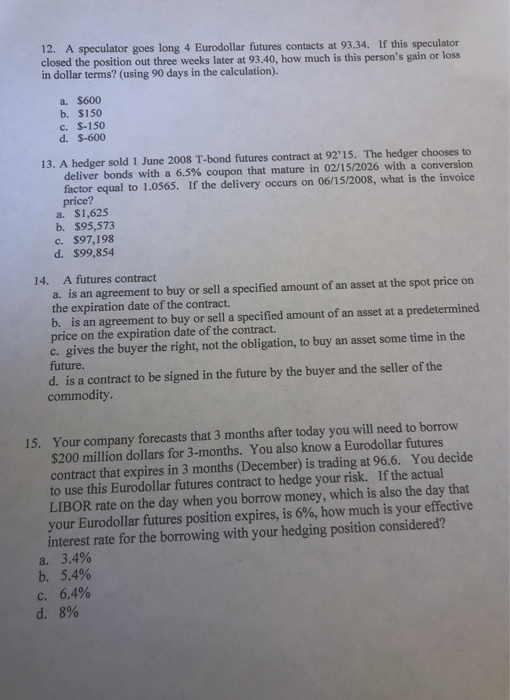

12. A speculator goes long 4 Eurodollar futures contacts at 93.34. If this speculator closed the position out three weeks later at 93.40, how much is this person's gain or los in dollar terms? (using 90 days in the calculation). a. $600 b. $150 c. $-150 d. $-600 13. A hedger sold 1 June 2008 T-bond futures contract at 92'15. The hedger chooses to deliver bonds with a 6.5% coupon that mature in 02/15/2026 with a conversion factor equal to 1.0565. If the delivery occurs on 06/15/2008, what is the invoice price? a. $1,625 b. $95,573 C. $97,198 d. $99,854 14. A futures contract a. is an agreement to buy or sell a specified amount of an asset at the spot price on the expiration date of the contract. b. is an agreement to buy or sell a specified amount of an asset at a predetermined price on the expiration date of the contract. c. gives the buyer the right, not the obligation, to buy an asset some time in the future d. is a contract to be signed in the future by the buyer and the seller of the commodity. Your company forecasts that 3 months after today you will need to borrow $200 million dollars for 3-months. You also know a Eurodollar futures contract that expires in 3 months (December) is trading at 96.6. You decide to use this Eurodollar futures contract to hedge your risk. If the actual LIBOR rate on the day when you borrow money, which is also the day that 15. your Eurodollar futures position expires, is 6%, how much is your effective interest rate for the borrowing with your hedging position considered? a. 3.4% b. 5.4% C. 6.4% d. 8% 12. A speculator goes long 4 Eurodollar futures contacts at 93.34. If this speculator closed the position out three weeks later at 93.40, how much is this person's gain or los in dollar terms? (using 90 days in the calculation). a. $600 b. $150 c. $-150 d. $-600 13. A hedger sold 1 June 2008 T-bond futures contract at 92'15. The hedger chooses to deliver bonds with a 6.5% coupon that mature in 02/15/2026 with a conversion factor equal to 1.0565. If the delivery occurs on 06/15/2008, what is the invoice price? a. $1,625 b. $95,573 C. $97,198 d. $99,854 14. A futures contract a. is an agreement to buy or sell a specified amount of an asset at the spot price on the expiration date of the contract. b. is an agreement to buy or sell a specified amount of an asset at a predetermined price on the expiration date of the contract. c. gives the buyer the right, not the obligation, to buy an asset some time in the future d. is a contract to be signed in the future by the buyer and the seller of the commodity. Your company forecasts that 3 months after today you will need to borrow $200 million dollars for 3-months. You also know a Eurodollar futures contract that expires in 3 months (December) is trading at 96.6. You decide to use this Eurodollar futures contract to hedge your risk. If the actual LIBOR rate on the day when you borrow money, which is also the day that 15. your Eurodollar futures position expires, is 6%, how much is your effective interest rate for the borrowing with your hedging position considered? a. 3.4% b. 5.4% C. 6.4% d. 8%