Answered step by step

Verified Expert Solution

Question

1 Approved Answer

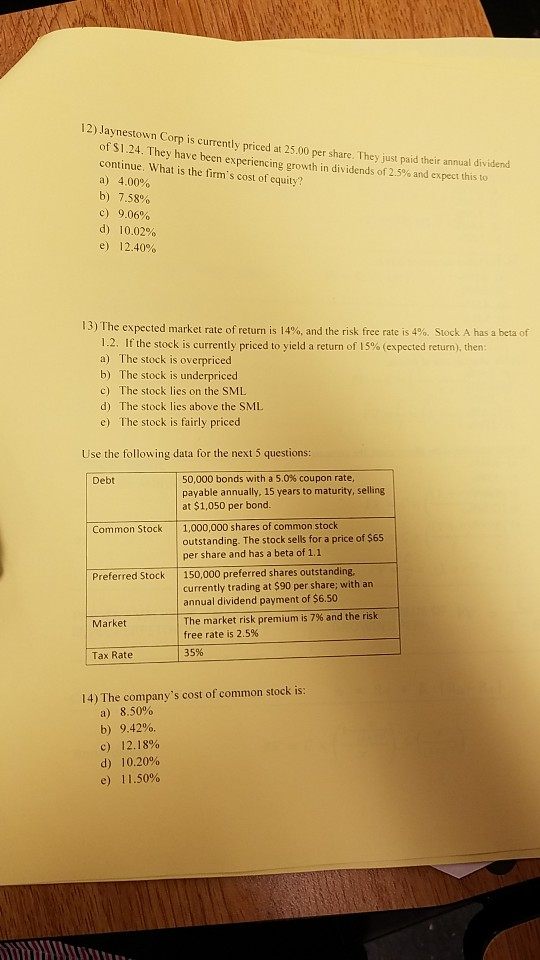

12) Jaynestown Corp is currently priced at 25.00 per share. They just paid their annual dividend of SI 24. They have been experiencing growth in

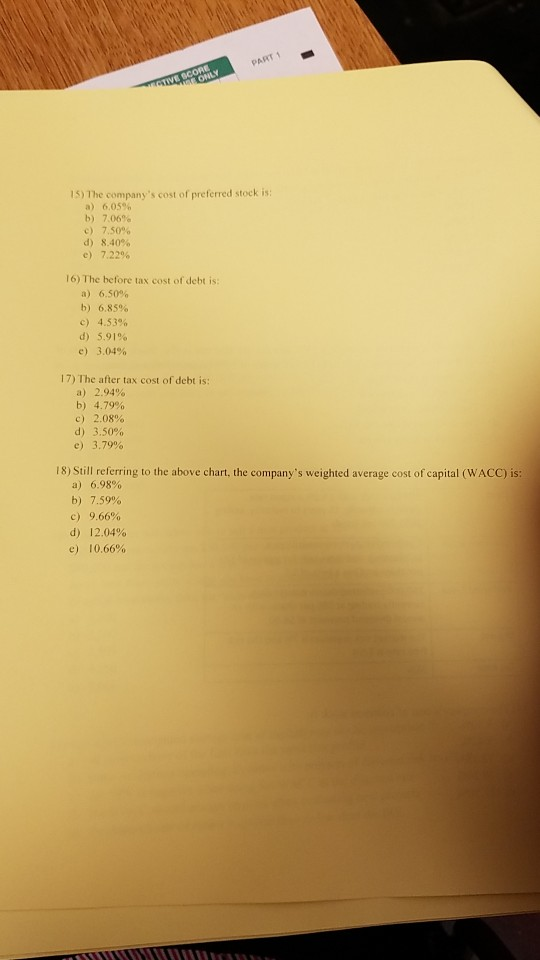

12) Jaynestown Corp is currently priced at 25.00 per share. They just paid their annual dividend of SI 24. They have been experiencing growth in dividends of 25% and expect hs io continue. What is the firm's cost of equity? a) 4.00% b) 7.58% c) 9.06% d) 10.02% e) 12.40% 13) The expected market rate of return is 14%, and the risk free rate is 4%, Stock A has a beta of 1.2. If the stock is currently priced to yield a return of 15% (expected return), then a) The stock is overpriced b) The stock is underpriced c) The stock lies on the SML d) The stock lies above the SML e) The stock is fairly priced Use the following data for the next 5 questions: 50,000 bonds with a 5.0% coupon rate, payable annually, 15 years to maturity, selling at $1,050 per bond Debt Common Stock 1,000,000 shares of common stock outstanding. The stock sells for a price of $65 per share and has a beta of 1.1 150,000 preferred shares outstanding. Preferred Stock currently trading at $90 per share; with an annual dividend payment of $6.50 The market risk premium is 7% and the risk free rate is 2.5% 35% Market Tax Rate 14) The company's cost of common stock is: a) 8.50% b) 9.42%. c) 12.18% d) 10.20% e) 11.50% 15) The company's cost of preferred stock is a) 6.05% b) 706% c) 7,50% d) 8.40% e) 7.22% 16) The before tax cost of debt is: a)6.50% b) 6.85% c) 4.53% d) 5,91% e) 3,04% 17) The after tax cost of debt is: 2.94% 4.79% 2.08% 3,50% 3,79% a) b) c) d) e) 18) Still referring to the above chart, the company's weighted average cost of capital (WACC) is: 6,98% 7.59% 9,66% 12.04% 10.66% a) b) c) d) e)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started