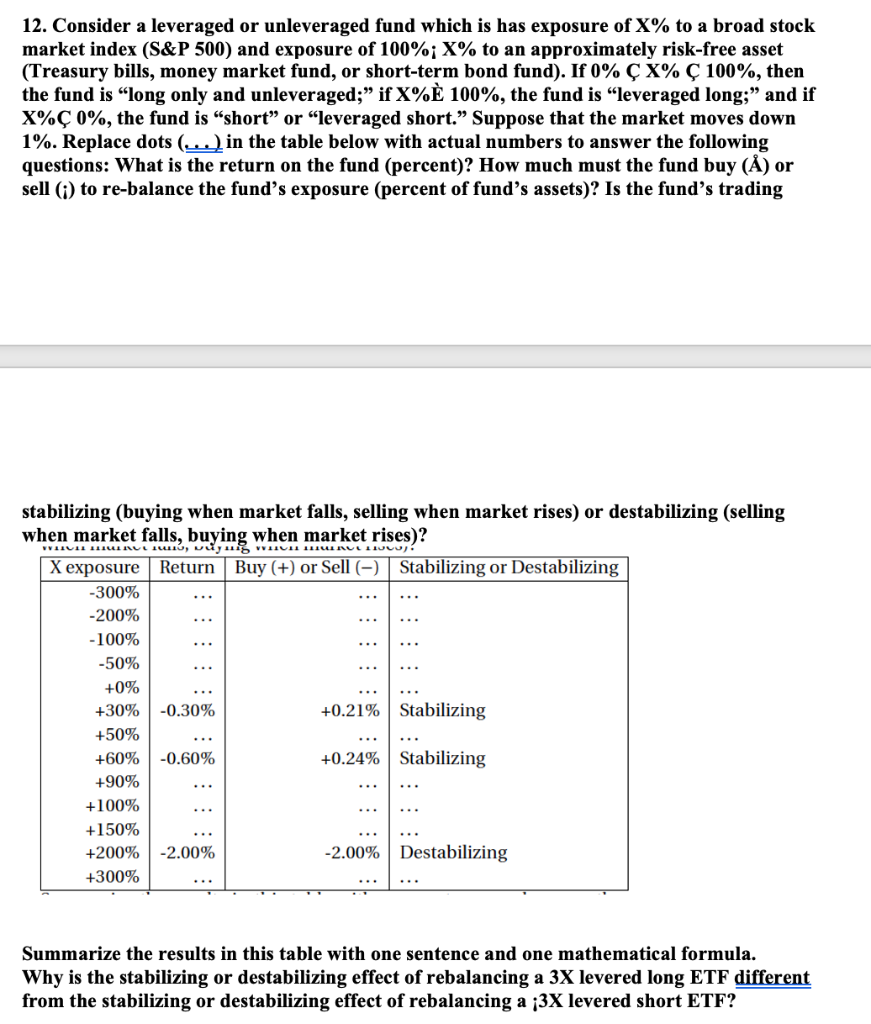

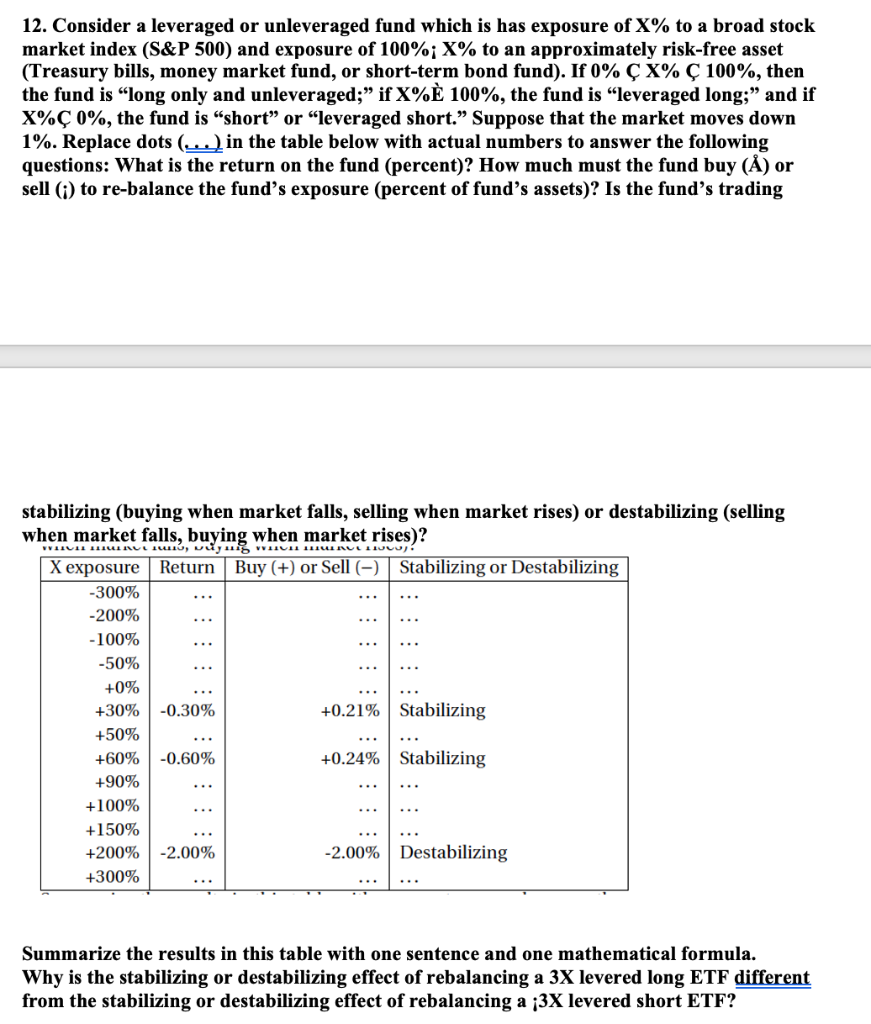

12. Consider a leveraged or unleveraged fund which is has exposure of X% to a broad stock market index (S&P 500) and exposure of 100%;X% to an approximately risk-free asset (Treasury bills, money market fund, or short-term bond fund). If 0% X% 100%, then the fund is long only and unleveraged; if X%! 100%, the fund is leveraged long; and if X% 0%, the fund is "short or leveraged short. Suppose that the market moves down 1%. Replace dots (...) in the table below with actual numbers to answer the following questions: What is the return on the fund (percent)? How much must the fund buy () or sell (i) to re-balance the fund's exposure (percent of fund's assets)? Is the fund's trading VITU LE LUI RUL, vay VALI ILIUNUL LULU) stabilizing (buying when market falls, selling when market rises) or destabilizing (selling when market falls, buying when market rises)? X exposure Return Buy (+) or Sell (-) Stabilizing or Destabilizing -300% -200% -100% -50% +0% +30% -0.30% +0.21% Stabilizing +50% +60% -0.60% +0.24% Stabilizing +90% +100% +150% +200% -2.00% -2.00% Destabilizing +300% Summarize the results in this table with one sentence and one mathematical formula. Why is the stabilizing or destabilizing effect of rebalancing a 3X levered long ETF different from the stabilizing or destabilizing effect of rebalancing a ;3X levered short ETF? 12. Consider a leveraged or unleveraged fund which is has exposure of X% to a broad stock market index (S&P 500) and exposure of 100%;X% to an approximately risk-free asset (Treasury bills, money market fund, or short-term bond fund). If 0% X% 100%, then the fund is long only and unleveraged; if X%! 100%, the fund is leveraged long; and if X% 0%, the fund is "short or leveraged short. Suppose that the market moves down 1%. Replace dots (...) in the table below with actual numbers to answer the following questions: What is the return on the fund (percent)? How much must the fund buy () or sell (i) to re-balance the fund's exposure (percent of fund's assets)? Is the fund's trading VITU LE LUI RUL, vay VALI ILIUNUL LULU) stabilizing (buying when market falls, selling when market rises) or destabilizing (selling when market falls, buying when market rises)? X exposure Return Buy (+) or Sell (-) Stabilizing or Destabilizing -300% -200% -100% -50% +0% +30% -0.30% +0.21% Stabilizing +50% +60% -0.60% +0.24% Stabilizing +90% +100% +150% +200% -2.00% -2.00% Destabilizing +300% Summarize the results in this table with one sentence and one mathematical formula. Why is the stabilizing or destabilizing effect of rebalancing a 3X levered long ETF different from the stabilizing or destabilizing effect of rebalancing a ;3X levered short ETF