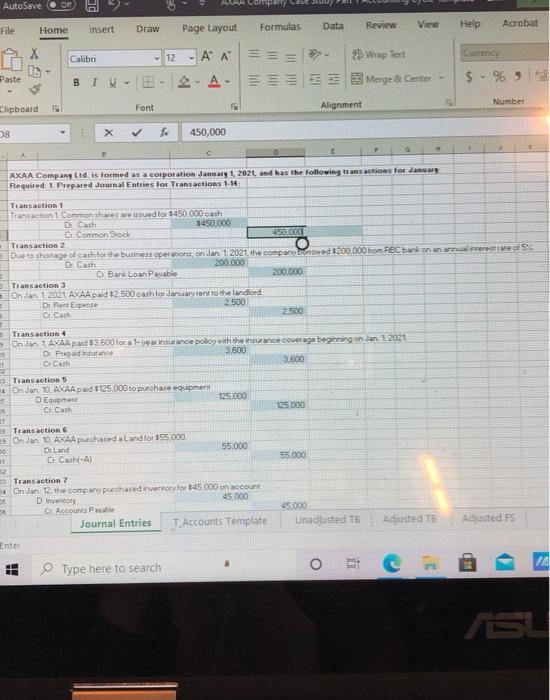

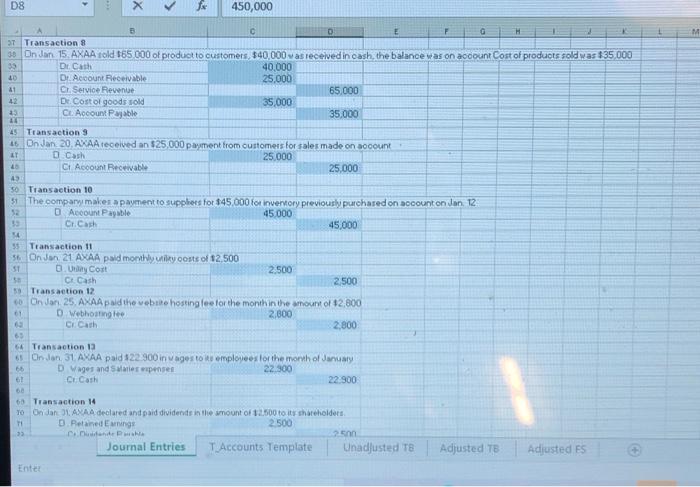

12 Fequired: 2. Prepare the Adjusting for Entries based on the following information AKAA accountant determined that the depreciation expense on the company's equipment $15,000 per month cere 2 AR AXA ce expense for lancary must be recorded D AXA recorded the rest on the bank loan for the month interest on the company bank loan must be accrued recogned for the month of larven though it is not currently AutoSave File Draw Home Insert Formulas View Acrobat Page Layout Data Review Help -12 Calibri - A A lil Currency 2 Wrap Text Merge Center Paste BI A- $ - % Clipboard Number Font Alignment 8 450,000 AXAA Company Ltd is formed as a corporation January 1, 2021, and has the following transactions for January Required: 1. Prepared Journal Entries for Transactions 11 Transaction 1 Transaction Common share rued tor 1450,000 each Cash $450.000 Or Common Stock 450.000 Transaction 2 Due to shortage of cash for the business operations, on Jan 1.2021 the compartonowe 200.000 hom PBC bark on an intensive of 5% Dr Cash 200.000 C Bank Loan Payable 200.000 Transaction On Jan 1 2021 AXAA pat2 500 cash for January to the landlord Dent Expense 2.500 Or Can 2.500 Transaction On Jan 1 AXAApad3 600 for 1-yenance policy with the insurance coverage beginning on Jan 12021 De Prepadnutne 5,500 C.Cash 3.500 1 125.000 125.000 - Transaction 5 On van 10. AXAApaid 125.000 to purchase equipment 3 DEqaper 36 Di Cash ET 20 Transaction 6 On Jan 10, AXAA purchased a Landlor 55.000 Orland C Cash-A 55.000 55.000 35 Transaction 7 On Jan 12 the company purchased inventory for 145.000 on Out Inventory 45.000 36 C: Account Paul Journal Entries T Accounts Template 45.000 Unadjusted TB Adjusted TB Adjusted FS Enter 14 Type here to search HE D8 450,000 40 D G H 3T Transaction 8 38 On Jan. 15. AXAA told 165 000 of product to customers, $40,000 was received in cash the balance was on account Cost of products sold was $35.000 39 Dr. Cath 40.000 Dr. Account Receivable 25,000 41 C Service Revenue 65.000 42 Dr. Cost of goods sold 35,000 23 Cl. Account Pable 35,000 14 45 Transaction 9 16 On Jan 20, AWAA received an $25,000 payment from oustomers for sales made on account D Cash 25.000 Ct Account Receivable 25,000 AT 49 50 Transaction 10 51 The compary make a payment to supplers for $45.000 for inventory previously purchased on account on Jan 12 Account Payable 45.000 33 Cr. Cash 45.000 ST 61 55 Transaction 11 56 On Jan 21 AXAA paid monthly lily costs of 12.500 y Cost 2.500 Ct Cash 2500 Transaction 12 On Jan 25, AXAA pad the vebule hosting lee for the month in the soul of 42,800 Webhosting 2.800 C Cash 2,800 65 4 Transaction 13 On Jan 31 AXAA paid 122 300 in ages to its employees for the month of January 66 Dages and Spensel 22 300 6! C Cash 22 900 60 60 Transaction 14 TO Ondan 1 AAA declared and paid dividends in the amount of 12.500 to it shareholders 11 D. Petanding 2500 3 unde wska 25 Journal Entries T Accounts Template Unadjusted te Enter Adjusted TB Adjusted Es ALAC Cym - D BTW --A-- 105O4 Med 2. Prepare the Magoti bude the foldering lotion ME Aded that the deprecio the company was $15.00 per month AXA E pense for any use orded w @ma RSDAE853 AXA code interest on the bank loan for the mothers on the constants must be redd for the month of any even the ocean SUS D o