Answered step by step

Verified Expert Solution

Question

1 Approved Answer

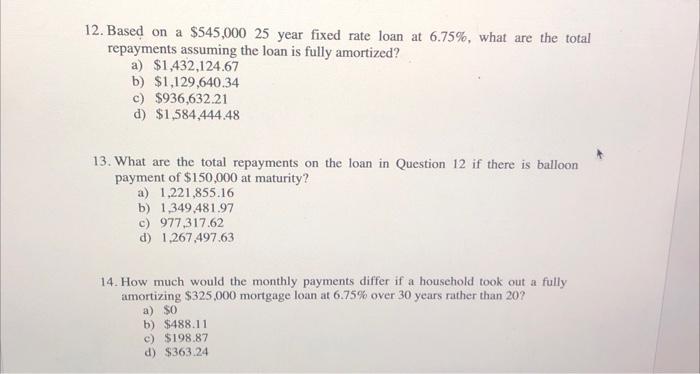

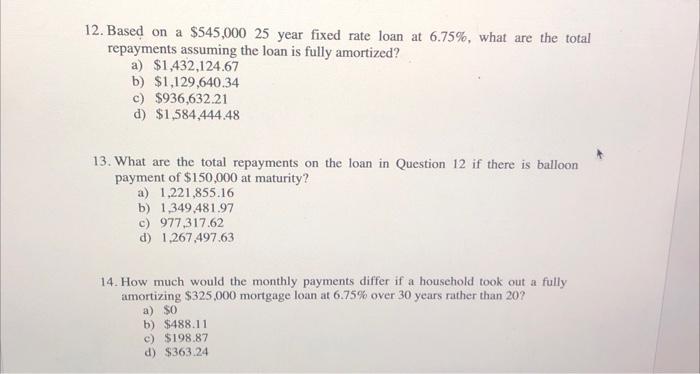

12. Based on a $545,00025 year fixed rate loan at 6.75%, what are the total repayments assuming the loan is fully amortized? a) $1,432,124.67 b)

12. Based on a $545,00025 year fixed rate loan at 6.75%, what are the total repayments assuming the loan is fully amortized? a) $1,432,124.67 b) $1,129,640.34 c) $936,632.21 d) $1,584,444.48 13. What are the total repayments on the loan in Question 12 if there is balloon payment of $150,000 at maturity? a) 1,221,855.16 b) 1,349,481.97 c) 977,317.62 d) 1,267,497.63 14. How much would the monthly payments differ if a household took out a fully amortizing $325,000 mortgage loan at 6.75% over 30 years rather than 20 ? a) $0 b) $488.11 c) $198.87 d) $363.24

12. Based on a $545,00025 year fixed rate loan at 6.75%, what are the total repayments assuming the loan is fully amortized? a) $1,432,124.67 b) $1,129,640.34 c) $936,632.21 d) $1,584,444.48 13. What are the total repayments on the loan in Question 12 if there is balloon payment of $150,000 at maturity? a) 1,221,855.16 b) 1,349,481.97 c) 977,317.62 d) 1,267,497.63 14. How much would the monthly payments differ if a household took out a fully amortizing $325,000 mortgage loan at 6.75% over 30 years rather than 20 ? a) $0 b) $488.11 c) $198.87 d) $363.24

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started