Question

12. For the taxable year 2021, a resident foreign corporation reported a total gross receipts from services of P30,000,000. It also reported direct costs and

12. For the taxable year 2021, a resident foreign corporation reported a total gross receipts from services of P30,000,000. It also reported direct costs and indirect expenses in the amounts of 5,000,000 and 500,000. respectively. Compute the MCIT in 2021.*

2 points

200,000

245,000

250,000

255,000

13. For the taxable year 2021, a resident foreign corporation reported a total gross receipts from services of P30,000,000. It also reported direct costs and indirect expenses in the amounts of 25,000,000 and 500,000. respectively. The total assets of the corporation is 25M excluding the land on which its office is situated. Compute the regular corporate income tax in 2021.*

2 points

1,000,000

1,250,000

900,000

1,125,000

14. For the taxable year 2021, a domestic corporation reported a total gross receipts from services of P15,000,000. It also reported direct costs and indirect expenses in the amounts of 10,000,000 and 500,000. respectively. The total assets of the corporation is 50M excluding the land on which its office is situated. Compute the regular corporate income tax in 2021.*

2 points

1,000,000

1,250,000

900,000

1,125,000

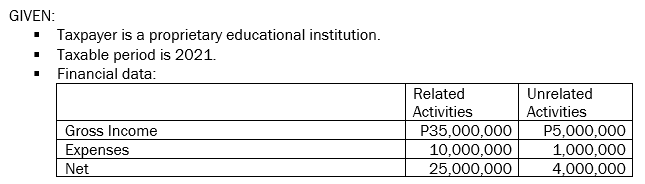

15. Given:

GIVEN: Taxpayer is a proprietary educational institution. Taxable period is 2021. Financial data: Gross Income Expenses Net Related Activities Unrelated Activities P35,000,000 P5,000,000 1,000,000 4,000,000 10,000,000 25,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the regular corporate income tax for each scenario we can use the formula Taxable In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started