Question

12. Earnings Per Share Basic earnings per share is computed by dividing net income by the weighted-average number of common shares outstanding for the fiscal

12. Earnings Per Share

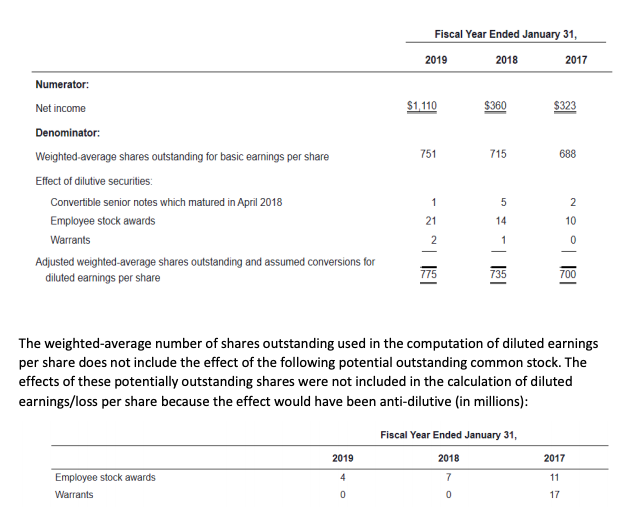

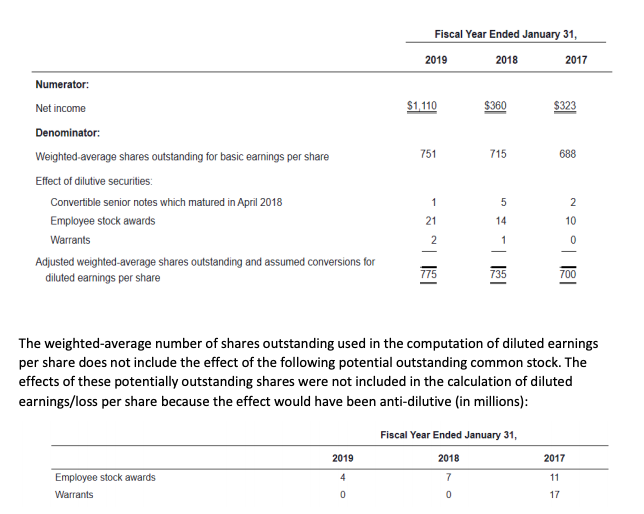

Basic earnings per share is computed by dividing net income by the weighted-average number of common shares outstanding for the fiscal period. Diluted earnings per share is computed by giving effect to all potential weighted average dilutive common stock, including options, restricted stock units, warrants and the convertible senior notes. The dilutive effect of outstanding awards and convertible securities is reflected in diluted earnings per share by application of the treasury stock method.

A reconciliation of the denominator used in the calculation of basic and diluted earnings per share is as follows (in millions):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started