Answered step by step

Verified Expert Solution

Question

1 Approved Answer

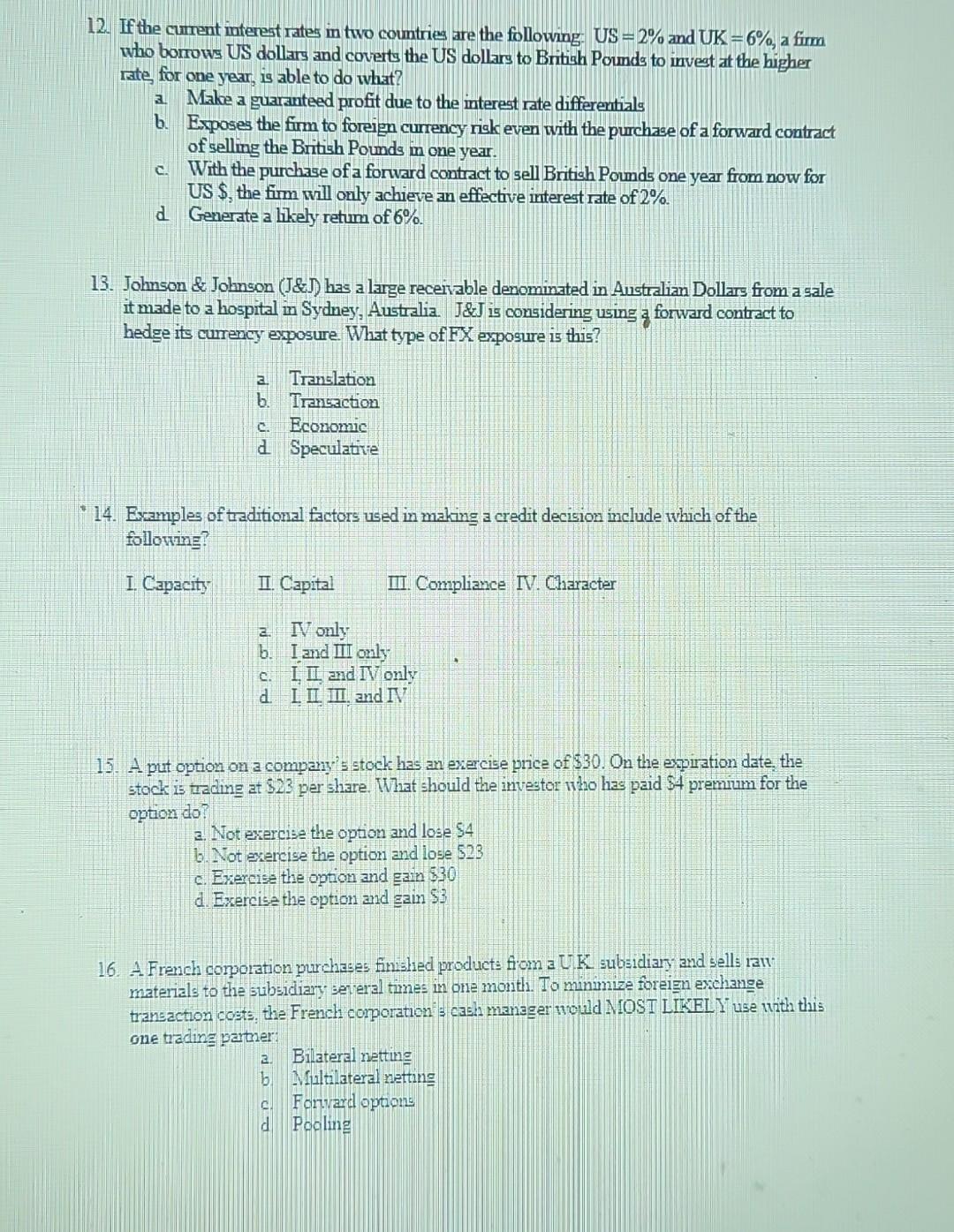

12. If the current interest rates in two coumtries are the following: US =2% and UK =6%,a firm who borrows US dollars and coverts the

12. If the current interest rates in two coumtries are the following: US =2% and UK =6%,a firm who borrows US dollars and coverts the US dollars to British Pounds to inveat at the higher rate, for one year, is able to do what? a. Make a guaranteed profit due to the interest rate differentials b. Exposes the firm to foreign currency risk even with the purchase of a forward contract of selling the British Pounds in one year. c. With the purchase of a forvard contract to sell British Pounds one year from now for US $, the firm will only achieve an effective interest rate of 2%. d. Generate a likely retum of 6%. 13. Johnson \& Johnson (J\&J) has a large receivable denominated in Australian Dollars from a sale it made to a hospital in Sydney, Australia. J\&J is considering using a forward contract to hedge its currency exposure. What type of FX exposure is this? a. Translation b. Transaction c. Economic d. Speculative "14. Examples of traditional factors used in making a credit decision include which of the following? I. Capacity II. Capital III. Compliance IV. Character a. Nonly b. I and III only c. I, II and IV only d. III III and IV 15. A put option on a company's stock has an exercise price of 530 . On the expiration date, the stock is tradine at $23 per share. What should the investor who has paid \$4 premum for the option do? a. Not exercise the option and lose $4 b. Not exercise the option and lose $23 c. Exercise the option and gain 530 d. Exercise the option and gain $3 16. A French coporation purchases finished products fiom a UK subsidiary and sells raw materials to the subsidiary several times in one month. To minimize foreign exchange transaction costs, the French comporation : cash manager nould MOSI LIKEL Y use with this one tradine partner: a. Bilateral netting b. Multilateral netting c. Fornard optione d Pooline

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started