Answered step by step

Verified Expert Solution

Question

1 Approved Answer

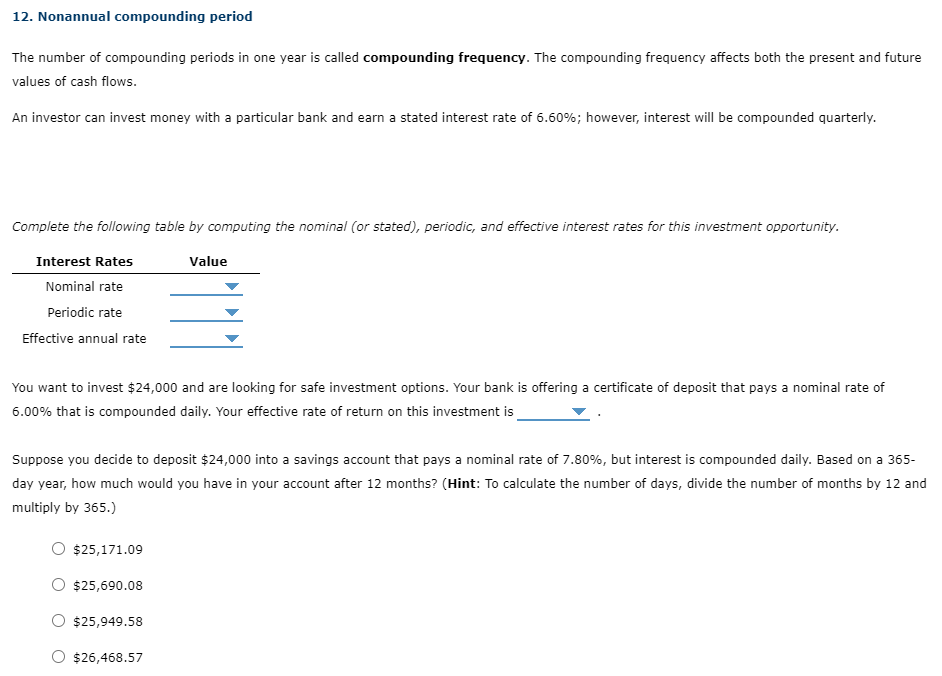

12. Nonannual compounding period The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future

12. Nonannual compounding period The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An investor can invest money with a particular bank and earn a stated interest rate of \6.60; however, interest will be compounded quarterly. Complete the following table by computing the nominal (or stated), periodic, and effective interest rates for this investment opportunity. You want to invest \\( \\$ 24,000 \\) and are looking for safe investment options. Your bank is offering a certificate of deposit that pays a nominal rate of \6.00 that is compounded daily. Your effective rate of return on this investment is Suppose you decide to deposit \\( \\$ 24,000 \\) into a savings account that pays a nominal rate of \7.80, but interest is compounded daily. Based on a 365 day year, how much would you have in your account after 12 months? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365. ) \\[ \\begin{array}{l} \\$ 25,171.09 \\\\ \\$ 25,690.08 \\\\ \\$ 25,949.58 \\\\ \\$ 26,468.57 \\end{array} \\]

12. Nonannual compounding period The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An investor can invest money with a particular bank and earn a stated interest rate of \6.60; however, interest will be compounded quarterly. Complete the following table by computing the nominal (or stated), periodic, and effective interest rates for this investment opportunity. You want to invest \\( \\$ 24,000 \\) and are looking for safe investment options. Your bank is offering a certificate of deposit that pays a nominal rate of \6.00 that is compounded daily. Your effective rate of return on this investment is Suppose you decide to deposit \\( \\$ 24,000 \\) into a savings account that pays a nominal rate of \7.80, but interest is compounded daily. Based on a 365 day year, how much would you have in your account after 12 months? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365. ) \\[ \\begin{array}{l} \\$ 25,171.09 \\\\ \\$ 25,690.08 \\\\ \\$ 25,949.58 \\\\ \\$ 26,468.57 \\end{array} \\] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started