Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#12 Entries for Costs in a Job Order Cost System Velasco Co. uses a job order cost system. The following data summarize the operations related

#12

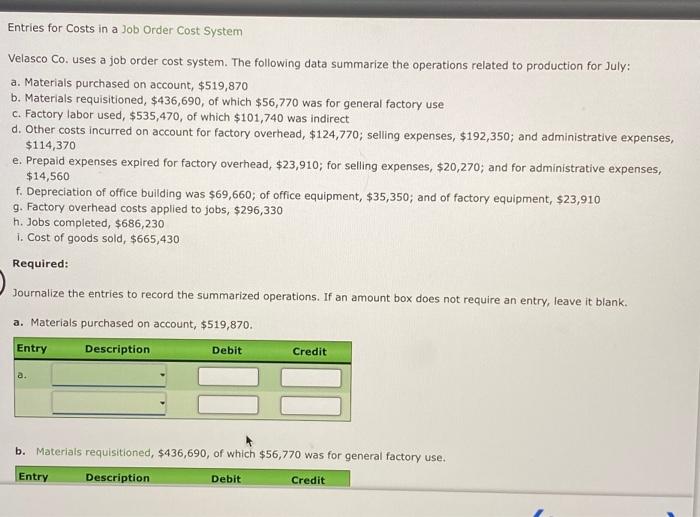

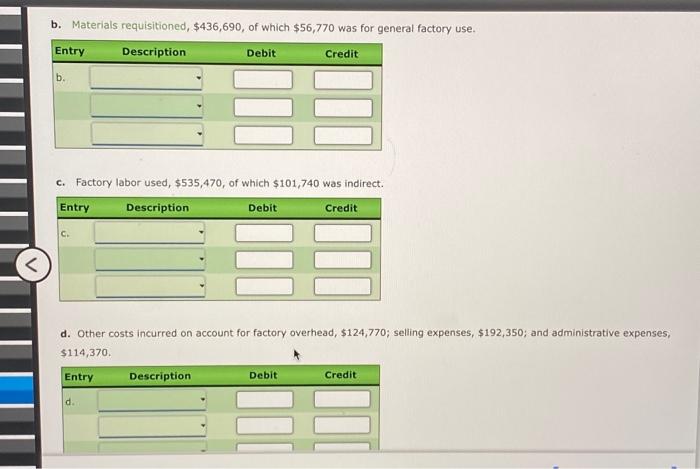

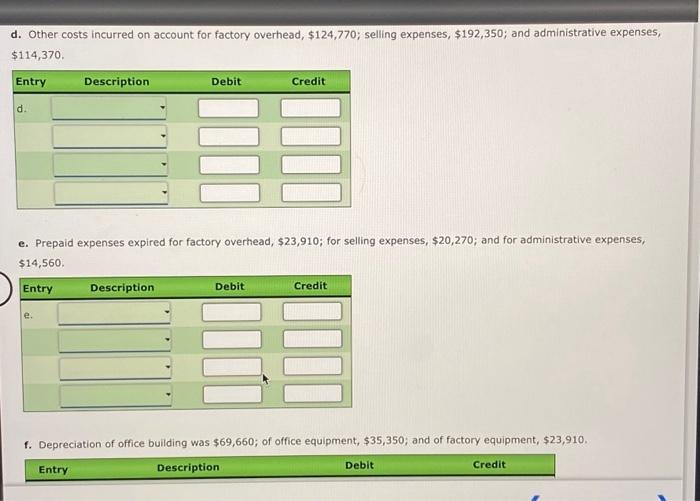

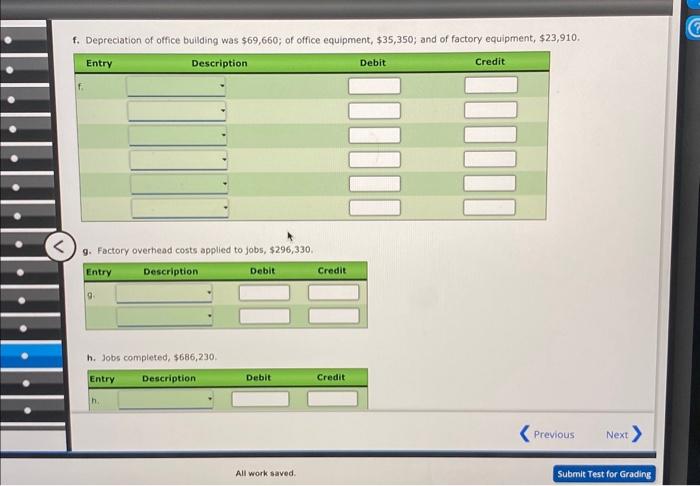

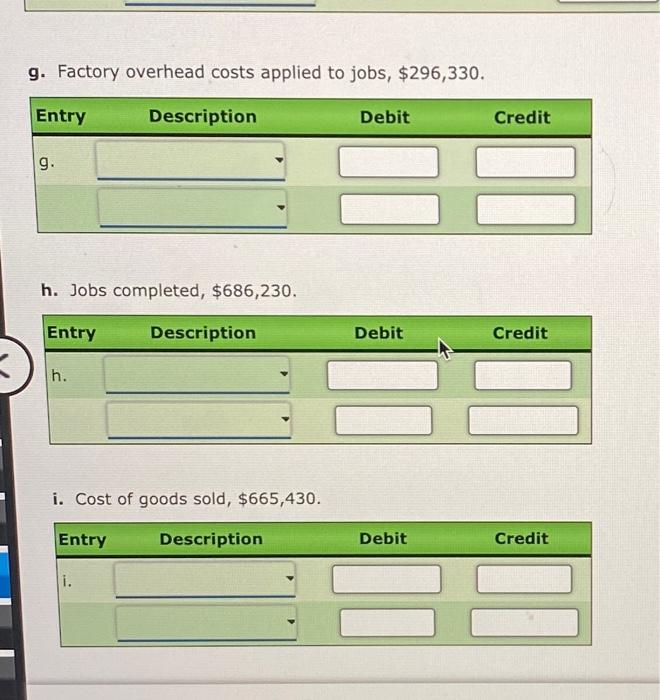

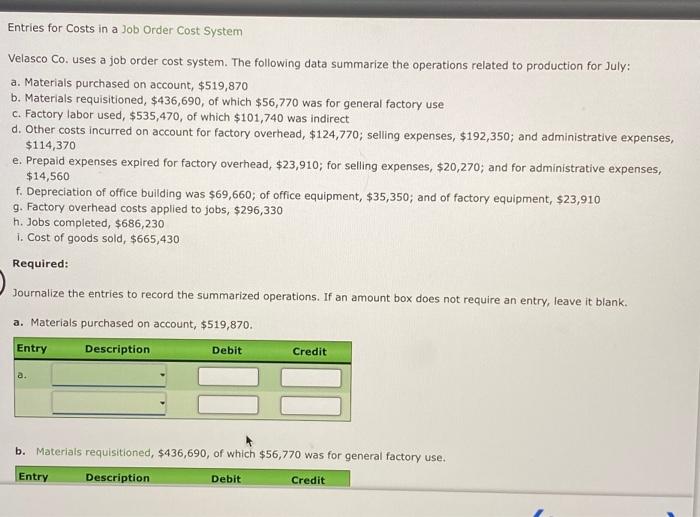

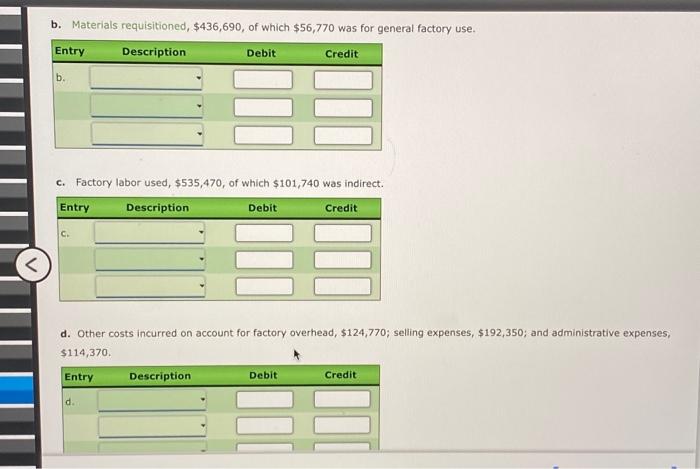

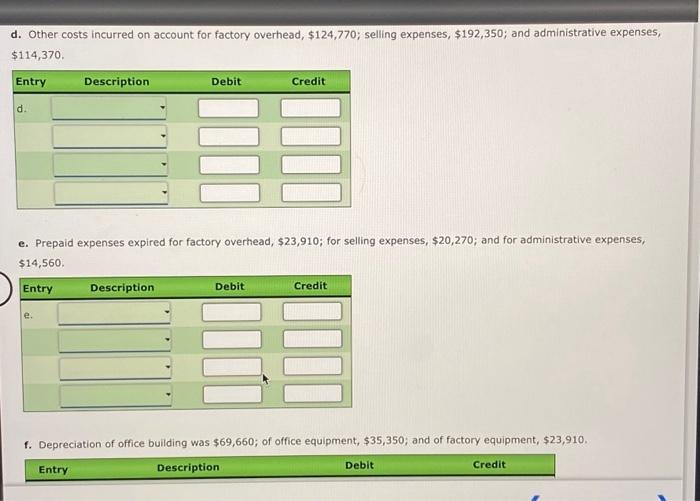

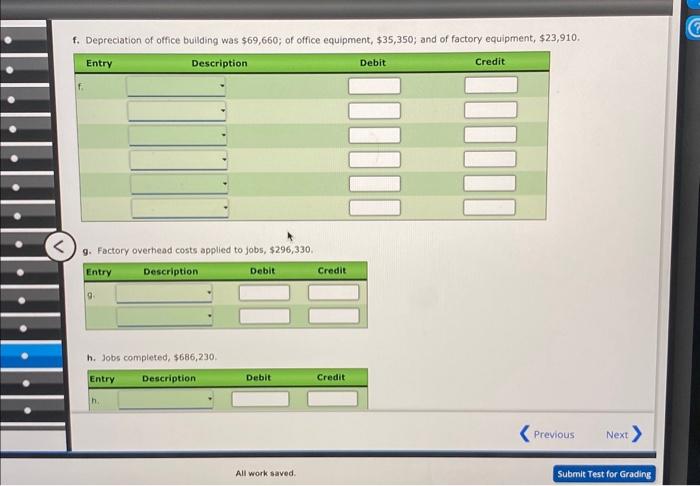

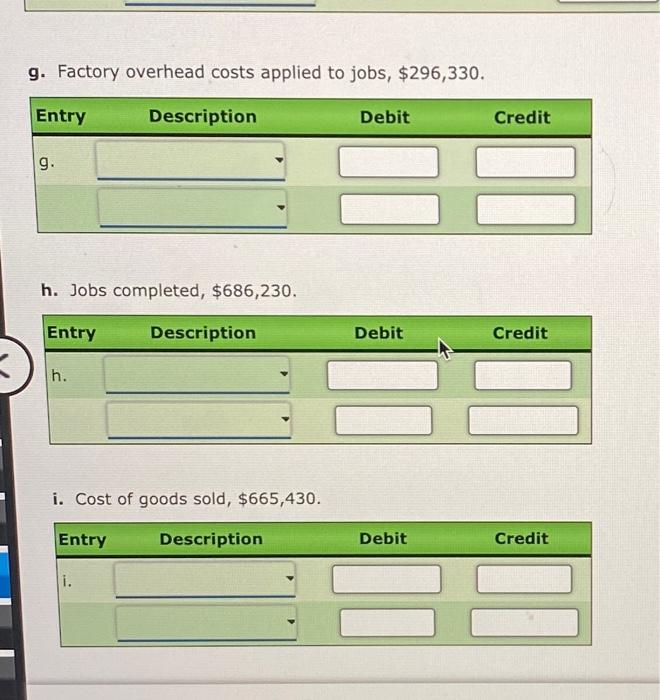

Entries for Costs in a Job Order Cost System Velasco Co. uses a job order cost system. The following data summarize the operations related to production for July: a. Materials purchased on account, $519,870 b. Materials requisitioned, $436,690, of which $56,770 was for general factory use c. Factory labor used, $535,470, of which $101,740 was indirect d. Other costs incurred on account for factory overhead, $124,770; selling expenses, $192,350; and administrative expenses, $114,370 e. Prepaid expenses expired for factory overhead, $23,910; for selling expenses, $20,270; and for administrative expenses, $14,560 f. Depreciation of office building was $69,660; of office equipment, $35,350; and of factory equipment, $23,910 g. Factory overhead costs applied to jobs, $296,330 h. Jobs completed, $686,230 i. Cost of goods sold, $665,430 Required: Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. a. Materials purchased on account, $519,870. b. Materials requisitioned, $436,690, of which $56,770 was for general factory use. b. Materials requisitioned, $436,690, of which $56,770 was for general factory use. c. Factory labor used, $535,470, of which $101,740 was indirect. d. Other costs incurred on account for factory overhead, $124,770; selling expenses, $192,350; and administrative expenses; $114,370. d. Other costs incurred on account for factory overhead, $124,770; selling expenses, $192,350; and administrative expenses, $114,370. e. Prepaid expenses expired for factory overhead, $23,910; for selling expenses, $20,270; and for administrative expenses, $14,560. f. Depreciation of office building was $69,660; of office equipment, $35,350; and of factory equipment, $23,910. f. Depreciation of office bullding was $69,660; of office equipment, $35,350; and of factory equipment, $23,910 9. Factory overhead costs applied to jobs, $296,330, h. Jobs completed, $686,230. g. Factory overhead costs applied to jobs, $296,330. h. Jobs completed, $686,230. i. Cost of goods sold, $665,430

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started