Answered step by step

Verified Expert Solution

Question

1 Approved Answer

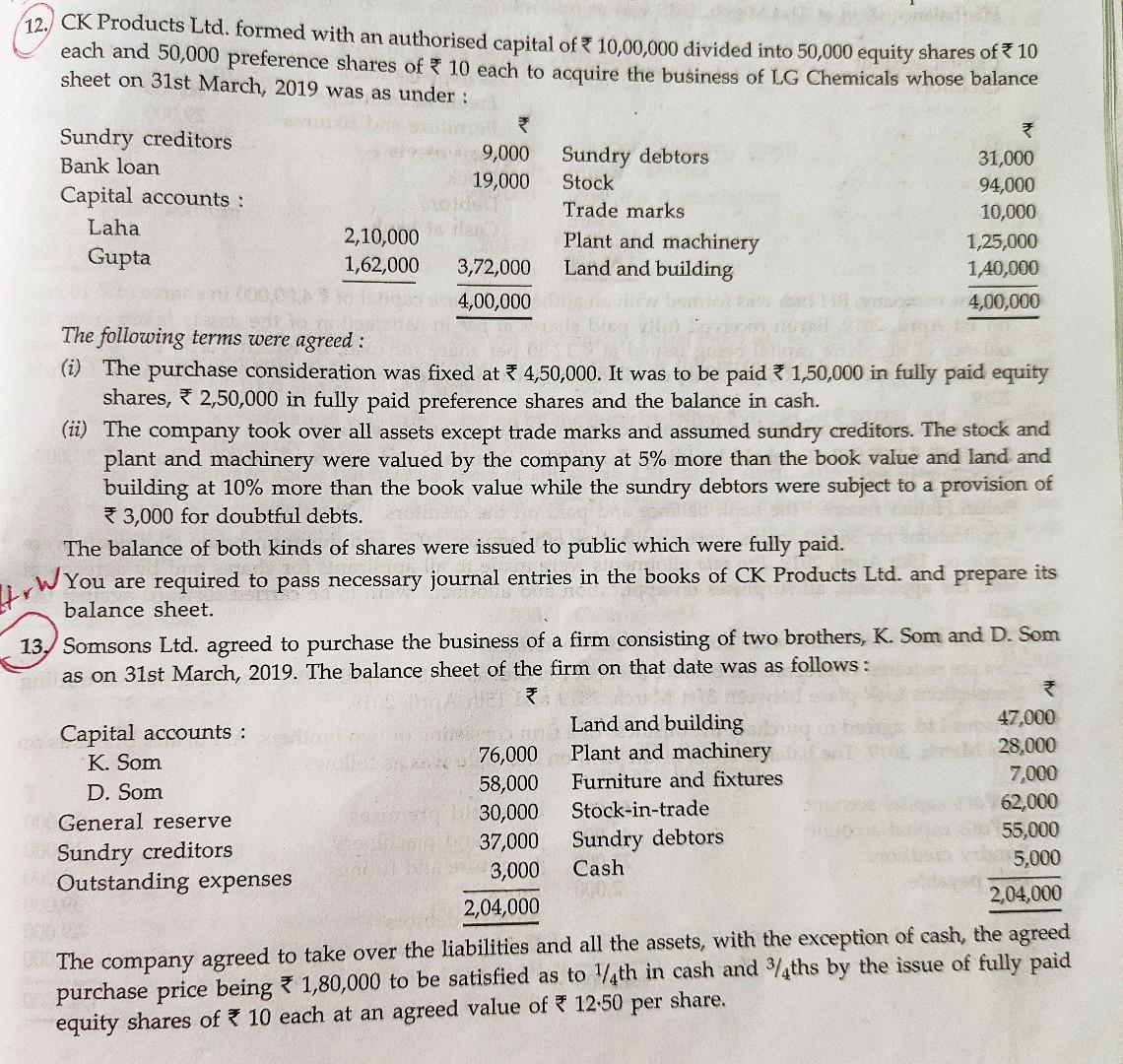

12. CK Products Ltd. formed with an authorised capital of 10,00,000 divided into 50,000 equity shares of 10 each and 50,000 preference shares of

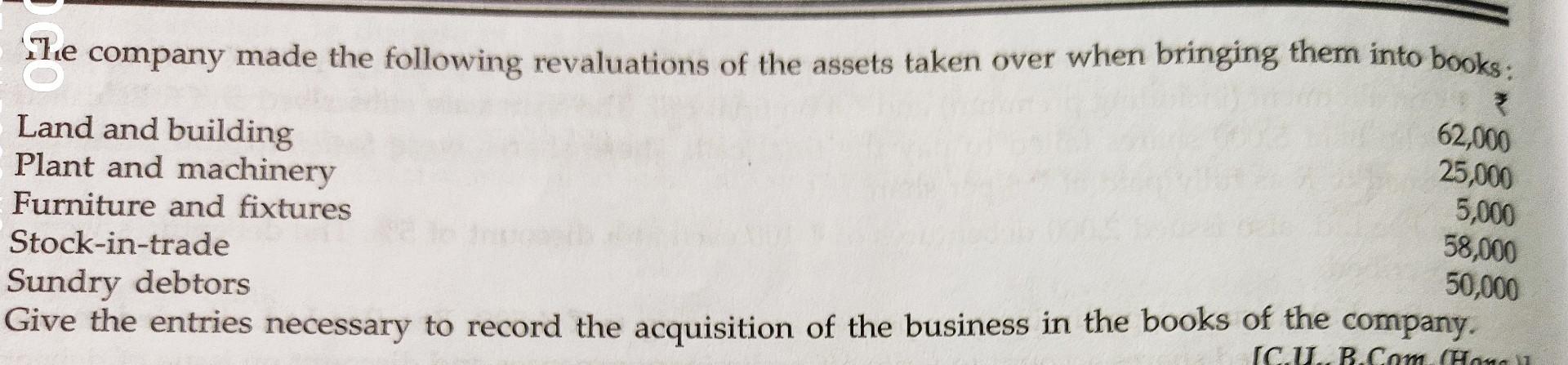

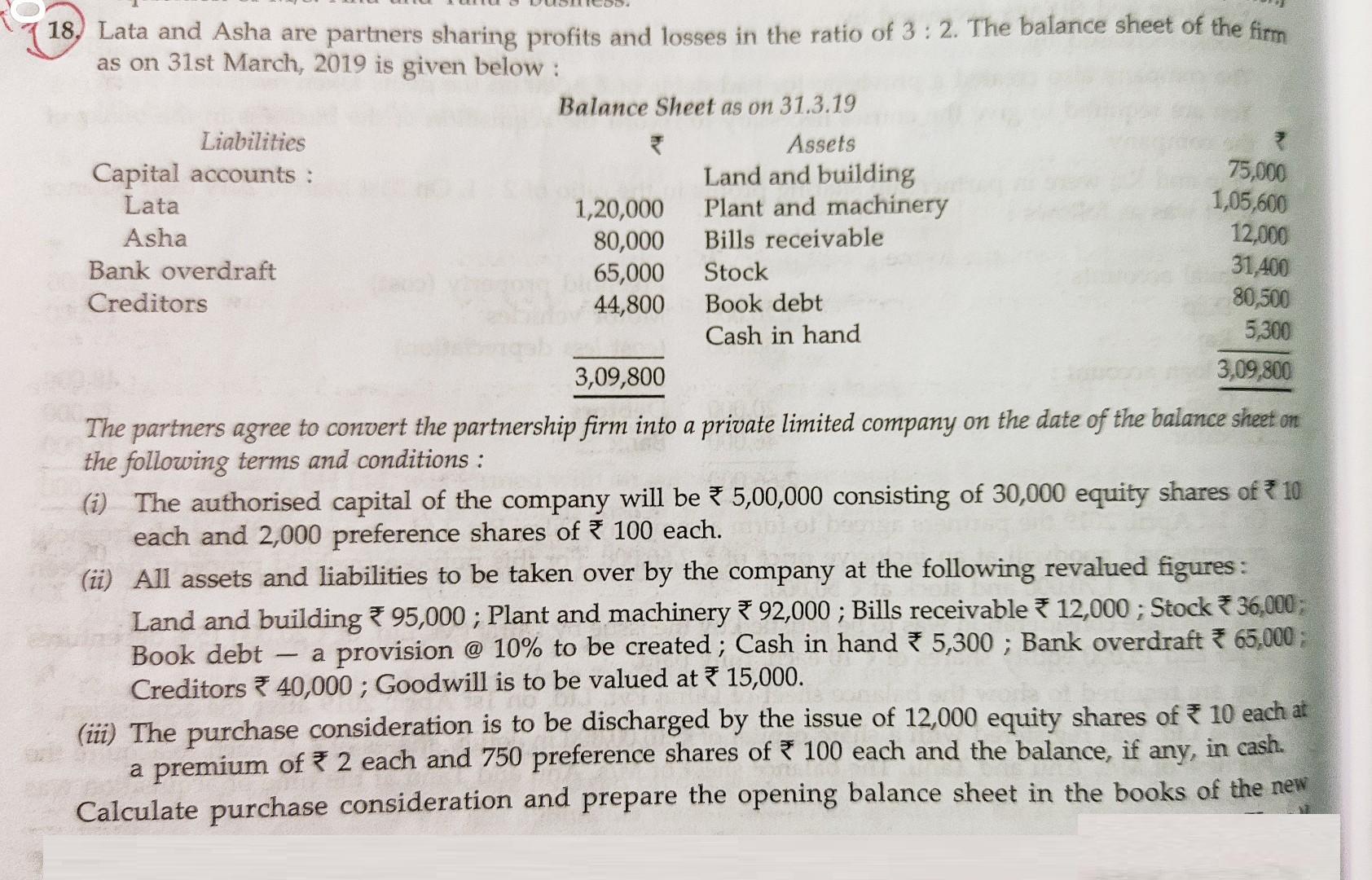

12. CK Products Ltd. formed with an authorised capital of 10,00,000 divided into 50,000 equity shares of 10 each and 50,000 preference shares of 10 each to acquire the business of LG Chemicals whose balance sheet on 31st March, 2019 was as under : Sundry creditors Bank loan Capital accounts: Laha Gupta 2,10,000 1,62,000 Capital accounts: K. Som 9,000 19,000 D. Som General reserve Sundry creditors Outstanding expenses 3,72,000 4,00,000 The following terms were agreed: (i) The purchase consideration was fixed at 4,50,000. It was to be paid 1,50,000 in fully paid equity shares, 2,50,000 in fully paid preference shares and the balance in cash. (ii) The company took over all assets except trade marks and assumed sundry creditors. The stock and plant and machinery were valued by the company at 5% more than the book value and land an building at 10% more than the book value while the sundry debtors were subject to a provision of 3,000 for doubtful debts. 1994 The balance of both kinds of shares were issued to public which were fully paid. You are required to pass necessary journal entries in the books of CK Products Ltd. and prepare its balance sheet. Sundry debtors Stock Trade marks Plant and machinery Land and building fr 13. Somsons Ltd. agreed to purchase the business of a firm consisting of two brothers, K. Som and D. Som as on 31st March, 2019. The balance sheet of the firm on that date was as follows: . Alerta 76,000 58,000 30,000 37,000 3,000 2,04,000 31,000 94,000 10,000 1,25,000 1,40,000 4,00,000 Land and building Plant and machinery Furniture and fixtures Stock-in-trade Sundry debtors Cash 47,000 28,000 7,000 62,000 55,000 5,000 2,04,000 The company agreed to take over the liabilities and all the assets, with the exception of cash, the agreed purchase price being 1,80,000 to be satisfied as to 1/4th in cash and 3/4ths by the issue of fully paid equity shares of 10 each at an agreed value of 12.50 per share. The company made the following revaluations of the assets taken over when bringing them into books: 62,000 25,000 Land and building Plant and machinery Furniture and fixtures Stock-in-trade 5,000 58,000 50,000 Sundry debtors Give the entries necessary to record the acquisition of the business in the books of the company. IC.U.. B.Com. (Hons) 18. Lata and Asha are partners sharing profits and losses in the ratio of 3:2. The balance sheet of the firm as on 31st March, 2019 is given below: Liabilities Capital accounts: Lata Asha 7 75,000 1,05,600 12,000 31,400 80,500 5,300 3,09,800 3,09,800 The partners agree to convert the partnership firm into a private limited company on the date of the balance sheet on the following terms and conditions: Balance Sheet as on 31.3.19 Assets Land and building Plant and machinery Bills receivable Stock Book debt Cash in hand Bank overdraft Creditors 1,20,000 80,000 65,000 44,800 (i) The authorised capital of the company will be 5,00,000 consisting of 30,000 equity shares of * 10 each and 2,000 preference shares of 100 each. (ii) All assets and liabilities to be taken over by the company at the following revalued figures: Land and building 95,000; Plant and machinery 92,000; Bills receivable 12,000; Stock 36,000; Book debt a provision @ 10% to be created; Cash in hand 5,300; Bank overdraft * 65,000; Creditors 40,000; Goodwill is to be valued at 15,000. (iii) The purchase consideration is to be discharged by the issue of 12,000 equity shares of 10 each at a premium of 2 each and 750 preference shares of 100 each and the balance, if any, in cash. Calculate purchase consideration and prepare the opening balance sheet in the books of the new

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries solution 13 31march 2019 Business purchase Dr Rs180000 To liquidat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started