Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12) Merchandise inventory: Must be sold within one month Includes supplies the company will use in future periods Is classified with investments on the balance

12) Merchandise inventory:

Must be sold within one month

Includes supplies the company will use in future periods

Is classified with investments on the balance sheet

Is a current asset.

Is a long-term asset

13) The current period's ending inventory is:

The current period's beginnng inventory.

The current period's cost of goods sold.

The next period's beginning inventory.

The current period's net purchases.

The prior period's beginning inventory.

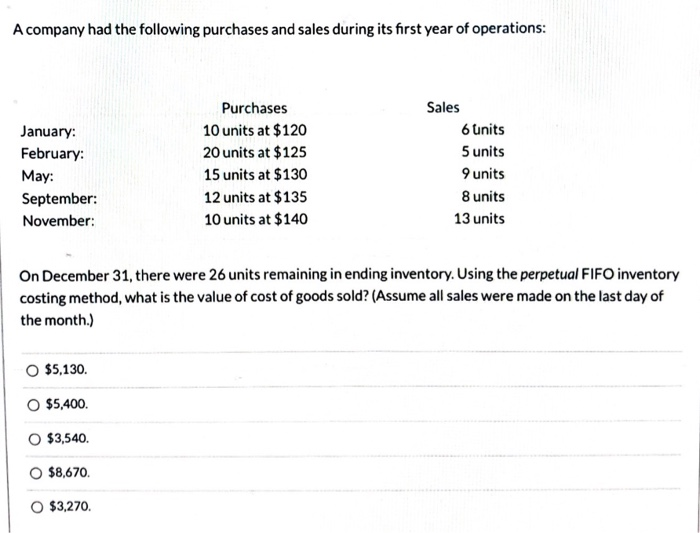

14)

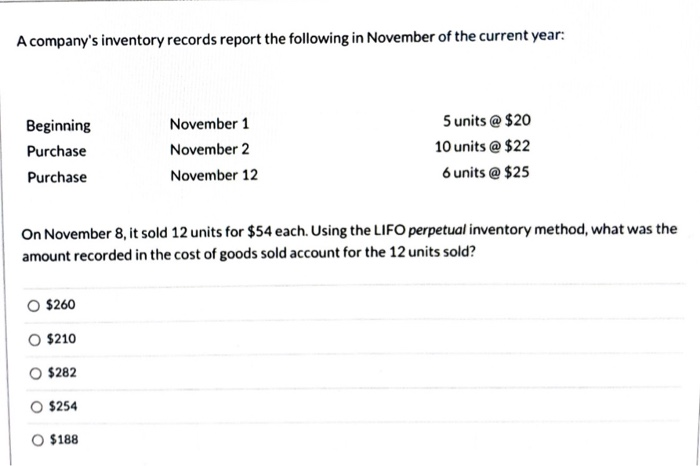

15)

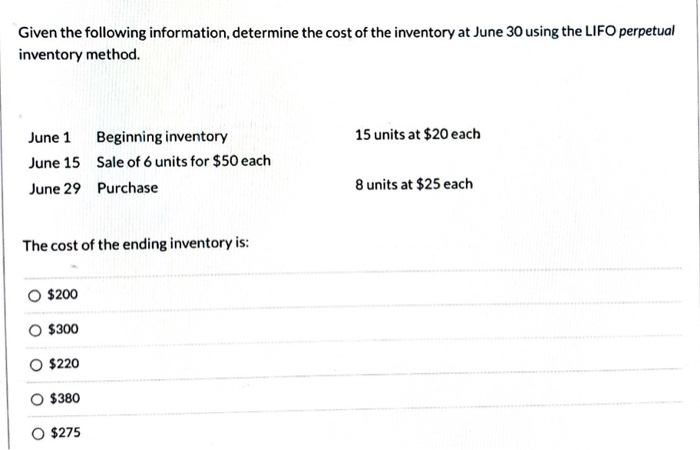

16)

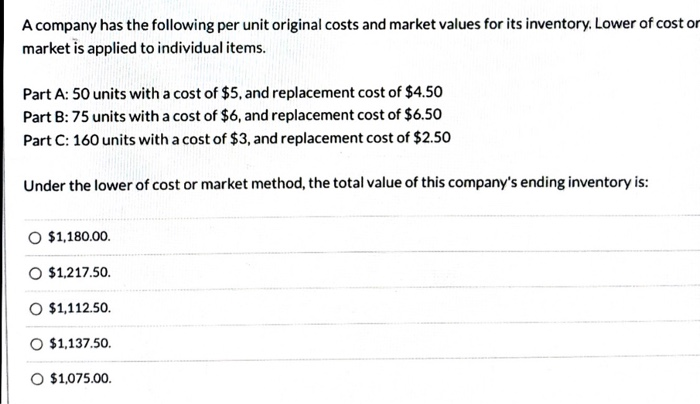

17) In applying the lower of cost or market method to LIFO inventory valuation, market is defined as:

Current sales price.

LIFO

Current replacement cost.

FIFO

Historical cost.

18) Generally accepted accounting principles require that the inventory of a company be reported at:

Retail value.

Replacement cost.

Market value.

Historical cost.

Lower of cost or market.

19)

20) Damaged and obsolete goods that can be sold:

Are included in inventory at their net realizable value.

Should be disposed of immediately.

Are included in inventory at their full cost.

Are never counted as inventory.

Are assigned a value of zero.

21) Goods in transit are included in a purchaser's inventory:

After the half-way point between the buyer and seller.

When the goods are shipped FOB shipping point.

When the supplier is responsible for freight charges.

At any time during transit.

If the goods are shipped FOB destination.

22) Companies can and often do use different costing methods for financial reporting and tax reporting. An

exception to this is the:

FIFO inventory valuation method.

Matching principle.

Consistency concept.

LIFO Conformity rule.

Full disclosure principle.

23) The understatement of the endinginventory balance causes:

Cost of goods sold to be overstated and net income to be understated.

Cost of goods sold to be overstated and net income to be correct.

Cost of goods sold to be understated and net income to be overstated.

Cost of goods sold to be overstated and net income to be overstated.

Cost of goods sold to be understated and net income to be understated.

24)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started