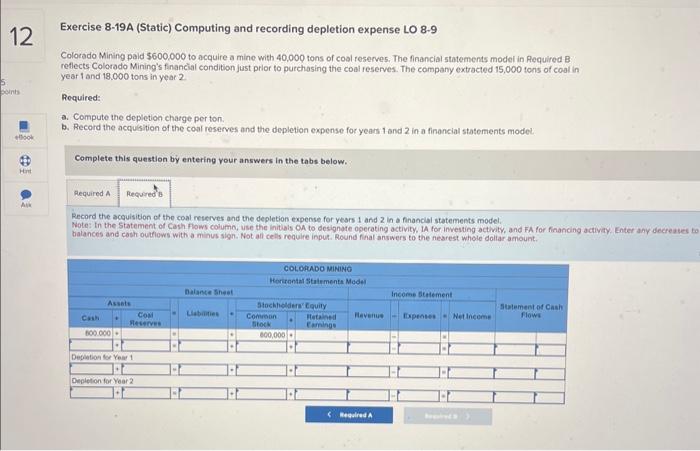

12 5 points eBook 103 Hint Ask Exercise 8-19A (Static) Computing and recording depletion expense LO 8-9 Colorado Mining paid $600,000 to acquire a mine with 40,000 tons of coal reserves. The financial statements model in Required B reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 15,000 tons of coal in year 1 and 18,000 tons in year 2. Required: a. Compute the depletion charge per ton. b. Record the acquisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model. Complete this question by entering your answers in the tabs below. Required A Required B Compute the depletion charge per ton. Depletion charge per ton

Exercise 8-19A (Static) Computing and recording depletion expense LO 8-9 Colorado Mining paid $600,000 to acquire a mine with 40,000 tons of coal reserves. The financial statements model in Required B reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 15.000 tons of coal in year 1 and 18,000 tons in year 2 . Required: a. Compute the depletion charge per ton. b. Record the acquisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model. Complete this question by entering your answers in the tabs below. Compute the depletion charge per ton. Exercise 8-19A (Static) Computing and recording depletion expense LO 8-9 Colorado Mining paid $600,000 to acquire a mine with 40,000 tons of coal reserves. The financial statements model in Required B reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 15,000 tons of coal in year 1 and 18,000 tons in year 2 . Required: a. Compute the depletion charge per ton. b. Record the acquasition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model. Complete this question by entering vour answers in the tabs below. Record the acguisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model. Note: in the Statement of Cash Flows column, use the initials on to designate operating octivity, IA for investing activity, and FA for financing activity. Enter any decreases to balances and cosh outfows with a minus sign. Not all cells require input. Round final answers to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started