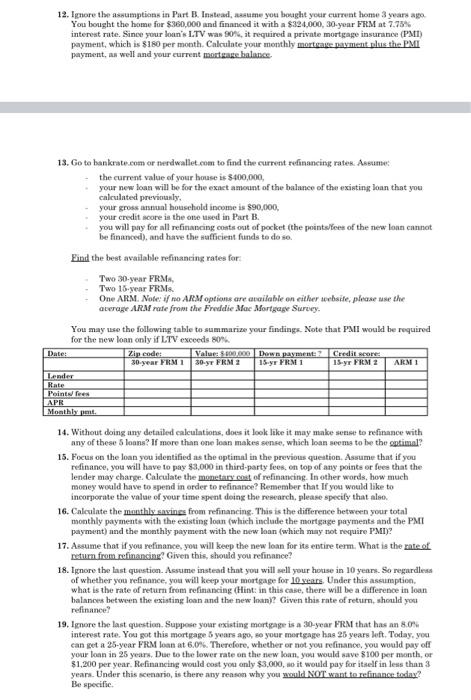

12. Ignore the asnumptions in Part B. Instead, asatame you botaght your current homse 3 yearn ago. You bought the home for $360,000 and financed it with a $324,000,30-year FitM at 7.739 interest rate. Since your loun's L.TV was S0h4, it required a private mortgage insurance (PMII) payment, which is $180 per month. Calculate your monthly mortease payment palus the PMII payment, an well and your current montgame halapee. 13. Go to bankratesom of nerdwallet com to find the cutrent redinancing ratek. Assumbe: the current value of your house is 3400,000 , your new loan will be for the exact amount of the balance of the exieting loan that you calculated previntasly, your gross annual household income is 890,000 . your credit score is the ore tased in Fart B. you will piny for all refinancing coats ont of pocket (the pointerfees of the nera loan cannot be financed), and have the witficient funds te do so. Eind the best avalahle refinancing rates for: Two 30-year FRMa, Two 15-year FRMs. One ARM. Note: if no ARM optians are atoilable on either secbsife, please use the aterage ARLM nate from the Freddie Mos Mortgage Suriey. You may we the following table to summarize your findings. Note that MMII would be required for the new loan only if LTV exceeds 80% 14. Without doing any detailed calculations, does it look like it may make sense to refinance with any of these 5 loans? If more than one loan makes sense, which loan seema to be the sosimal? 15. Focus on the loan you jdentified as the optimal in the previous queation. Assume that if you refinance, you wall have to pay 93,000 in third-party fees, on top of any poink or fees that the lender may charge. Calculate the monetary cosl of refinameing. In other words, how much money woald have to apend in order to refinance? Remember that If you would like to incorporate the value of your time spent doing the research, jolease spectly that alao. 16. Calculate the monthly saxinge from refinancing. This is the difference hetween your total monthly payments with the existing loan (which include the mortgage payments and the PMII paymunt) and the moathly payment with the new laan (which may not require MMIT)? 17. Assume that if you refinance, yout will keep the new loan for its estire term. What is the gateaf retume from refinancing? Given this, should you refinance? 18. Ifnore the last question. Acstime instead that you will sell your house in 10 years. So regardless of whether you refinance, you will keep your mostgage for 10 yiars. Under this ascumptioe. what is the rate of retarn from refinancing (Hint: in this case, there will be a dafference in loan halances between the existing loan and the new Inan)? Given this rate of return, should you reffenance? interest rate, You got this mortgage 5 years ago, so your mortgage has 26 years bett. Today. you can get a 25-year FFM loan at 6.0. . Therefore, whether or not yoa refinance, you would pay off your loan in 25 years. Doe to the lower rate an the new boan. you would aave 8100 per msonth, of $1,200 per year. Refinancing would cost you anly $3,000, so it would pay for itself in less than 3 years. Under this scenario, is there any reason why you mould NoTT want to refinance today? Be specific. 12. Ignore the asnumptions in Part B. Instead, asatame you botaght your current homse 3 yearn ago. You bought the home for $360,000 and financed it with a $324,000,30-year FitM at 7.739 interest rate. Since your loun's L.TV was S0h4, it required a private mortgage insurance (PMII) payment, which is $180 per month. Calculate your monthly mortease payment palus the PMII payment, an well and your current montgame halapee. 13. Go to bankratesom of nerdwallet com to find the cutrent redinancing ratek. Assumbe: the current value of your house is 3400,000 , your new loan will be for the exact amount of the balance of the exieting loan that you calculated previntasly, your gross annual household income is 890,000 . your credit score is the ore tased in Fart B. you will piny for all refinancing coats ont of pocket (the pointerfees of the nera loan cannot be financed), and have the witficient funds te do so. Eind the best avalahle refinancing rates for: Two 30-year FRMa, Two 15-year FRMs. One ARM. Note: if no ARM optians are atoilable on either secbsife, please use the aterage ARLM nate from the Freddie Mos Mortgage Suriey. You may we the following table to summarize your findings. Note that MMII would be required for the new loan only if LTV exceeds 80% 14. Without doing any detailed calculations, does it look like it may make sense to refinance with any of these 5 loans? If more than one loan makes sense, which loan seema to be the sosimal? 15. Focus on the loan you jdentified as the optimal in the previous queation. Assume that if you refinance, you wall have to pay 93,000 in third-party fees, on top of any poink or fees that the lender may charge. Calculate the monetary cosl of refinameing. In other words, how much money woald have to apend in order to refinance? Remember that If you would like to incorporate the value of your time spent doing the research, jolease spectly that alao. 16. Calculate the monthly saxinge from refinancing. This is the difference hetween your total monthly payments with the existing loan (which include the mortgage payments and the PMII paymunt) and the moathly payment with the new laan (which may not require MMIT)? 17. Assume that if you refinance, yout will keep the new loan for its estire term. What is the gateaf retume from refinancing? Given this, should you refinance? 18. Ifnore the last question. Acstime instead that you will sell your house in 10 years. So regardless of whether you refinance, you will keep your mostgage for 10 yiars. Under this ascumptioe. what is the rate of retarn from refinancing (Hint: in this case, there will be a dafference in loan halances between the existing loan and the new Inan)? Given this rate of return, should you reffenance? interest rate, You got this mortgage 5 years ago, so your mortgage has 26 years bett. Today. you can get a 25-year FFM loan at 6.0. . Therefore, whether or not yoa refinance, you would pay off your loan in 25 years. Doe to the lower rate an the new boan. you would aave 8100 per msonth, of $1,200 per year. Refinancing would cost you anly $3,000, so it would pay for itself in less than 3 years. Under this scenario, is there any reason why you mould NoTT want to refinance today? Be specific