Question

12. Gloria and her husband purchased a home on December 31, 2019 for $300,000, and sold the home for a selling price of $900,000

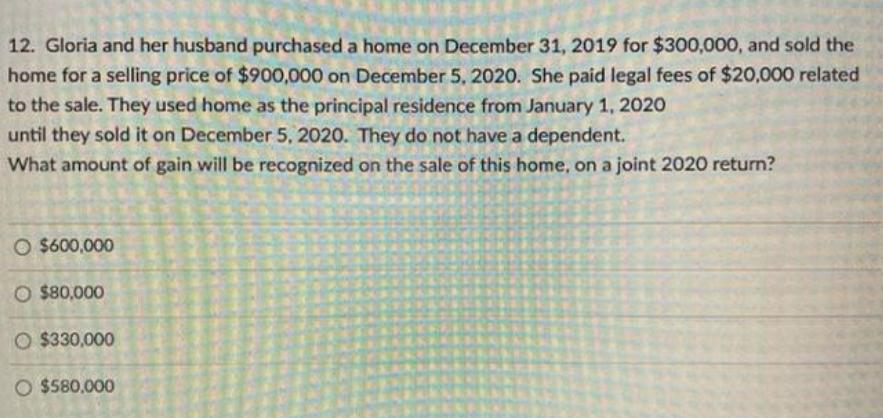

12. Gloria and her husband purchased a home on December 31, 2019 for $300,000, and sold the home for a selling price of $900,000 on December 5, 2020. She paid legal fees of $20,000 related to the sale. They used home as the principal residence from January 1, 2020 until they sold it on December 5, 2020. They do not have a dependent. What amount of gain will be recognized on the sale of this home, on a joint 2020 return? O $600,000 O $80,000 O $330,000 O $580.000

Step by Step Solution

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

o7 thu homne Glona Purchased home 300000 15 D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2021

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

12th Edition

1260247139, 978-1260247138

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App