Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. Consider portfolios of three assets: Google stock (stock G), Starbucks stock (stock S), and T-bills (risk-free asset). Assume the single-index model holds, along

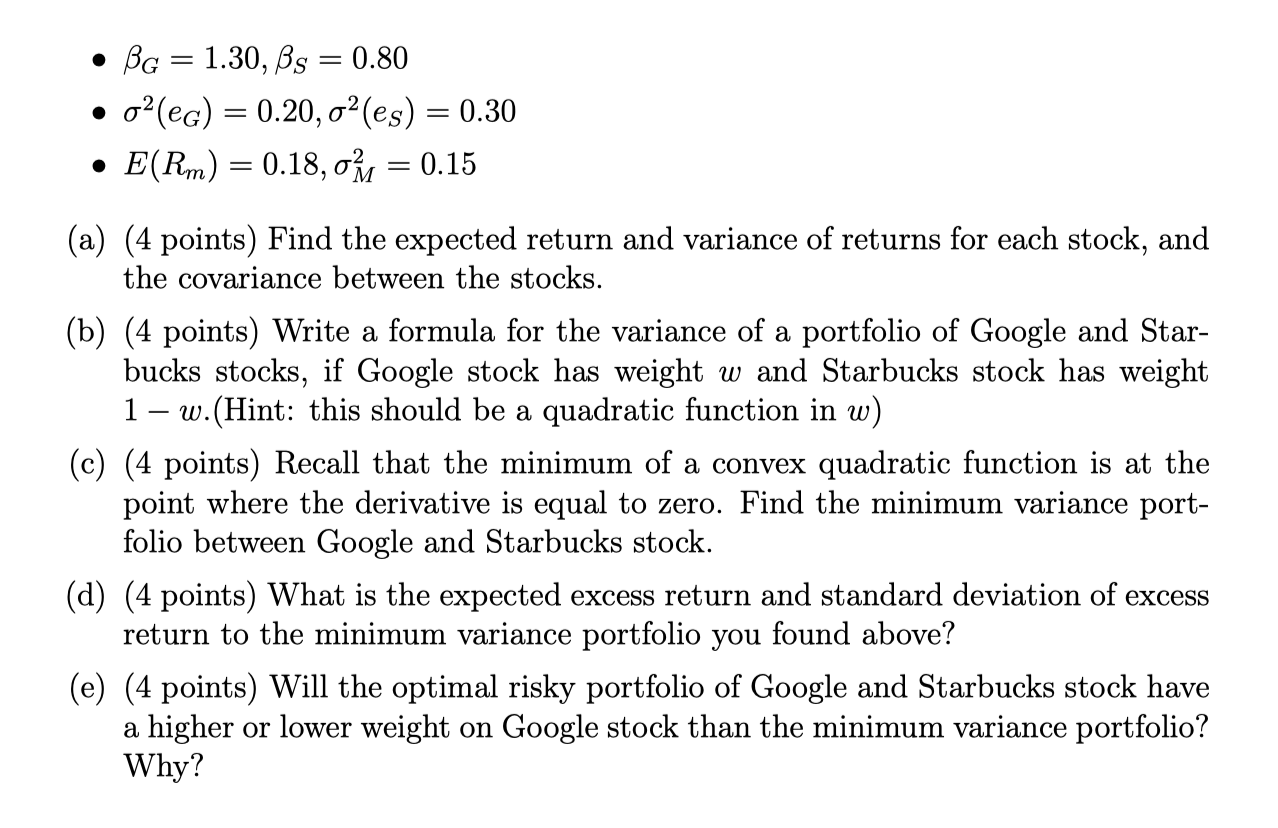

12. Consider portfolios of three assets: Google stock (stock G), Starbucks stock (stock S), and T-bills (risk-free asset). Assume the single-index model holds, along with the following: AG = = 0.15, as = 0.20 BG = 1.30, Bs = 0.80 o(eg) = 0.20, o(es) = 0.30 E(Rm) = 0.18, o = 0.15 (a) (4 points) Find the expected return and variance of returns for each stock, and the covariance between the stocks. (b) (4 points) Write a formula for the variance of a portfolio of Google and Star- bucks stocks, if Google stock has weight w and Starbucks stock has weight 1 w. (Hint: this should be a quadratic function in w) (c) (4 points) Recall that the minimum of a convex quadratic function is at the point where the derivative is equal to zero. Find the minimum variance port- folio between Google and Starbucks stock. (d) (4 points) What is the expected excess return and standard deviation of excess return to the minimum variance portfolio you found above? (e) (4 points) Will the optimal risky portfolio of Google and Starbucks stock have a higher or lower weight on Google stock than the minimum variance portfolio? Why?

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a Expected Return and Variance For Google G Expected Return ERG Rf betaG ERm Rf Rf 130 018 Rf Varian...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started