12

12

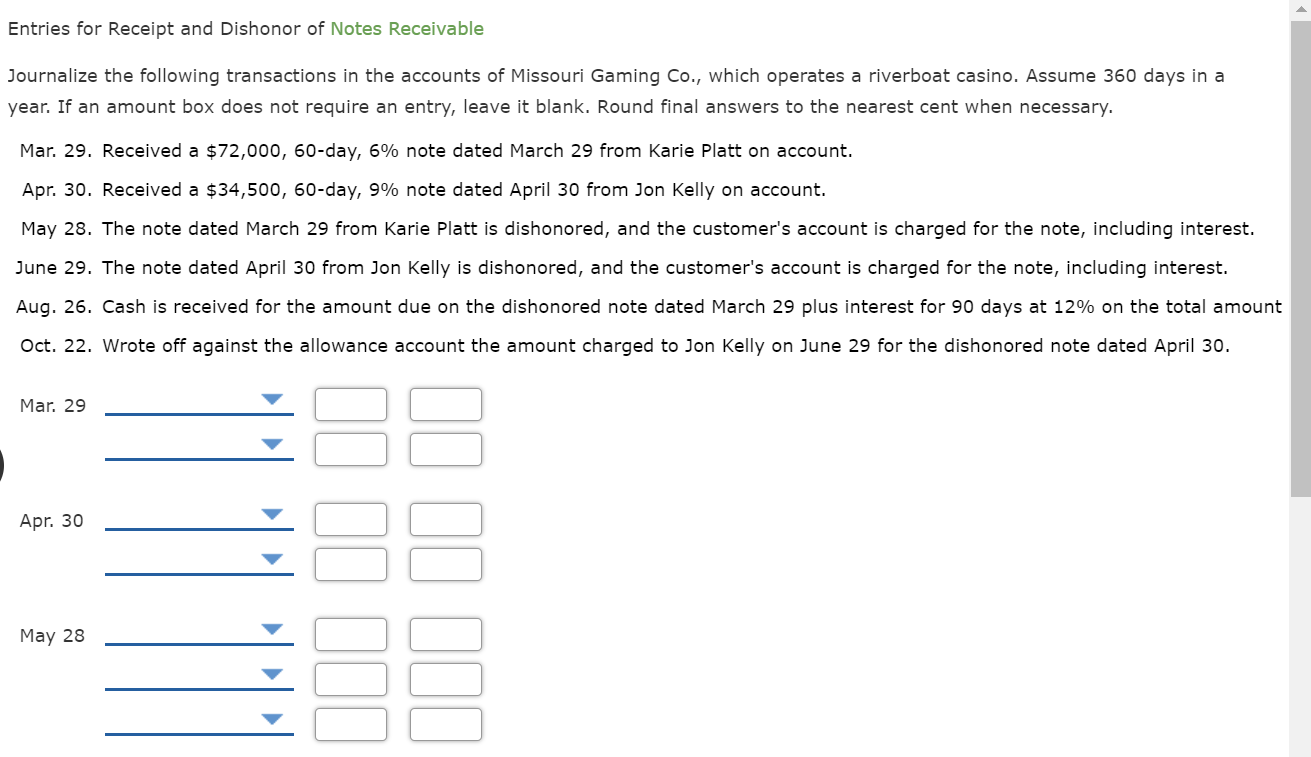

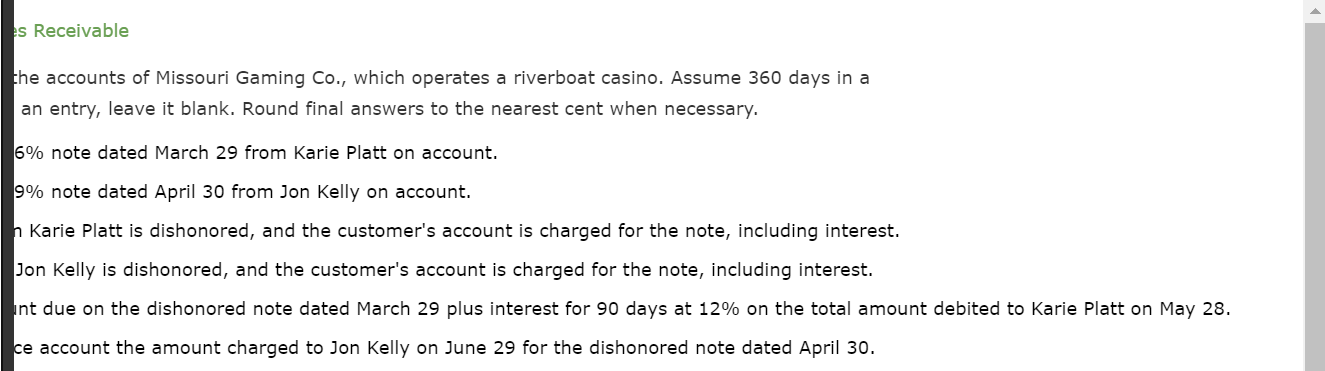

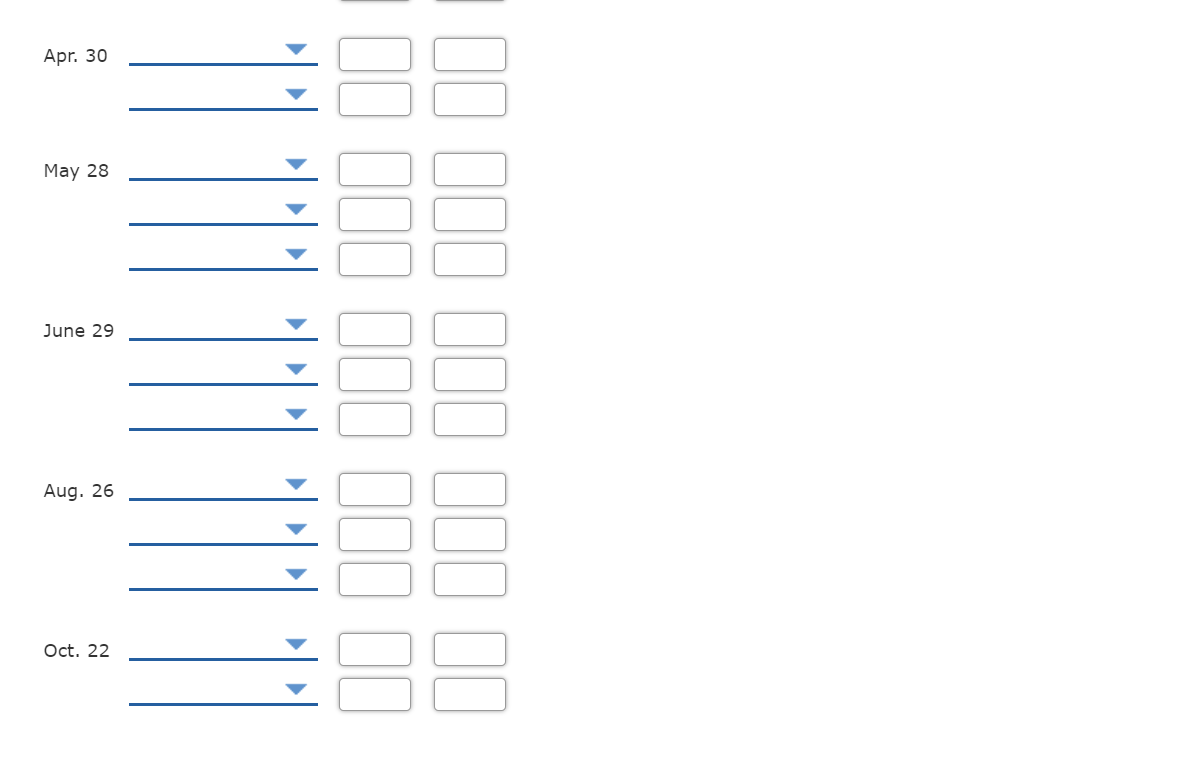

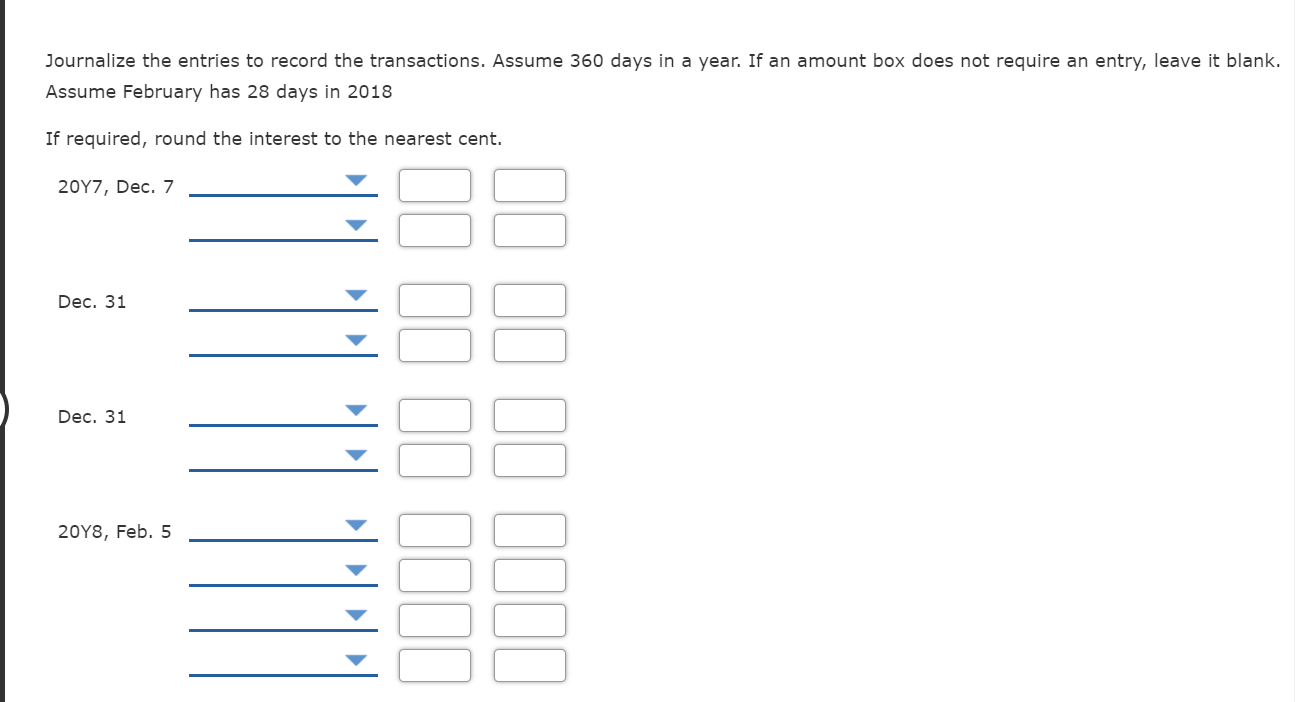

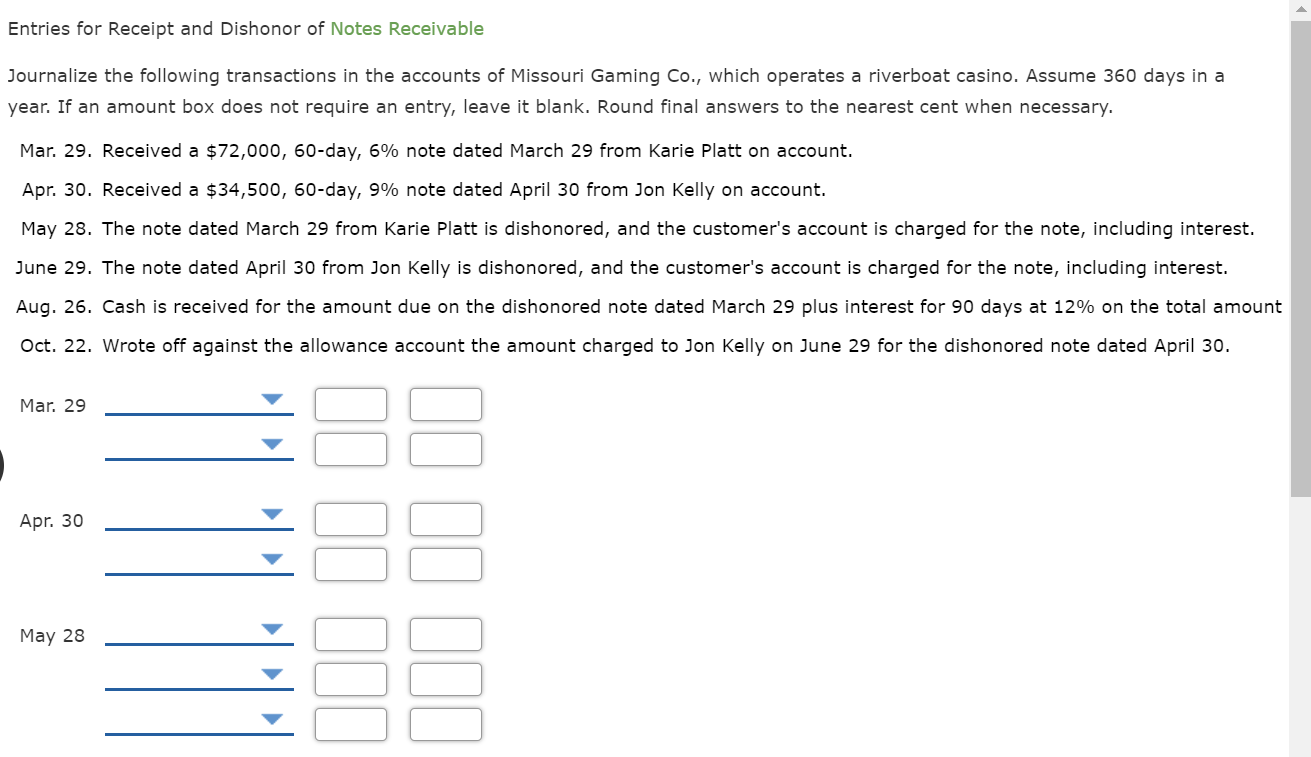

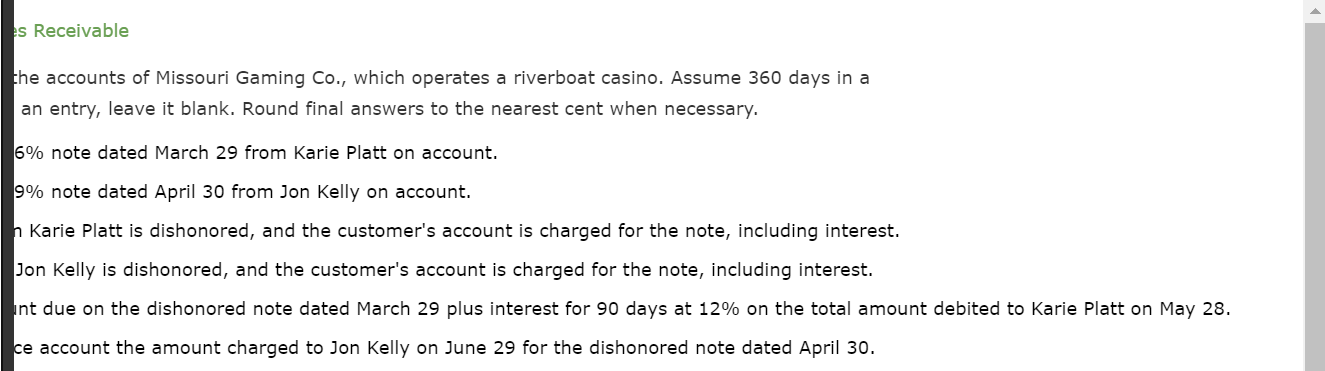

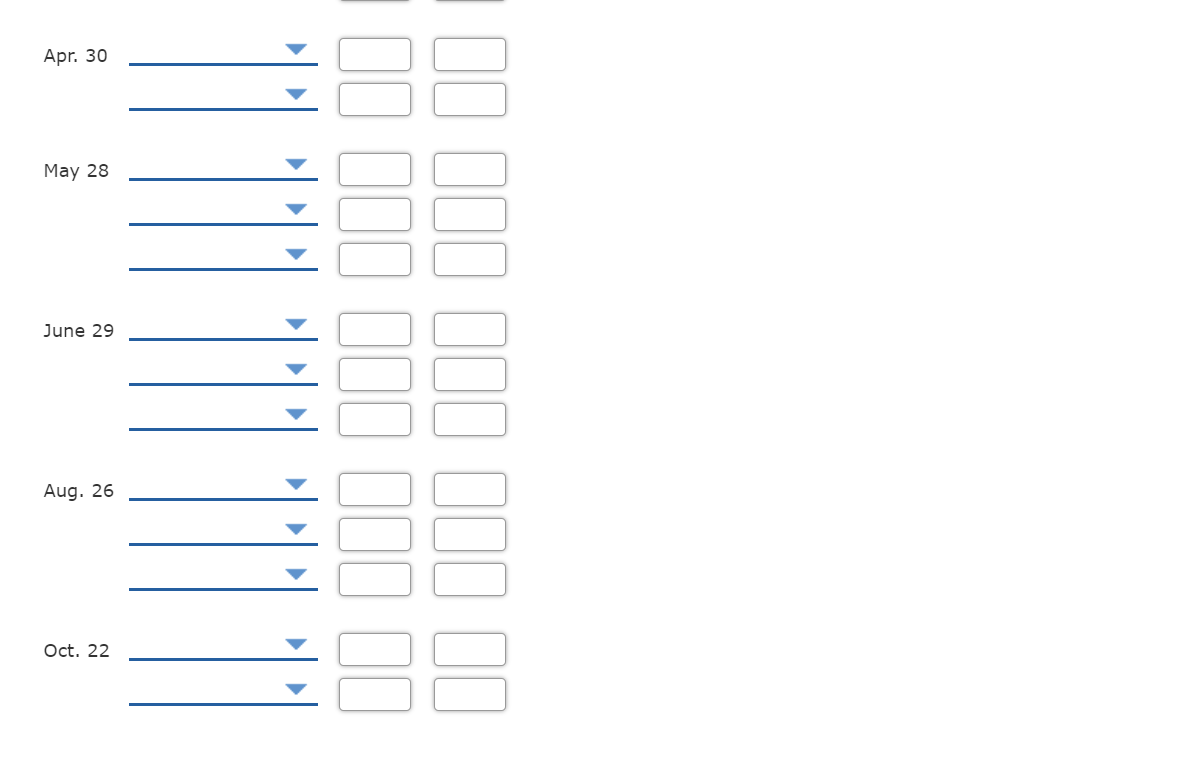

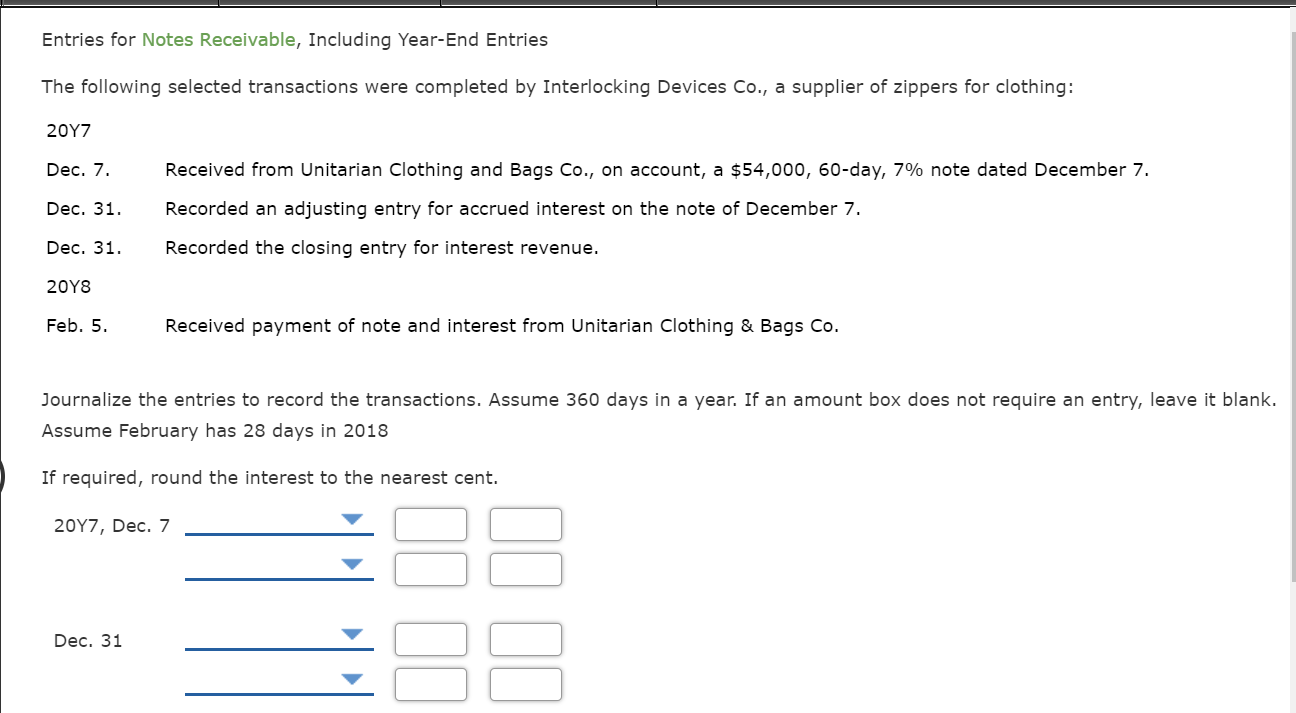

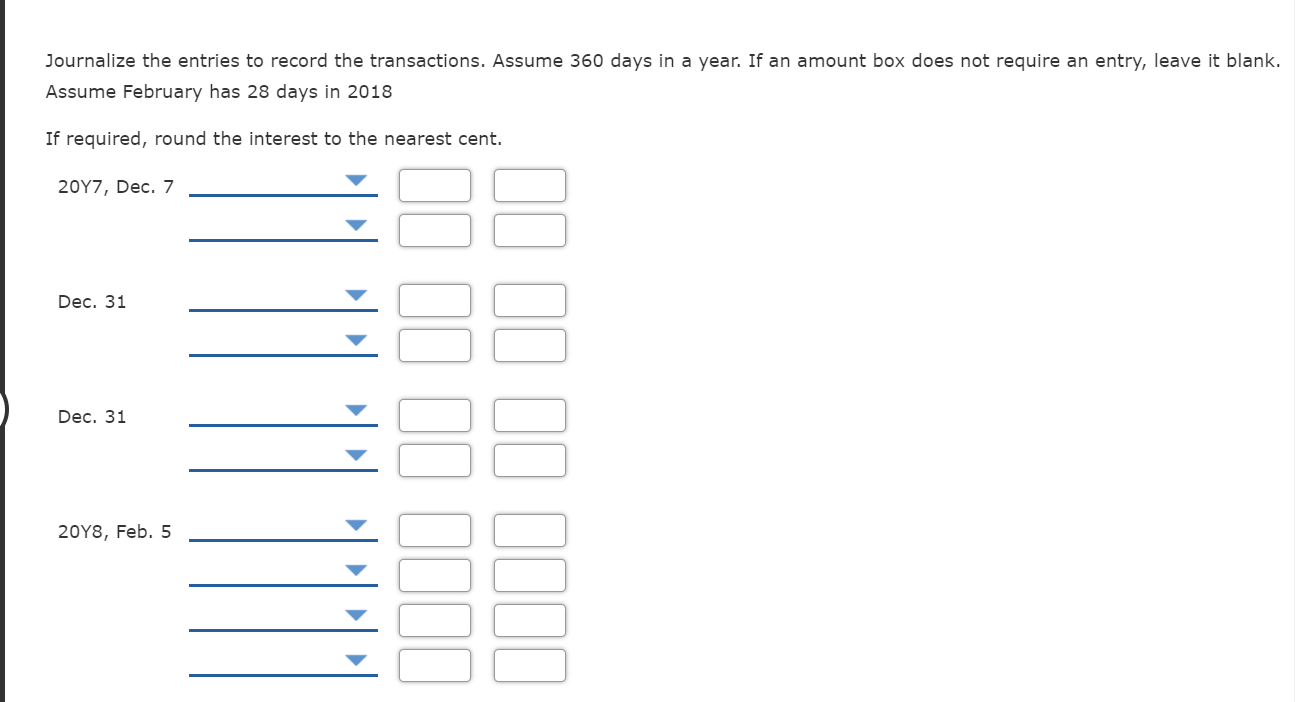

Entries for Notes Receivable, Including Year-End Entries The following selected transactions were completed by Interlocking Devices Co., a supplier of zippers for clothing: 2017 Dec. 7. Received from Unitarian Clothing and Bags Co., on account, a $54,000, 60-day, 7% note dated December 7. Recorded an adjusting entry for accrued interest on the note of December 7. Dec. 31. Dec. 31. Recorded the closing entry for interest revenue. 20Y8 Feb. 5. Received payment of note and interest from Unitarian Clothing & Bags Co. Journalize the entries to record the transactions. Assume 360 days in a year. If an amount box does not require an entry, leave it blank. Assume February has 28 days in 2018 If required, round the interest to the nearest cent. 2017, Dec. 7 Dec. 31 Journalize the entries to record the transactions. Assume 360 days in a year. If an amount box does not require an entry, leave it blank. Assume February has 28 days in 2018 If required, round the interest to the nearest cent. 2017, Dec. 7 Dec. 31 Dec. 31 20Y8, Feb. 5 IIII Entries for Receipt and Dishonor of Notes Receivable Journalize the following transactions in the accounts of Missouri Gaming Co., which operates a riverboat casino. Assume 360 days in a year. If an amount box does not require an entry, leave it blank. Round final answers to the nearest cent when necessary. Mar. 29. Received a $72,000, 60-day, 6% note dated March 29 from Karie Platt on account. Apr. 30. Received a $34,500, 60-day, 9% note dated April 30 from Jon Kelly on account. May 28. The note dated March 29 from Karie Platt is dishonored, and the customer's account is charged for the note, including interest. June 29. The note dated April 30 from Jon Kelly is dishonored, and the customer's account is charged for the note, including interest. Aug. 26. Cash is received for the amount due on the dishonored note dated March 29 plus interest for 90 days at 12% on the total amount Oct. 22. Wrote off against the allowance account the amount charged to Jon Kelly on June 29 for the dishonored note dated April 30. Mar. 29 Apr. 30 May 28 s Receivable the accounts of Missouri Gaming Co., which operates a riverboat casino. Assume 360 days in a an entry, leave it blank. Round final answers to the nearest cent when necessary. 6% note dated March 29 from Karie Platt on account. 9% note dated April 30 from Jon Kelly on account. h Karie Platt is dishonored, and the customer's account is charged for the note, including interest. Jon Kelly is dishonored, and the customer's account is charged for the note, including interest. nt due on the dishonored note dated March 29 plus interest for 90 days at 12% on the total amount debited to Karie Platt on May 28. ce account the amount charged to Jon Kelly on June 29 for the dishonored note dated April 30. Apr. 30 May 28 June 29 lll II III III II II III Aug. 26 Oct. 22

12

12