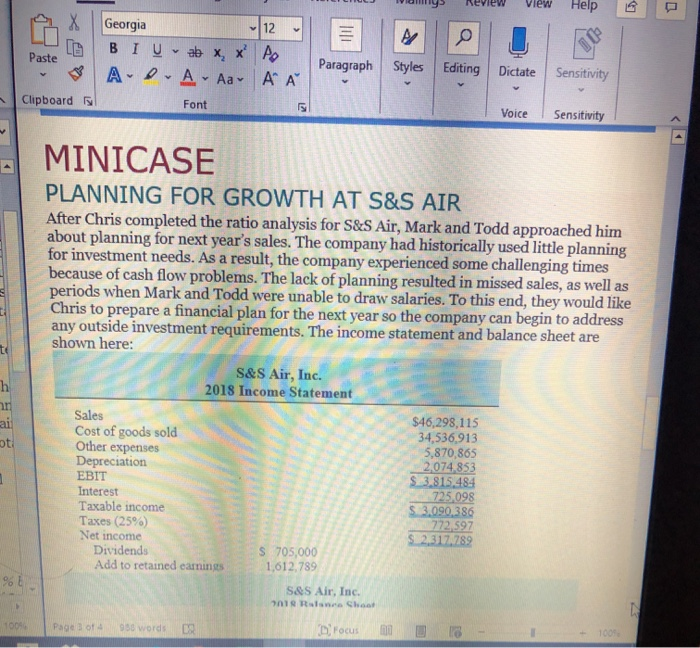

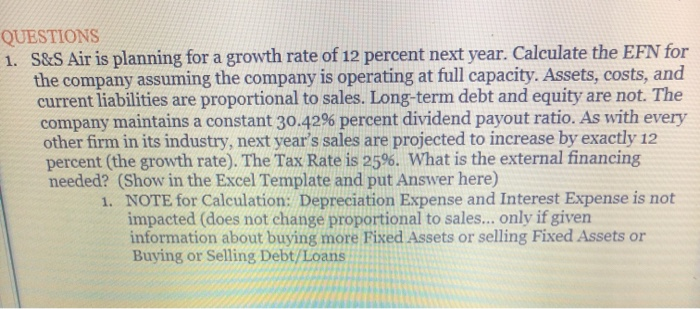

12 A A A Georgia BI U ab X, X A-D-A- A Font Paste Paragraph Styles Editing Dictate Sensitivity Clipboard Voice Sensitivity MINICASE PLANNING FOR GROWTH AT S&S AIR After Chris completed the ratio analysis for S&S Air, Mark and Todd approached him about planning for next year's sales. The company had historically used little planning for investment needs. As a result, the company experienced some challenging times because of cash flow problems. The lack of planning resulted in missed sales, as well as periods when Mark and Todd were unable to draw salaries. To this end, they would like Chris to prepare a financial plan for the next year so the company can begin to address any outside investment requirements. The income statement and balance sheet are shown here: S&S Air, Inc. 2018 Income Statement Sales $46,298,115 Cost of goods sold 34,536,913 Other expenses 5,870,865 Depreciation 2,074,853 EBIT $ 3.815,484 Interest 725,098 Taxable income $ 3.090.386 Taxes (25%) 772,597 Net income $ 2,317.789 Dividends $ 705,000 Add to retained earnings 1,612,789 S&S Air, Inc. n1 Rance Shoot I Pages of ass words 2 D Focus I 18 QUESTIONS 1. S&S Air is planning for a growth rate of 12 percent next year. Calculate the EFN for the company assuming the company is operating at full capacity. Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 30.42% percent dividend payout ratio. As with every other firm in its industry, next year's sales are projected to increase by exactly 12 percent (the growth rate). The Tax Rate is 25%. What is the external financing needed? (Show in the Excel Template and put Answer here) 1. NOTE for Calculation: Depreciation Expense and Interest Expense is not impacted (does not change proportional to sales... only if given information about buying more Fixed Assets or selling Fixed Assets or Buying or Selling Debt/Loans 12 A A A Georgia BI U ab X, X A-D-A- A Font Paste Paragraph Styles Editing Dictate Sensitivity Clipboard Voice Sensitivity MINICASE PLANNING FOR GROWTH AT S&S AIR After Chris completed the ratio analysis for S&S Air, Mark and Todd approached him about planning for next year's sales. The company had historically used little planning for investment needs. As a result, the company experienced some challenging times because of cash flow problems. The lack of planning resulted in missed sales, as well as periods when Mark and Todd were unable to draw salaries. To this end, they would like Chris to prepare a financial plan for the next year so the company can begin to address any outside investment requirements. The income statement and balance sheet are shown here: S&S Air, Inc. 2018 Income Statement Sales $46,298,115 Cost of goods sold 34,536,913 Other expenses 5,870,865 Depreciation 2,074,853 EBIT $ 3.815,484 Interest 725,098 Taxable income $ 3.090.386 Taxes (25%) 772,597 Net income $ 2,317.789 Dividends $ 705,000 Add to retained earnings 1,612,789 S&S Air, Inc. n1 Rance Shoot I Pages of ass words 2 D Focus I 18 QUESTIONS 1. S&S Air is planning for a growth rate of 12 percent next year. Calculate the EFN for the company assuming the company is operating at full capacity. Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 30.42% percent dividend payout ratio. As with every other firm in its industry, next year's sales are projected to increase by exactly 12 percent (the growth rate). The Tax Rate is 25%. What is the external financing needed? (Show in the Excel Template and put Answer here) 1. NOTE for Calculation: Depreciation Expense and Interest Expense is not impacted (does not change proportional to sales... only if given information about buying more Fixed Assets or selling Fixed Assets or Buying or Selling Debt/Loans