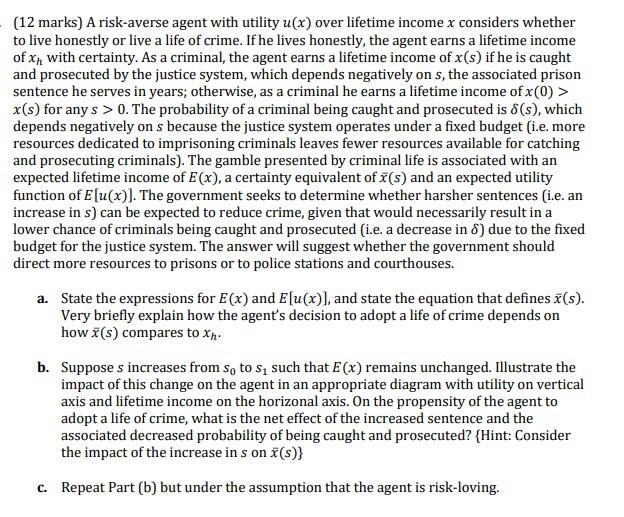

(12 marks) A risk-averse agent with utility u(x) over lifetime income x considers whether to live honestly or live a life of crime. If he lives honestly, the agent earns a lifetime income of xn with certainty. As a criminal, the agent earns a lifetime income of x(s) if he is caught and prosecuted by the justice system, which depends negatively on s, the associated prison sentence he serves in years; otherwise, as a criminal he earns a lifetime income of x(0) > x(s) for any s > 0. The probability of a criminal being caught and prosecuted is 8(s), which depends negatively on s because the justice system operates under a fixed budget (i.e. more resources dedicated to imprisoning criminals leaves fewer resources available for catching and prosecuting criminals). The gamble presented by criminal life is associated with an expected lifetime income of E(x), a certainty equivalent of x(s) and an expected utility function of E[u(x)]. The government seeks to determine whether harsher sentences (i.e. an increase in s) can be expected to reduce crime, given that would necessarily result in a lower chance of criminals being caught and prosecuted (i.e. a decrease in 8) due to the fixed budget for the justice system. The answer will suggest whether the government should direct more resources to prisons or to police stations and courthouses. a. State the expressions for E(x) and E[u(x)], and state the equation that defines x(s). Very briefly explain how the agent's decision to adopt a life of crime depends on how x(s) compares to X b. Suppose s increases from so to sy such that E(x) remains unchanged. Illustrate the impact of this change on the agent in an appropriate diagram with utility on vertical axis and lifetime income on the horizonal axis. On the propensity of the agent to adopt a life of crime, what is the net effect of the increased sentence and the associated decreased probability of being caught and prosecuted? (Hint: Consider the impact of the increase in son x(s)} c. Repeat Part (b) but under the assumption that the agent is risk-loving. (12 marks) A risk-averse agent with utility u(x) over lifetime income x considers whether to live honestly or live a life of crime. If he lives honestly, the agent earns a lifetime income of xn with certainty. As a criminal, the agent earns a lifetime income of x(s) if he is caught and prosecuted by the justice system, which depends negatively on s, the associated prison sentence he serves in years; otherwise, as a criminal he earns a lifetime income of x(0) > x(s) for any s > 0. The probability of a criminal being caught and prosecuted is 8(s), which depends negatively on s because the justice system operates under a fixed budget (i.e. more resources dedicated to imprisoning criminals leaves fewer resources available for catching and prosecuting criminals). The gamble presented by criminal life is associated with an expected lifetime income of E(x), a certainty equivalent of x(s) and an expected utility function of E[u(x)]. The government seeks to determine whether harsher sentences (i.e. an increase in s) can be expected to reduce crime, given that would necessarily result in a lower chance of criminals being caught and prosecuted (i.e. a decrease in 8) due to the fixed budget for the justice system. The answer will suggest whether the government should direct more resources to prisons or to police stations and courthouses. a. State the expressions for E(x) and E[u(x)], and state the equation that defines x(s). Very briefly explain how the agent's decision to adopt a life of crime depends on how x(s) compares to X b. Suppose s increases from so to sy such that E(x) remains unchanged. Illustrate the impact of this change on the agent in an appropriate diagram with utility on vertical axis and lifetime income on the horizonal axis. On the propensity of the agent to adopt a life of crime, what is the net effect of the increased sentence and the associated decreased probability of being caught and prosecuted? (Hint: Consider the impact of the increase in son x(s)} c. Repeat Part (b) but under the assumption that the agent is risk-loving