Answered step by step

Verified Expert Solution

Question

1 Approved Answer

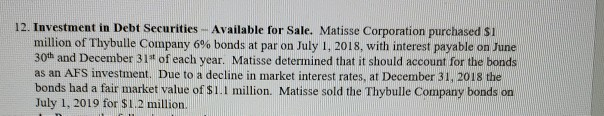

12. Investment in Debt Securities- Available for Sale. Matisse Corporation purchased SI million of Thybulle Company 6% bonds at par on July 1, 2018, with

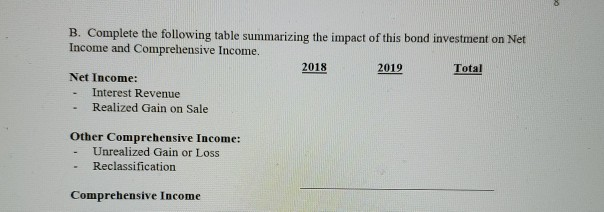

12. Investment in Debt Securities- Available for Sale. Matisse Corporation purchased SI million of Thybulle Company 6% bonds at par on July 1, 2018, with interest payable on June 30th and December 31t of each year. Matisse determined that it should account for the bonds as an AFS investment. Due to a decline in market interest rates, at December 31, 2018 the bonds had a fair market value of SI.1 million. Matisse sold the Thybulle Company bonds on July 1, 2019 for $1.2 million. B. Complete the following table summarizing the impact of this bond investment on Net Income and Comprehensive Income. 2018 2019 Total Net Income: Interest Revenue - Realized Gain on Sale Other Comprehensive Income: - Unrealized Gain or Loss - Reclassification Comprehensive Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started