Answered step by step

Verified Expert Solution

Question

1 Approved Answer

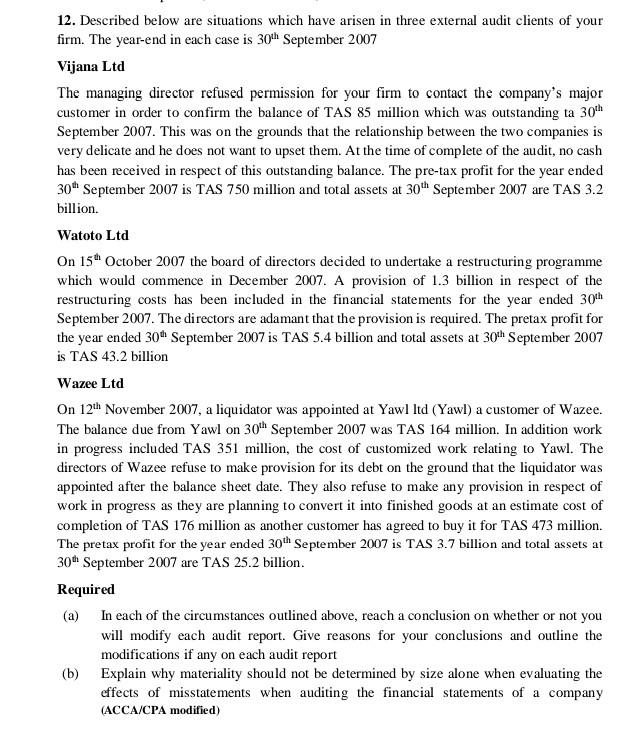

12. Described below are situations which have arisen in three external audit clients of your firm. The year-end in each case is 30th September 2007

12. Described below are situations which have arisen in three external audit clients of your firm. The year-end in each case is 30th September 2007 Vijana Ltd The managing director refused permission for your firm to contact the company's major customer in order to confirm the balance of TAS 85 million which was outstanding ta 30th September 2007. This was on the grounds that the relationship between the two companies is very delicate and he does not want to upset them. At the time of complete of the audit, no cash has been received in respect of this outstanding balance. The pre-tax profit for the year ended 30th September 2007 is TAS 750 million and total assets at 30th September 2007 are TAS 3.2 billion. Watoto Ltd On 15th October 2007 the board of directors decided to undertake a restructuring programme which would commence in December 2007. A provision of 1.3 billion in respect of the restructuring costs has been included in the financial statements for the year ended 30th September 2007 . The directors are adamant that the provision is required. The pretax profit for the year ended 30th September 2007 is TAS 5.4 billion and total assets at 30th September 2007 is TAS 43.2 billion Wazee Ltd On 12th November 2007 , a liquidator was appointed at Yawl ltd (Yawl) a customer of Wazee. The balance due from Yawl on 30th September 2007 was TAS 164 million. In addition work in progress included TAS 351 million, the cost of customized work relating to Yawl. The directors of Wazee refuse to make provision for its debt on the ground that the liquidator was appointed after the balance sheet date. They also refuse to make any provision in respect of work in progress as they are planning to convert it into finished goods at an estimate cost of completion of TAS 176 million as another customer has agreed to buy it for TAS 473 million. The pretax profit for the year ended 30th September 2007 is TAS 3.7 billion and total assets at 30th September 2007 are TAS 25.2 billion. Required (a) In each of the circumstances outlined above, reach a conclusion on whether or not you will modify each audit report. Give reasons for your conclusions and outline the modifications if any on each audit report (b) Explain why materiality should not be determined by size alone when evaluating the effects of misstatements when auditing the financial statements of a company (ACCA/CPA modified)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started