Answered step by step

Verified Expert Solution

Question

1 Approved Answer

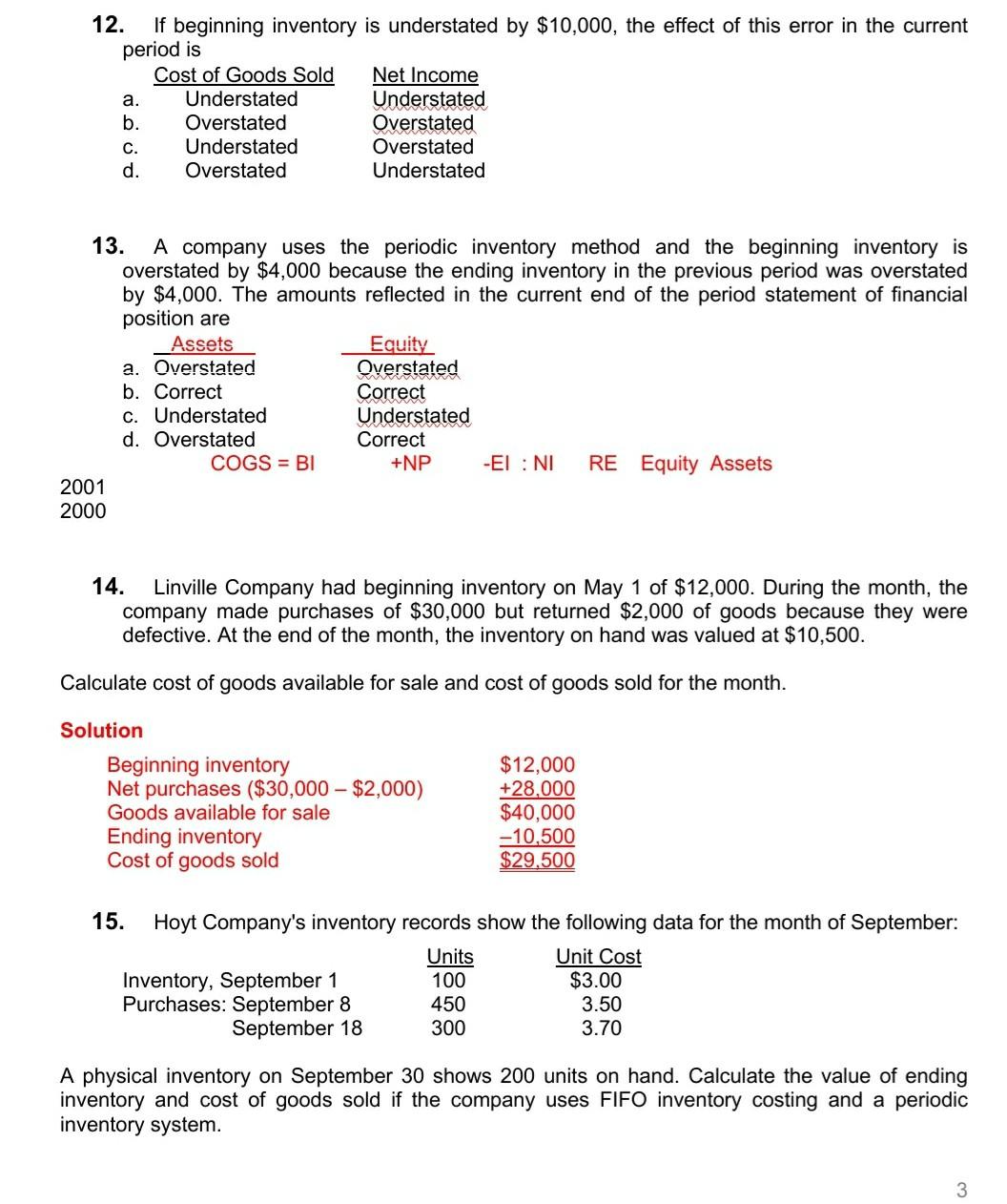

12. If beginning inventory is understated by $10,000, the effect of this error in the current period is Cost of Goods Sold Net Income a.

12. If beginning inventory is understated by $10,000, the effect of this error in the current period is Cost of Goods Sold Net Income a. Understated Understated b. Overstated Overstated C. Understated Overstated d. Overstated Understated 13. A company uses the periodic inventory method and the beginning inventory is overstated by $4,000 because the ending inventory in the previous period was overstated by $4,000. The amounts reflected in the current end of the period statement of financial position are Assets Equity a. Overstated Overstated b. Correct Correct C. Understated Understated d. Overstated Correct COGS = BI -EL : NI RE Equity Assets +NP 2001 2000 14. Linville Company had beginning inventory on May 1 of $12,000. During the month, the company made purchases of $30,000 but returned $2,000 of goods because they were defective. At the end of the month, the inventory on hand was valued at $10,500. Calculate cost of goods available for sale and cost of goods sold for the month. Solution Beginning inventory Net purchases ($30,000 $2,000) Goods available for sale Ending inventory Cost of goods sold $12,000 +28,000 $40,000 -10.500 $29.500 15. Hoyt Company's inventory records show the following data for the month of September: Units Unit Cost Inventory, September 1 100 $3.00 Purchases: September 8 450 3.50 September 18 300 3.70 A physical inventory on September 30 shows 200 units on hand. Calculate the value of ending inventory and cost of goods sold if the company uses FIFO inventory costing and a periodic inventory system. 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started