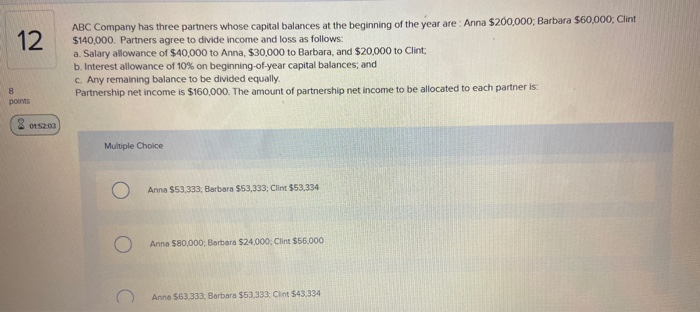

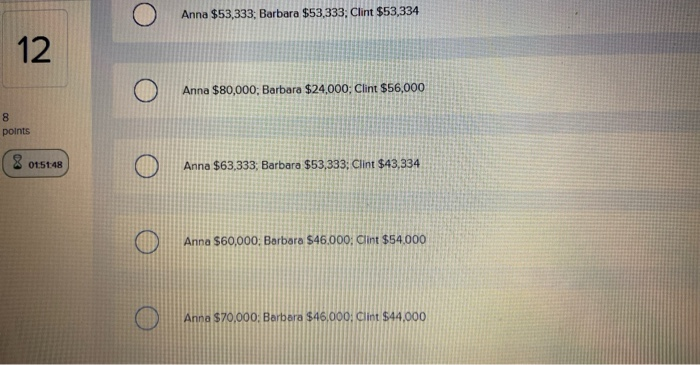

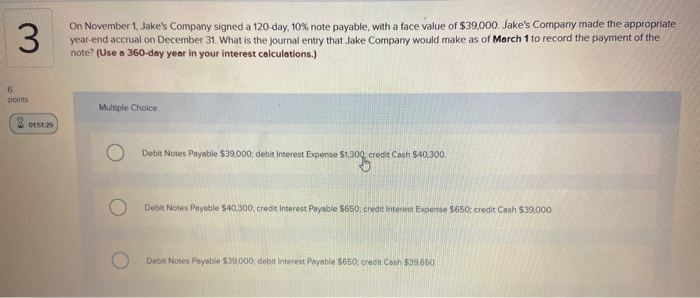

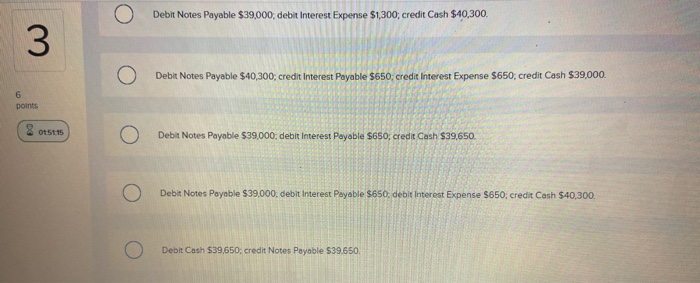

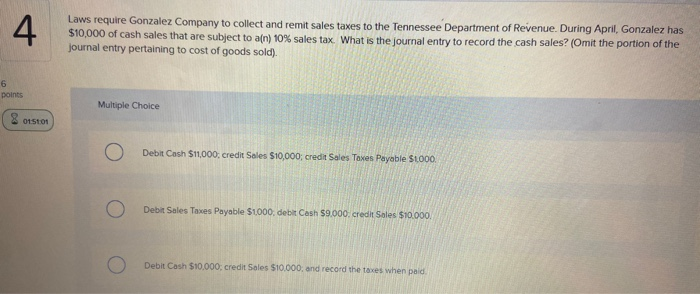

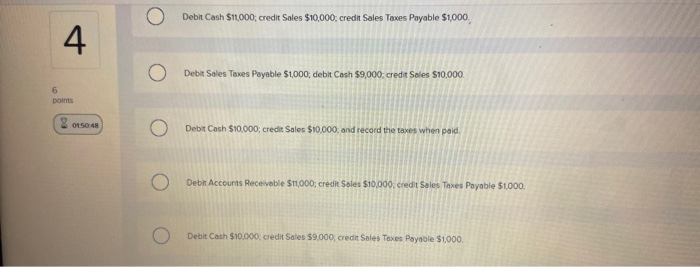

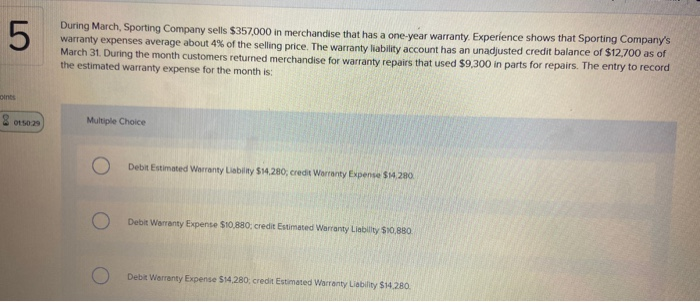

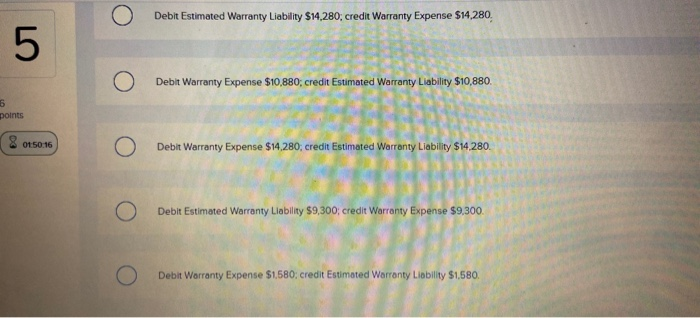

12 ABC Company has three partners whose capital balances at the beginning of the year are: Anna $200,000; Barbara $60,000; Clint $140,000. Partners agree to divide income and loss as follows: a. Salary allowance of $40,000 to Anna, $30,000 to Barbara, and $20,000 to Clint b. Interest allowance of 10% on beginning-of-year capital balances, and c. Any remaining balance to be divided equally Partnership net income is $160,000. The amount of partnership net income to be allocated to each partner is: 8 points 01:52:00 Multiple Choice Anna $53,333, Barbara $53,333; Clint $53,334 Anna $80,000; Barbara $24,000: Clint $56.000 Anna $63.333. Barbara $53,333: Clint $43,334 Anna $53,333; Barbara $53,333, Clint $53,334 12 Anna $80,000; Barbara $24,000; Clint $56,000 8 points 8 015148 Anna $63,333, Barbara $53,333; Clint $43,334 Anna $60,000; Barbara $46.000: Clint $54.000 Anna $70,000. Barbara $46,000: Clint $44,000 3 On November 1, Jake's Company signed a 120 day, 10% note payable, with a face value of $39,000. Jake's Company made the appropriate year-end accrual on December 31. What is the journal entry that Jake Company would make as of March 1 to record the payment of the note? (Use a 360-day year in your interest calculations.) 6 points Multiple Choice 01529 Debit Notes Payable $39.000, debit Interest Expense $1,300. credit Cash $40.300 Boere Debit Notes Payable $40.300credit Interest Payable $650 credit Interest Expense $650, credit Cash $39,000. Debit Notes Payable $39.000, debit interest Payable 5650, credit Cosh $39.650 Debit Notes Payable $39,000, debit Interest Expense $1,300, credit Cash $40,300. 3 Debit Notes Payable $40,300; credit Interest Payable $650, credit Interest Expense $650, credit Cash $39,000. 6 points 8 0151 Debit Notes Payable $39,000: debit interest Payable $650; credit Cash $39.650. O Debit Notes Payable $39.000, debit Interest Payable $650, debit interest Expense S650; credit Cash $40,300 Debit Cash $39,650, credit Notes Payable $39.650. 4 Laws require Gonzalez Company to collect and remit sales taxes to the Tennessee Department of Revenue. During April Gonzalez has $10,000 of cash sales that are subject to afn) 10% sales tax. What is the journal entry to record the cash sales? (Omit the portion of the journal entry pertaining to cost of goods sold). 6 points Multiple Choice 8 015101 Debit Cash $11,000 credit Sales S10,000, credit Sales Taxes Payable S1000 Debit Sales Taxes Payable $1.000, debit Cash $9.000. credit Sales $10.000 Debit Cash $10,000 credit Sales $10.000. and record the taxes when paid Debit Cash $11,000, credit Sales $10,000, credit Sales Taxes Payable $1,000 4 Debit Sales Taxes Payable $1,000, debit Cash $9,000, credit Sales $10,000 6 points 01:50:48 Debit Cash $10,000 credit Sales $10,000, and record the taxes when poid. Debit Accounts Receivable $11,000; credit Soles $10,000 credit Sales Taxes Payable $1,000. O Debit Cash $10.000, credit Sales $9,000, credit Sales Taxes Payable $1,000 During March, Sporting Company sells $357,000 in merchandise that has a one-year warranty. Experience shows that Sporting Company's warranty expenses average about 4% of the selling price. The warranty liability account has an unadjusted credit balance of $12,700 as of March 31. During the month customers returned merchandise for warranty repairs that used $9,300 in parts for repairs. The entry to record the estimated warranty expense for the month is: oints 801023 Multiple Choice Debit Estimated Warranty Liability $14.280, credit Warranty Expense $14280 Debit Warranty Expense $10,880credit Estimated Warranty Liability $10,880 Debit Warranty Expense $14280 credit Estimated Warranty Liability $14280 Debit Estimated Warranty Liability $14,280, credit Warranty Expense $14,280, 5 Debit Warranty Expense $10,880, credit Estimated Warranty Liability $10,880. 6 points 8 0150:16 Debit Warranty Expense $14,280, credit Estimated Warranty Liability $14.280. Debit Estimated Warranty Liability $9,300, credit Warranty Expense $9,300. Debit Warranty Expense $1.580: credit Estimated Warranty Liability $1,580