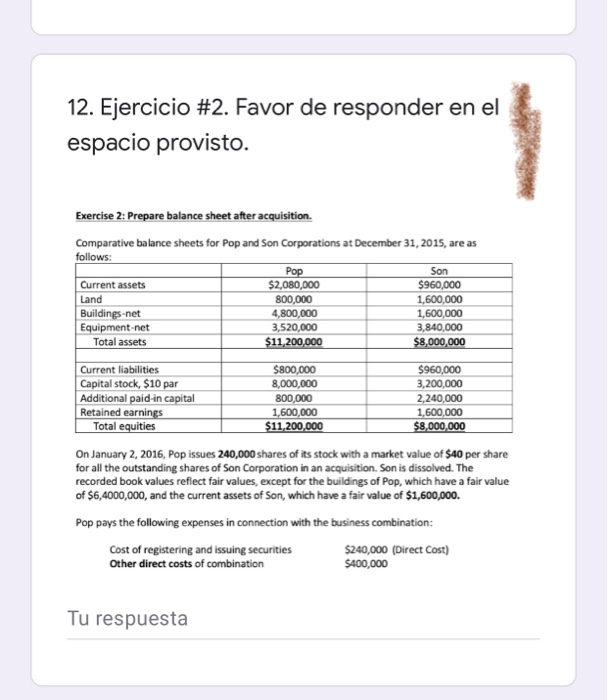

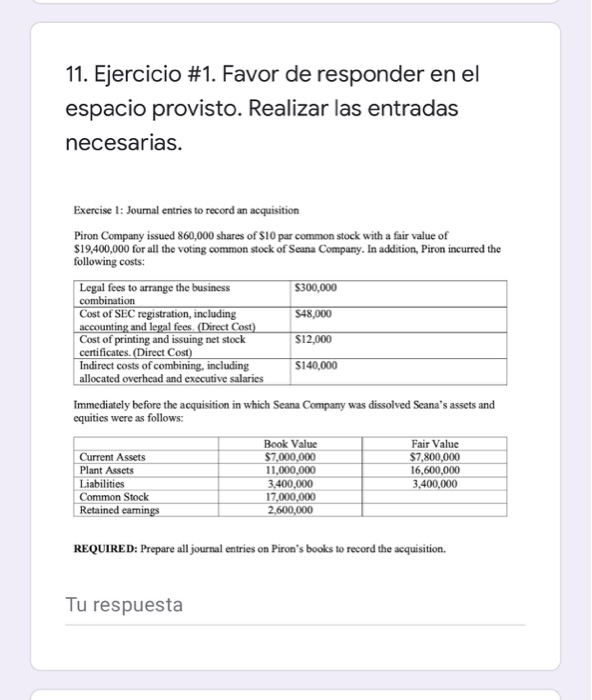

12. Ejercicio #2. Favor de responder en el espacio provisto. Son Exercise 2: Prepare balance sheet after acquisition Comparative balance sheets for Pop and Son Corporations at December 31, 2015, are as follows: Pop Current assets $2,080,000 $960,000 Land 800,000 1,600,000 Buildings-net 4,800,000 1,600,000 Equipment-net 3,520,000 3,840,000 Total assets $11,200,000 $8,000,000 Current liabilities $800,000 $960,000 Capital stock, $10 par 8,000,000 3,200,000 Additional paid-in capital 800,000 2,240,000 Retained earnings 1,600,000 1,600,000 Total equities $11,200,000 $8,000,000 On January 2, 2016, Pop issues 240,000 shares of its stock with a market value of $40 per share for all the outstanding shares of Son Corporation in an acquisition. Son is dissolved. The recorded book values reflect fair values, except for the buildings of Pop, which have a fair value of $6,4000,000, and the current assets of Son, which have a fair value of $1,600,000. Pop pays the following expenses in connection with the business combination: Cost of registering and issuing securities $240,000 (Direct Cost) Other direct costs of combination $400,000 Tu respuesta 11. Ejercicio #1. Favor de responder en el espacio provisto. Realizar las entradas necesarias. Exercise 1: Journal entries to record an acquisition Piron Company issued 860,000 shares of $10 par common stock with a fair value of $19,400,000 for all the voting common stock of Seana Company. In addition, Piron incurred the following costs: Legal fees to arrange the business $300,000 combination Cost of SEC registration, including S48,000 accounting and legal fees (Direct Cost) Cost of printing and issuing net stock $12,000 certificates. (Direct Cost) Indirect costs of combining, including S140,000 allocated overhead and executive salaries Immediately before the acquisition in which Seana Company was dissolved Seana's assets and equities were as follows: Book Value Fair Value Current Assets $7,000,000 $7,800,000 Plant Assets 11,000,000 16,600,000 Liabilities 3,400,000 3,400,000 Common Stock 17,000,000 Retained earnings 2,600,000 REQUIRED: Prepare all journal entries on Piron's books to record the acquisition. Tu respuesta