Question

(12) Assume that you manage a portfolio of $1,500,000 and you wish to hedge against any potential loss in your portfolio value one month

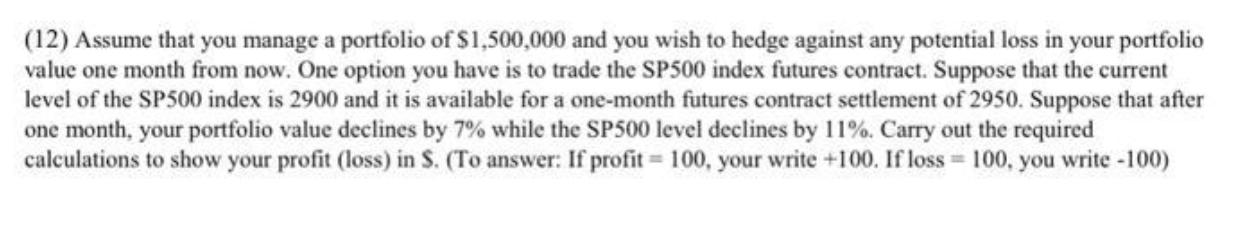

(12) Assume that you manage a portfolio of $1,500,000 and you wish to hedge against any potential loss in your portfolio value one month from now. One option you have is to trade the SP500 index futures contract. Suppose that the current level of the SP500 index is 2900 and it is available for a one-month futures contract settlement of 2950. Suppose that after one month, your portfolio value declines by 7% while the SP500 level declines by 11%. Carry out the required calculations to show your profit (loss) in S. (To answer: If profit=100, your write +100. If loss 100, you write -100)

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the profit or loss in S the value of the SP500 index futures contract we need to consid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Markets and Institutions

Authors: Jeff Madura

12th edition

9781337515535, 1337099740, 1337515531, 978-1337099745

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App